Aerospace Plastics Market Size, Share & Trends Analysis Report By Plastic Type (PEEK, PPSU, PC, PEI, PMMA, PA, PPS, PAI, PU), By Process, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-189-4

- Number of Pages: 210

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry:Bulk Chemicals

Report Overview

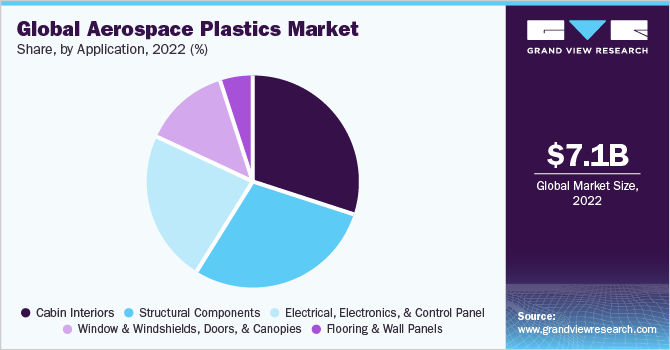

The global aerospace plastics market size was estimated at USD 7.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2023 to 2030. The increasing demand for plastics in several aerospace applications including cabin interiors, structural components, electrical electronics & control panels, windows, windshields, and canopies is expected to drive the growth of the aerospace plastics industry in the forthcoming years. Reduction in overall airplane weight directly impacts performance and efficiency. In addition, with reduction of 1 kilogram (kg) weight is estimated to nullify lifetime operating costs associated with fuel, for a commercial airplane. Plastics being lightweight and highly durable, they are used as an alternative to aluminum and steel components, increasing their share in the overall structure of an airplane.

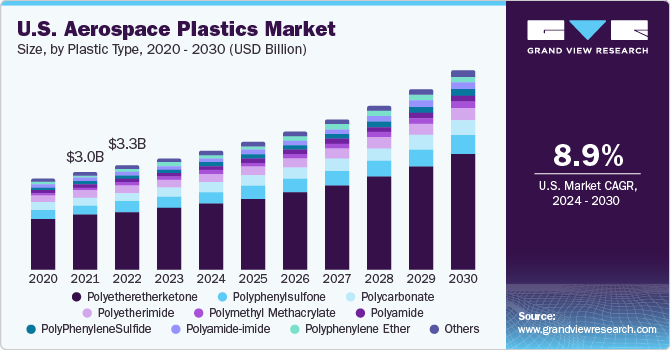

According to theInternational Trade Administration, and theU.S. Department of Commerce,美国被认为是主要的国家global aerospace market. The country hosts a number of aircraft manufacturers such as Boeing, Lockheed Martin Corporation, Gulfstream Aerospace Corporation, and Airbus Helicopters, Inc. among others, which has contributed to the growth of the aerospace sector in the country.

The Continuous Lower Energy, Emissions and Noise (CLEEN) Program which was launched in 2010, has designated the Federal Aviation Administration to introduce steps for reducing noise & aviation emissions and improving fuel efficiency by 20%. Also as of September 2021, more than USD 100.0 million has been awarded so far by the U.S. Department of Transportation’s Federal Aviation Administration (FAA) for noise and emission reduction.

The award is part of a series of steps to drive innovation across the federal government, aircraft manufacturers, airlines, and fuel producers, thereby positioning American aviation to grow towards net zero emissions by 2050. Such initiatives have driven the demand for substitute materials such as plastics, thus significantly impacting the aerospace plastics industry in the U.S.

Plastic Type Insights

Polyetheretherketone (PEEK) emerged as the leading plastic under-plastic type segment and accounted for more than 61.4% revenue share in 2022. This is attributed to its inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions. Aircraft parts manufactured from PEEK are chemically resistant to hydraulic fluid, water, salt, steam, and jet fuel. Furthermore, the incredible strength and stiffness offered by PEEK plastic make it a suitable alternative to metals such as steel and aluminum.

Polyphenyl sulfone (PPSU) is also being used in aircraft components due to its high-temperature resistance (180 °C), good electrical insulation, high impact strength, good chemical compatibility, and favorable dielectric characteristics. Its versatility and compliance with FAA regulations have allowed it to be used in decorative & structural interior components of aircraft. For instance, the Radel brand PPSU from Solvay is used as an alternative to aluminum in the manufacturing of aircraft catering trolleys in the cabin interior. Also, Radel PPSU foam offers better resistance to Skydrol aircraft hydraulic fluid and cleaning agents compared to PEI foam, driving its consumption in the cabin interiors.

Polymethyl methacrylate (PMMA) is used as an alternative to glass and polycarbonate. Its excellent resistance to scratching, outstanding optical properties, transparency, and excellent resistance to sun rays compared to polycarbonate and glass have increased its demand in aircraft canopies and windshields.

Polyamide-imide (PAI) offers stiffness and high strength at extreme temperatures. It is considered the best choice for applications requiring a combination of mechanical strength along with wear resistance, corrosion resistance, and high-temperature resistance properties. The aerospace sector requires materials that can operate in harsh chemical and thermal environments even under severe stress. Since PAI exhibits flame retardant ability and maintains its strength at temperatures high as 500°F, it is widely used in aircraft structural components.

Process Insights

Injection molding emerged as the leading process segment and accounted for more than 35.0% in terms of revenue in 2022. The injection molding process is significantly used in the production of aerospace parts as it offers repeatable precision with high-volume production. Aerospace parts created through injection molding include housings, lenses, chassis components, panels, bezels, turbine blades, and turbine housings.

aeros中使用塑料热成型过程pace parts manufacturing on account of benefits such as low tooling costs, high detailing with low costs, ability to produce complex geometry, reduced product development time, and economical large parts manufacturing compared to other aerospace plastic processes.

End-Use Insights

Commercial & freighter aircraft was the leading end-user segment and accounted for more than 72.4% of the revenue share in 2022. The high share can be attributed to the emergence of several service providers in the air transport industry. The military aircraft segment has also been lucrative, its utilization attributed to growing security and defense concerns. Inclination towards niche air transportation options has led to the exploration of rotary aircraft and gliders for special travel purposes.

Freight and large passenger aircraft are some of the major application areas for plastics in the aerospace industry. The utilization of polymers in aircraft aids in reducing operating costs by reducing weight and lowers the occurrence of maintenance issues. This has encouraged aircraft manufacturers to potentially increase plastic content in commercial as well as freighter aircraft.

Manufacturers of military aircraft have been using plastics to reduce the overall weight and improve fuel efficiency. Military aircraft are often treated as the testing grounds for innovative aerospace structures, and the advancements in the application of plastics are often witnessed in military aircraft where demand for polymers is high. Aerospace plastics provide a high degree of freedom in the designing of complicated components of an aircraft. As a result, the percentage of aerospace plastics utilized in manufacturing commercial and military airplanes has increased significantly over the past couple of decades.

Application Insights

Cabin interiors emerged as the leading application segment and accounted for more than 30.0% in terms of revenue share in 2022. Cabin interiors include seats & seating components, galleys, cabin dividers, overhead storage compartments, over-molded aircraft cabin brackets, and other cabin interior components. Earlier aircraft seats consisted of metal composite materials which comply with strict FAA flammability regulations, such as smoke density, vertical burn tests, and heat release tests for aircraft interiors.

However, the properties exhibited by the plastics such as lightweight, flame retardancy, cushioning, and other beneficial properties complying with FAA flammability regulations and cost-effectiveness have resulted in the inclusion of plastic & plastic composites in seats & seating components. Safran, a global aircraft cabin interior manufacturer uses PEEK polymer and carbon-fibre-LMPAEK composite developed by Victrex plc to manufacture over-molded aircraft cabin brackets.

Structural components were the next leading application segment. Structural components consist ofaircraft propulsion system components, wingtips, engine parts, rotors, landing gear, fuselage, and other hardware components. Aircraft frame contains the maximum amount of carbon fiber reinforced plastic and composites reducing the weight by 20%. The extended use of composites and plastics in the high-tension loaded environment of the fuselage reduces maintenance primarily due to fatigue.

Aerostructure is the most important part of the airplane as it forms the basis for the shape and size of the aircraft. PEEK and POM have widely used polymers in this application owing to durability and corrosion and heat resistance. As the demand for general aviation and commercial aviation is rising, the demand for the two polymers is projected to grow significantly.

Regional Insight

North America was the leading region in the demand for aerospace plastics and accounted for more than 57.3% of the revenue share in 2022. The region is expected to witness a growing demand for fuel-efficient aircraft in the next eight years on account of the rising fuel prices. A high replacement rate mainly for regional aircraft is driving the growth in the matured North America aerospace plastics market. The urge to modify/replace the existing inefficient aircraft with a fuel-efficient airplane is expected to augment market growth.

The Western European market witnessed significant growth in 2022 and is expected to continue its growth on account of the availability of skilled engineers and the glut of investments seen in research and development. The presence of aircraft manufacturing companies in France including European consortiums along with French participants (ATR, EADS, etc.), has bolstered the Western European aerospace polymers market.

The constant change in the economic environment of Asia Pacific has significantly impacted the airline industry in the past five years. However, emerging economies in Asia including China, India, and Japan are largely fueling the aerospace polymers market owing to the emergence airplane manufacturing industry in the region.

The region has witnessed major global aircraft manufacturing companies entering into collaboration with regional aircraft manufacturers to further penetrate the aerospace market in Asia Pacific. For instance, in September 2021, Airbus and Tata Sons Private Limited signed a USD 220.0 billion (INR 22,000 crore) deal to set up a manufacturing plant for C 295 transport aircraft, which can drive the consumption of aerospace plastics in the region.

东南亚确立为明显cant Maintenance, Repair, and Overhaul (MRO) industry for aerospace applications. The growth of the MRO industry depends on country-specific policies and the absence of a favorable policy framework can significantly restrain the growth of MRO services. For the aviation industry, the import duties on spare parts and tax regimes influence the MRO services delivery. Singapore, the Philippines, and Malaysia provide tax incentives, and duty-free import of machines, spares, and equipment, making these Southeast Asian countries major supporters of the MRO market for the aerospace sector which can positively impact the aerospace plastics industry.

In the Middle East, the supportive policies of the governments have contributed significantly to market growth in recent years since the aerospace industry has received a boost in terms of imported materials and impetus for regional manufacturing. As per the statistics of IATA (International Air Transport Association), the BRIC nations (Brazil, Russia, India, and China) have experienced substantial growth in domestic air travel post-COVID-19, which in turn is expected to aid market growth.

Key Companies & Market Share Insights

The global aerospace market is fragmented and highly competitive with the presence of a number of multinational companies across the major economies. The companies lay high emphasis on increasing the area of operation to increase the market share and drive the revenues of the company. This provides the company with a different business portfolio that accounts for an increase in sales.

The aerospace plastic industry is fragmented with the presence of significant plastic manufacturers catering to the local market as well as international markets. Aerospace plastic manufacturing companies are developing new products to strengthen their market position. For instance, in March 2021, Toray Industries Inc. developed a carbon fiber reinforced plastic (CFRP) prepreg that exhibits good flame retardancy and provides equivalent mechanical properties as currently uses aerospace materials. Some prominent players in the global aerospace plastics market include:

Victrex plc

Ensinger

SABIC

Solvay

BASF SE

Evonik Industries AG

Toray Advanced Composites

Saint Gobain Aerospace

DuPont

Celanese Corporation

Sumitomo Chemical Co., Ltd.

Covestro AG

the Mitsubishi Chemical Group of companies

PPG Industries, Inc.

Röchling

Recent Developments

In February 2022, StyLight® thermoplastic composite materials business was acquired by Ensinger. By acquiring the StyLight® business,Ensingeris expanding its portfolio of aerospace plastics and reinforcing its position in the global aerospace industry.

In June 2021, Evonik developed PROPULSE, a pure aluminum container with a 220-liter capacity for the transportation of high-concentrated hydrogen peroxide. This closed a logistical gap in the aerospace industry.

In March 2021, Victrex and Asia Innovation & Technology Centre (AITC) in Shanghai entered into a strategic collaboration to innovate solutions for the aerospace and automotive sectors and improve the design-to-mass production workflow for engineering design in Asia Pacific.

In March 2021,Evonikdeveloped an innovative 3D printable filament INFINAM® PEEK based on polyether ether ketone (PEEK) and launched the new filament under the INFINAM® PEEK 9359 F brand name. The product acts as a metal replacement for industrial 3D applications including automotive, aerospace, and oil & gas industries.

Aerospace Plastics Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 7.61 billion |

Revenue forecast in 2030 |

USD 13.89 billion |

Growth Rate |

CAGR of 9.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2019 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in tons, revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Volume & revenue forecast, company profiles, competitive landscape, growth factors, and trends |

Segments covered |

Plastic type, process, application, end-use, region |

Region scope |

North America; Western Europe; Eastern Europe; China; Asia; Southeast Asia; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; France; U.K.; China; India; Japan; Indonesia; Brazil; Saudi Arabia; United Arab Emirates |

Key companies profiled |

Victrex plc; Ensinger; SABIC; Solvay; BASF SE; Evonik Industries AG; Toray Advanced Composites; Saint Gobain Aerospace; DuPont; Celanese Corporation; Sumitomo Chemical Co., Ltd.; Covestro AG; the Mitsubishi Chemical Group of companies; PPG Industries, Inc.; Röchling; |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Aerospace Plastics Market Report Segmentation

This report forecasts volume and revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global aerospace plastics market report based on plastic type, process, application, end-use, and region:

Plastic Type Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

Polyetheretherketone (PEEK)

Polyphenylsulfone (PPSU)

Polycarbonate (PC)

Polyetherimide (PEI)

Polymethyl Methacrylate (PMMA)

Polyamide (PA)

PolyPhenyleneSulfide (PPS)

Polyamide-imide (PAI)

Polyphenylene Ether (PPE)

Polyurethane (PU)

Others

Process Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

Injection Molding

Thermoforming

CNC Machining

Extrusion

3D Printing

Others

Application Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

Cabin Interiors

Structural Components

Electrical, Electronics, And Control Panel

Window & Windshields, Doors, And Canopies

Flooring & Wall Panels

End-Use Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

Commercial & Freighter Aircraft

General Aviation

Military Aircraft

Rotary Aircraft

Regional Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

North America

U.S.

Canada

Mexico

Western Europe

Germany

U.K.

France

Eastern Europe

China

Asia

India

Japan

Southeast Asia

Indonesia

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

United Arab Emirates

Frequently Asked Questions About This Report

b.The global aerospace plastics market size was estimated at USD 7.14 billion in 2022 and is expected to reach USD 7.61 billion in 2023.

b.The global aerospace plastics market is expected to witness a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 13.89 billion by 2030.

b.Polyetheretherketone (PEEK) in the product segment accounted for the largest share of more than 61.4% in 2022 in terms of revenue. This is attributed to the inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions properties of PEEK.

b.SABIC, BASF SE, Solvay, Victrex plc, Evonik Industries AG, Röchling, DuPont, Toray Advanced Composites, and Sumitomo Chemical Company are some of the key players operating in the aerospace plastics market.

b.Key factors that are driving the market growth include due to their durability, high strength, light weight, and high corrosion and chemical resistance and their increasing use for assembling heads-up-displays, night vision systems, firearms, and other military and aerospace applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."