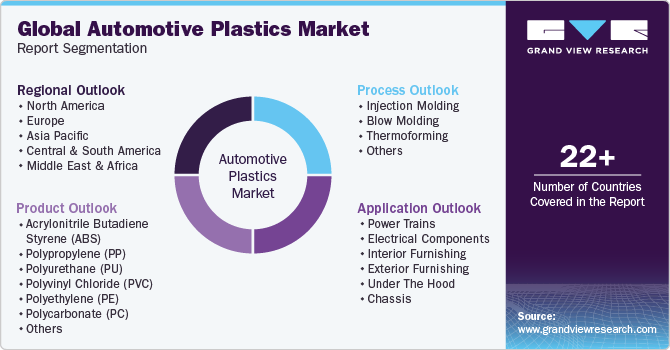

Automotive Plastics Market Size, Share & Trends Analysis Report By Product (Acrylonitrile Butadiene Styrene, Polypropylene), By Application (Powertrain, Electrical Component), By Process, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-193-1

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry:Bulk Chemicals

Automotive Plastics Market Size & Trends

The globalautomotive plastics market size was estimated at USD 30.44 billion in 2023and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Globally, a greater prominence given to vehicle weight reduction, better vehicle design capabilities, and pollution control are important drivers boosting automotive plastics industry growth. Plastics are majorly used in automobile parts and components as they are easy to manufacture, offer improved designs, and can be obtained from renewable raw materials.

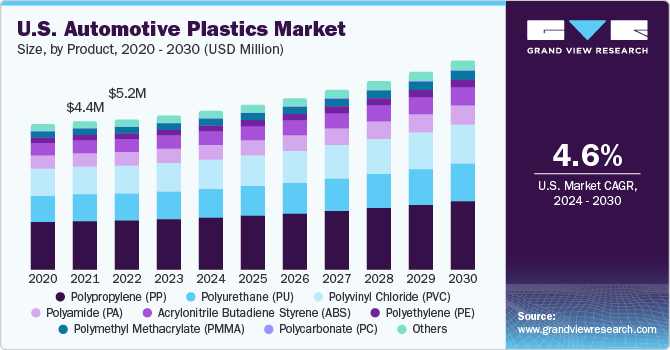

The U.S. automotive plastic industry is thriving and has experienced substantial growth.Plasticshave become vital to vehicle production and design, offering several benefits such as weight reduction, enhanced safety, better fuel efficiency, and greater design flexibility. Polypropylene (PP), Polyurethane (PU), Acrylonitrile Butadiene Styrene (ABS), and Polyvinyl Chloride (PVC) are widely used for vehicle parts and component applications. Plastics undergo five stages while recycling, which include washing, identification, shredding, sorting & classification, and extruding into the final component or product.

的一个重要的汽车司机plastic market in the US is stringent fuel efficiency and emissions regulations set by the government. Plastics are lightweight compared to traditional materials such as metal, contributing to overall weight reduction in vehicles. This weight reduction helps automakers meet strict fuel economy standards, leading to lower emissions and improved environmental sustainability.

Such a trend is anticipated to grow due to the rising demand for lightweight, high-performance, and fuel-efficient vehicles from consumers in the U.S., thus augmenting the demand for automotive plastics. Moreover, weight reduction offers an economical way to lower Greenhouse Gas (GHG) emissions and fuel consumption, thus helping in the conservation of non-renewable crude oil reserves.

市场Dynamics

Manufacturers of lightweight automobiles are increasing the demand for automotive polymers. Stringent environmental and safety standards enforced by various governments have compelled car original equipment manufacturers (OEMs) to replace metal components with polymer components. These rules have compelled vehicles to use lighter materials, such as plastics. Advanced plastics materials increase fuel efficiency while retaining vehicle safety and performance.

The market expansion is aided by the risingelectric vehicles(EVs) demand. EVs are more efficient than conventional vehicles while also being lightweight and run on renewable energy supply. The increasing demand for electric vehicles is expected to result in higher revenues in this market from 2024 to 2030.

Increased environmental awareness, government subsidies and incentives, and OEM investments in the EV industry. Volkswagen, General Motors, BMW, Ford, Tesla Motors, and Toyota are among the leading automakers in the electric vehicle segment. EVs are more efficient, self-sufficient, and superior to their gas-powered counterparts. Thus, the growing demand for EVs presents an expansion opportunity for the automotive plastics sector.

Product Insights

The polypropylene segment led the market and accounted for the largest revenue share of more than 32.25% in 2023. This growth can be attributed to rising product demand from end-use industries such as packaging, electrical and electronics, construction, consumer products, and automotive. Polypropylene finds application in both rigid andflexible packagingowing to its physical and chemical properties. Apart from this, it offers excellent chemical and electrical resistance at very high temperatures. PP is quite lightweight as compared to other plastics, making it suitable for applications in the automotive sector for reducing the overall weight of vehicles, which helps reduce fuel consumption and carbon dioxide emissions.

Thepolyvinyl chloridesegment is expected to grow at a significant rate over the forecast period. PVC is used in a broad range of domestic and industrial products such as shower curtains, raincoats, window frames, and indoor plumbing. Its primary automotive uses include underbody coatings, floor modules, sealants, passenger compartment parts, wiring harnesses, and external parts.

Process Insights

The注塑成型segment led the market and accounted for the largest revenue share of over 56% in 2023. The high share is attributed to applications of a broad range of injection-molded plastics in the automotive industry to manufacture door handles, console and dashboard covers and brackets, engine hoses and tubes, radio covers and other electrical internal components, buttons and bezel panels, controls and covers for sunroof, knobs for shifter levers, and convertible roof assemblies.

Injection molding is one of the most common processes used in the automotive industry to mold plastic. It is a process of creating customized plastic parts and fittings by injecting molten plastic material into a metal mold under high pressure. Modern innovations to minimize error rates have increased the importance of injection molding technology in the mass production of complicated plastic molds.

Moreover, the blow-molding process is also widely used in the automotive industry owing to its advantage of making more complex products in various designs and shapes that would otherwise be challenging with other technologies with the cost of the end product being significantly higher. This process allows companies to increase their production output in a relatively short period while maintaining flexibility in terms of design and materials.

Application Insights

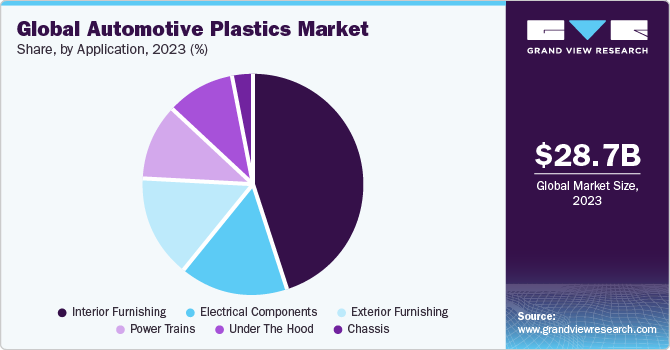

The interior furnishings segment led the market for automotive plastics and accounted for the largest revenue share of more than 43.0% in 2023. The growing demand for automotive plastics in an area such as seat covers, body and light panels, seat bases, load floors, steering wheels, headliners, and rear package shelves and fascia systems is projected to boost the market for automotive plastics.

Moreover, the proliferation of digitalization has fostered the demand for plastics integrated into car dashboards to support highly advanced electronics. Safety concerns and the high electrical insulation properties of plastics have also boosted their demand for instrument panels containing advanced electronic systems. Plastics including PVC exhibit excellent chemical & solvent resistance with good tensile strength and flexibility, which makes them highly suitable for instrument panels and other electrical components.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 46% in 2023. Shifting manufacturing bases from developed regions to developing economies of Asia Pacific, particularly in China, India, Vietnam, and Thailand. Consumers in Europe and APAC are highly conscious regarding fuel efficiency. This has also increased the need for environment-friendly polymers. For instance, in November 2021, Indian Oil Corporation (IOC) and two other public sector oil companies declared plans to build 22,000 charging stations for electric vehicles over the next three to five years.

Europe accounted for a revenue share of more than 31.0% in 2023 and is expected to grow at a significant rate. Automobile manufacturers in Europe are using high-performance plastics as these materials are energy-efficient and help in the weight reduction of vehicles. European automakers to switch from diesel engines to electrified motors. This is also expected to augment product demand.

Key Companies & Market Share Insights

Global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers and regulations. Companies in the market compete on the basis of product quality offered and technology used for the production of automotive plastics. Major players, in particular, compete on the basis of application development capability and new technologies used for product formulation.

In August 2023, Borouge, a petrochemical company that provides polyolefin solutions, and Borealis, a polyolefin manufacturer, introduced two new sustainable polymer products for the automotive sector. These polypropylene solutions have undergone TÜV Rheinland-certified ISO 14067 carbon footprint assessment and are made from up to 70% post-consumer recycled materials. The assessment spans the complete life cycle of the products (from cradle to gate). These new grades reduce carbon emissions and energy consumption while providing comparable performance and consistency to virgin compounds.

Key Automotive Plastics Companies:

- BASF SE

- SABIC

- Dow Inc.

- AkzoNobel N.V.

- CovestroAG

- Evonik Industries AG

- Borealis AG

- Royal DSM N.V.

- Magna International, Inc.

- Teijin Limited

Automotive Plastics Market Report Scope

Report Attribute |

Details |

市场size value in 2024 |

USD 31.63 billion |

Revenue forecast in 2030 |

USD 43.44 billion |

Growth rate |

CAGR of 5.4% from 2024 to 2030 |

Base year for estimation |

2023 |

Historical data |

2018 - 2022 |

Forecast period |

2024 - 2030 |

Report updated |

November 2023 |

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, trends |

Segments covered |

Product, process, application, region |

区域范围 |

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Southeast Asia; Brazil |

Key companies profiled |

BASF SE;沙特基础工业公司;陶氏化学公司。阿克苏诺贝尔公司喷嘴速度;CovestroAG; Evonik Industries AG; Borealis AG; Royal DSM N.V.; Magna International; Inc.; Teijin Limited |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Automotive Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive plastics market report based on product, process, application, and region:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Acrylonitrile Butadiene Styrene (ABS)

Polypropylene (PP)

PP LGF 20

PP LGF 30

PP LGF 30Y

Others

Polyurethane (PU)

Polyvinyl Chloride (PVC)

Polyethylene (PE)

Polycarbonate (PC)

Polymethyl Methacrylate (PMMA)

Polyamide (PA)

Others

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Injection Molding

Blow Molding

Thermoforming

Other

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

动力系统

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Polyurethane (PU)

Acrylonitrile Butadiene Styrene (ABS)

Polycarbonate (PC)

Polyamide (PA)

Others

Electrical Components

Polyamide (PA)

Polypropylene (PP)

Polymethyl Methacrylate (PMMA)

Acrylonitrile Butadiene Styrene (ABS)

Polyvinyl Chloride (PVC)

Others

Interior Furnishings

Polyurethane (PU)

Polypropylene (PP)

Polymethyl Methacrylate (PMMA)

Acrylonitrile Butadiene Styrene (ABS)

Polyvinyl Chloride (PVC)

Exterior Furnishings

Polypropylene (PP)

Acrylonitrile Butadiene Styrene (ABS)

Polyvinyl Chloride (PVC)

Polyurethane (PU)

Polyamide (PA)

Under the Hood

Polyethylene (PE)

Polypropylene (PP)

Polyamide (PA)

Acrylonitrile Butadiene Styrene (ABS)

Polyurethane (PU)

Chassis

Polyethylene (PE)

Polypropylene (PP)

Acrylonitrile Butadiene Styrene (ABS)

Polyamide (PA)

Polyurethane (PU)

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

Italy

France

Asia Pacific

China

India

Japan

Southeast Asia

Central and South America

Brazil

Middle East and Africa

Frequently Asked Questions About This Report

b.The global automotive plastics market size was estimated at USD 30.44 billion in 2023 and is expected to reach USD 31.63 billion in 2024.

b.The automotive plastics market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 43.44 billion by 2030.

b.The polypropylene segment led the global automotive plastics market and accounted for the largest revenue share of more than 32.30% in 2023.

b.The injection molding segment led the global automotive plastics market and accounted for the largest revenue share of more than 56.15% in 2023.

b.The interior furnishings segment led the global automotive plastics market and accounted for the largest revenue share of more than 44.25% in 2023.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."