Aerosol Market Size, Share & Trends Analysis Report By Material (Steel, Aluminum, Others), By Type (Bag-In-Valve, Standard), By Application (Personal Care, Household, Automotive & Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-288-4

- 页数:140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Bulk Chemicals

Report Overview

The global aerosol market size was estimated at USD 78.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The global aerosol market is anticipated to be driven by the growing demand for various products, including deodorants, hair sprays, hair mousse, dry shampoos,insecticides, air fresheners, cleaning,lubricants, and medical spray. Increasing disposable income and changing consumer lifestyles are key factors attributing to the market growth.

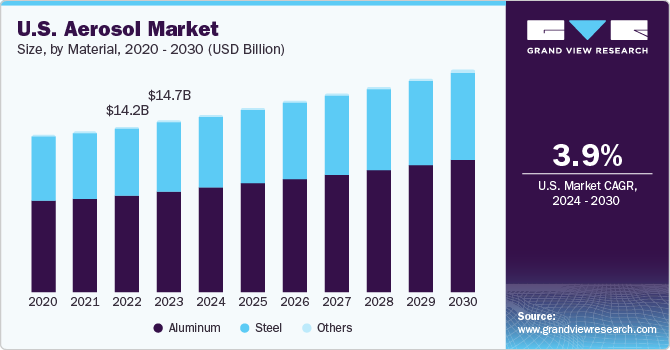

The U.S. is a significant and growing industry, with an estimated value of USD 14.18 billion in 2022. The U.S. aerosol market is increasing due to the expanding personal care and household industry. The presence of a robust manufacturing base of personal care companies such as Estée Lauder, Johnson & Johnson, and Procter & Gamble in the U.S. is anticipated to have a positive impact on market growth. Product launches by these manufacturing companies are expected to propel further market demand for aerosols over the forecast period.

Furthermore, the demand for sanitizing spray and disinfectants is also expected to rise significantly in the country owing to the increased cleaning preference amid the COVID-19 outbreak. This is expected to support the demand growth for aerosol in household applications.

The U.S. is among the leading countries in per capita vehicle ownership. As of 2021, for every 1,000 people, there were 842 vehicles. Moreover, car owners in the country are increasingly spending on car care products such as waxes, glass cleaners, protectant sprays, and lacquer aerosols. This trend is expected to favor the growth of the aerosol paint application segment in the coming years.

Material Insights

The aluminum segment dominated the market and accounted for the largest revenue share of 60.6% in 2022 and is also projected to expand at a considerable growth rate over the forecast period. Aluminum is an environment-friendly material and can be recycled multiple times. In addition, it also offers robust packaging and significantly enhances the aesthetic appeal of the product. These factors are majorly contributing to the growth of the segment. Globally, aluminum prices have significantly increased over the past several years.

Increasing aluminum prices are further leading to a rise in the final costs of aerosols. On account of this factor, aerosol manufacturers are expected to opt for a low-priced alternative, which may hamper the growth of the aluminum material segment in the coming years. The plastic material segment has also been experiencing significant demand for the past few years due to the low weight, low cost, and high recyclability of PET plastic. However, a strict ban onplastic packaging, especially in Europe, is expected to hamper the growth of this segment over the coming years.

Type Insights

The standard segment dominated the market and accounted for the largest revenue share of 82.1% in 2022 and is projected to continue its dominance throughout the forecast period. This segment includes continuous and metering-type valves; continuous valves are used in applications where a continuous spray is required. The increasing utilization of these valves in food products, technical products, and home care products, such as insecticides,rodenticides, and decoration products, is expected to drive segment growth. Metered valves are specifically preferred for the efficient dispensing of metered doses, thus are used in pharmaceutical applications and air fresheners. Bag-in-valve is a packaging technology wherein the bag containing the product is welded to the valve.

推进剂是放在袋子和th之间e can. Therefore, the propellant and the product are completely separated from each other, which improves the integrity of the packaged product. In a bag-in-valve aerosol, the product is dispensed mainly by the propellant by squeezing the bag after the pressing of the spray button. Cosmetic, medical, and food products are usually packaged in aerosol with a bag-in-valve to maintain the purity of the product. The bag in the valve offers nearly 99.5% of product dispersion; the bag is usually made of four-layer laminates, which minimizes the possibility of oxidation, and the product is hermetically sealed with the bag. These advantages are attracting various product manufacturers towards the bag-in-valve aerosol type segment. This, in turn, is expected to propel the segment growth in the coming years.

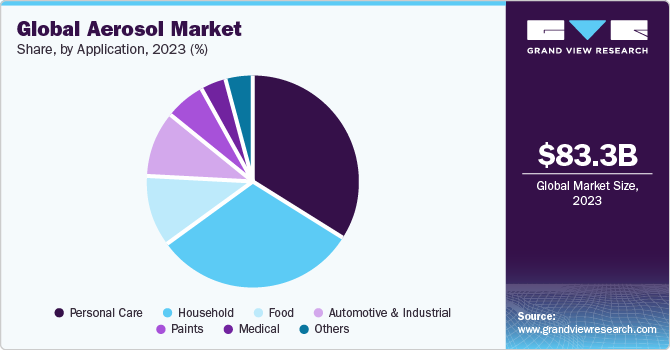

Application Insights

The personal care segment dominated the market and accounted for the largest revenue share 34.7% in 2022. The segment is driven by the growing demand for hair care products and deodorants. The demand for personal care products is increasing in emerging economies owing to the changing lifestyle, rising consumer spending, and emphasis on gender-specific products.

The rapid growth of the household segment is attributed to the improvement in standards of living and emphasis on hygiene, especially in developing regions. This has led to a rise in the consumption of household products like air fresheners, cleaners, sanitizing agents, and disinfectants. Dispersion of these products in less quantity reduces wastage and increases their longevity.

Regional Insights

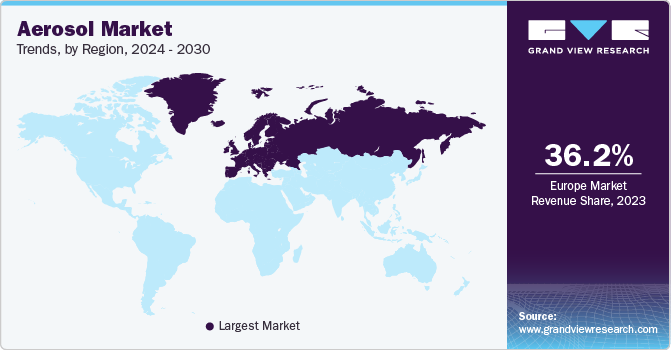

Europe dominated the aerosol market and accounted for the largest revenue share of 36.1% in 2022. The region is also the leading producer of aerosols. Its large share is mainly attributable to the widespread presence of the personal care industry. Factors including high cosmetics consumption, rapid growth in thefragranceindustry, and increasing consumer spending are boosting regional market growth. Despite the increasing demand from the personal care industry, the growth of the European market is hindered by regulations regarding Volatile Organic Compounds (VOC) emissions, laid down by the European Commission and Environmental Protection Agency (EPA). However, the region is anticipated to overcome this challenge in the near future with innovations. For example, in 2018, a new line of aerosol cleaners was introduced by Breathe, certified by the EPA’s Safer Choice Program.

In terms of revenue, Asia Pacific is amongst the fastest-growing regions and is expected to register a CAGR of 8.0% over the forecast period. The governments of China and India have been focusing on promoting favorable investments, which is expected to create lucrative growth opportunities for the market over the forecast period. Increasing consumer spending in emerging Asian economies is boosting the demand for aerosol in the personal care, automotive, and paint sectors. The Middle East and Africa are also estimated to witness significant growth over the forecast period due to high spending on hair care products in countries such as Saudi Arabia and UAE. In addition, the presence of hypermarkets, such as Carrefour, and Lulu Hypermarket, in the UAE, Saudi Arabia, and Kuwait have ensured the retail distribution of consumer products.

Key Companies & Market Share Insights

Key companies are increasingly adopting market strategies such as acquisitions to strengthen their market position and expand into new territories. For instance, in June 2020, Unilever collaborated with Tubex, an aerosol can manufacturer, to develop eco-friendly packaging for its product Rexona Recycled Refreshed. The aerosol can is composed of 25% of post-consumer material. Furthermore, Procter & Gamble received approval from the U.S. Environmental Protection Agency for its product Microban 24, which is a sanitizing spray. The spray was found effective against the SARS-CoV-2 virus responsible for COVID-19. Some of the prominent players in the global aerosol market include:

Henkel AG & Co., KGaA

S. C. Johnson & Son, Inc.

Procter & Gamble

Unilever

Honeywell International Inc.

Akzo Nobel N.V.

Beiersdorf AG

Estée Lauder Inc.

Oriflame Cosmetics Global SA

Aerosol MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 83.5 billion |

Revenue forecast in 2030 |

USD 131.74 billion |

Growth rate |

CAGR of 6.7% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million; Volume in million units; CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Material, type, application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa |

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; China; India; Japan; South Korea; Vietnam; Singapore; Australia; Brazil Argentina; Chile; Saudi Arabia; South Africa; UAE |

Key companies profiled |

Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; Oriflame Cosmetics Global SA |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

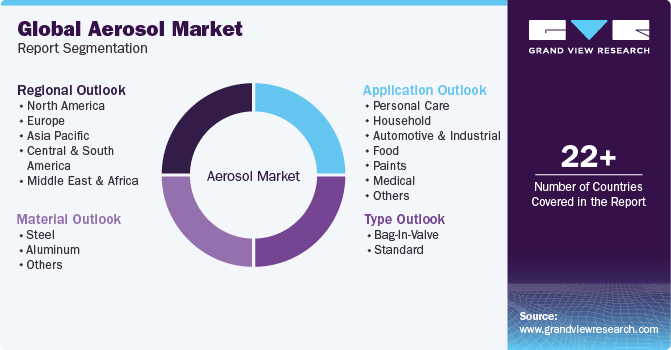

Global Aerosol Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aerosol market report on the basis of material, type, application, and region:

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

Steel

Aluminum

Others

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

Bag-In-Valve

Standard

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

Personal Care

Deodorants

Hair Mousse

Hair Spray

Shaving Mousse/Foam

Suncare

Others

Household

Insecticides

Plant Protection

Air Fresheners

Furniture & Wax Polishes

Disinfectants

Surface care

Others

Automotive & Industrial

Greases

Lubricants

Spray Oils

Cleaners

Food

Oils

Whipped Cream

Edible Mousse

Sprayable Flavours

Paints

Industrial

Consumer

Medical

Inhaler

Topical Application

Others

Aerosol Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Netherlands

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Central & South America

Brazil

Argentina

Chile

Middle East & Africa

Saudi Arabia

South Africa

UAE

Frequently Asked Questions About This Report

b.The global aerosol market was estimated at USD 78.7 billion in the year 2022 and is expected to reach USD 83.5 billion in 2023

b.The global aerosol market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 131.7 billion by 2030.

b.Europe region dominated the market and accounted for more than 36.1% share of revenue in 2022. The factors attributed to driving the European market are the presence of global players of cosmetic and pharmaceutical industries in Europe and high per capita consumption of cosmetic products.

b.The key market player in the aerosol market includes Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; Oriflame Cosmetics Global SA.

b.Global aerosol market is anticipated to be driven by the growing demand for various products including deodorants, hair sprays, hair mousse, dry shampoos, insecticides, air fresheners, cleaning, lubricants, and medical spray. Increasing disposable income and changing consumer lifestyles are key factors attributing to the growing demand of aerosol products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."