Dietary Supplements Market Size, Share & Trends Analysis Report By Ingredient (Vitamins, Botanicals), By Form (Tablets, Soft gels), By End-user, By Application, By Type, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-919-7

- Number of Pages: 189

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Dietary Supplements Market Size & Trends

The globaldietary supplements market size was estimated at USD 164.0 billion in 2022预计到年复合增长增长th rate (CAGR) of 9.0% from 2023 to 2030. The global market is expected to witness significant growth in light of the favorable outlook toward the medical nutrition market, considering the increasing application for treating malnutrition- and cardiovascular-related illnesses. Furthermore, over the past few years, the rising sales volume of sports nutrition products in main markets such as the U.S. and China, along with new product launches, is likely to have a significant impact on the industry over the projected period. Increasing consumer awareness regarding nutrition, health & wellness is driving the market growth.

Various awareness campaigns run by government agencies, nongovernmental organizations, and companies have boosted consumer understanding pertaining to the nutritional benefits of dietary supplements, which, in turn, is projected to fuel market growth. Moreover, the consumption of premium nutrition-infused products is regarded as a symbol of one’s social status in many countries.

The product line of some companies engaged in the manufacturing of dietary supplements includes organic and natural products, which is further driving the market growth. The use of attractive packaging methods has led to increased consumer awareness, which, in turn, has triggered spending on such supplements.

In addition, increased demand for sports nutritional supplements is also driving the market growth.Sports nutritioninvolves the consumption of nutrients such as vitamins, proteins, supplements, fats, carbohydrates, minerals, and organic substances. Sports nutritional products comprise sports beverages, sports supplements, and sports foods, which are targeted at enhancing the strength & endurance of athletes and bodybuilders to increase their overall performance, stamina, promote muscle growth, and improve health.

Nanoencapsulation和微型胶囊技术ies have gained popularity over the past few years owing to controlled release and minimum utilization of ingredients. Increasing application of encapsulation technologies in the fortification of food & beverage products is expected to tap new markets for sports nutrition ingredients. Furthermore, the ascending demand for naturally derived ingredients in light of increasing health concerns related to synthetic ingredients is expected to fuel the penetration of herbal supplements in the sports nutrition industry.

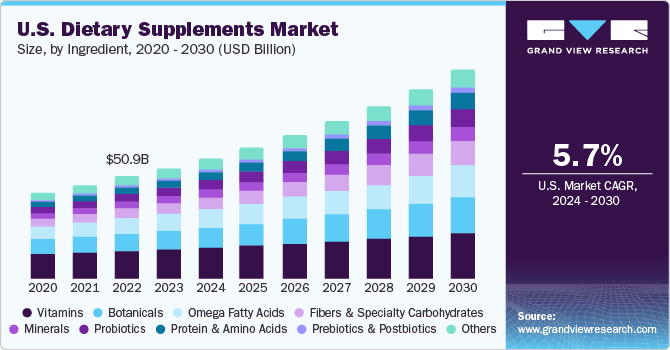

The U.S. had the largest market in North America with over 91.54% of the revenue share in 2022. Factors fueling interest in dietary supplements in the U.S. include growing healthcare costs, changes in food laws affecting label and product claims, rapid advances in science and technology, a rising geriatric population, and growing interest in attaining wellness through diet.

Prebiotics, together with probiotics, open new avenues for heightened levels of health in general, thus, allowing consumers to afford and include them in their daily diets. These products are specifically beneficial for the gut as they promote digestion by retaining and promoting healthy intestinal flora in the human digestive system. High intake of prebiotics lowers the risk of cardiovascular diseases and retains healthy cholesterol levels, thereby, leading to increasing product demand in the U.S. market.

Ingredient Insights

根据维生素成分,部分帐户ed for a substantial market share of 30.2% in 2022. These supplements are available in several forms, such as vitamin A (carotenoids and retinols), vitamin B (folic acid), vitamin C (ascorbic acid), and vitamin D (cholecalciferol), among others. Vitamin A aids in the maintenance and improvement of eye health as well as the immune system, while vitamin E assists in repairing the DNA and strengthening immunity. These products are expected to find more applications among working professionals and sports athletes in the form of multivitamin tablets, powders, and liquids over the forecast period.

Protein & amino acids are projected to grow at the fastest CAGR of 13.4% from 2023 to 2030. Consumers have become more health-conscious, which has led to them demanding for products that can address their nutritional requirements. Amino acid and protein supplements are considered to be an effective & convenient mode of ensuring adequate intake, especially in individuals with hectic lifestyles or particular dietary restrictions.

Application Insights

With regard to application, the energy andweight managementsegment accounted for the highest revenue share of 30.5% in the market in 2022. The demand for dietary supplements that include vitamins and proteins is mainly influenced by sports enthusiasts. These supplements aid athletes in restoring their energy, bettering their muscular endurance, and minimizing body wear & tear. In addition, the growing demand for collagen and vitamin D-based dietary supplements can be attributed to several health objectives such as improving joint health, enhancing weight loss, and increasing bone and muscle strength, which further drives the market growth.

The others segment is projected to grow at a CAGR of 11.7% from 2023 to 2030. The segment includes products that help in improving vision, mood, and nervous & urinary system functioning, along with curing hangovers. Dietary supplements encourage optimal health in consumers and minimize the risk of diseases. The positive outlook of the masses toward the maintenance of eye health owing to the increasing focus on an active lifestyle and the surged awareness among consumers about the benefits offered by protein, vitamin, mineral, andcollagen supplementsare expected to play a crucial role in promoting the consumption of dietary supplements globally over the coming years.

End-user Insights

In terms of end-user, the adults segment held the largest revenue share of 46.01% in 2022 in the global dietary supplements industry. The rising consumption of dietary supplements by working individuals to maintain a healthy lifestyle is expected to remain a favorable factor for the market. Furthermore, increasing awareness toward healthy diets among working individuals and sports athletes to maintain the nutritional balance in their bodies is expected to promote the scope of dietary supplements over the forecast period.

The infants segment is projected to grow at the fastest CAGR of 13.7% from 2023 to 2030. Increasing research & development activities in terms of infant nutrition on account of rising consumption of breast milk substitutes, which closely resemble the functionality and composition of breast milk, are anticipated to drive the segment over the forecast period.

Type Insights

Based on type, the OTC segment held the largest revenue share of 75.6% in 2022. The OTC sales of dietary supplements are anticipated to witness steady growth because of rising consumer awareness regarding the nutritional value and health benefits of these products. Self-medication for treating gastrointestinal and immunity-related issues is another key factor driving the demand for OTC dietary supplements. The convenience of direct purchases and cost-effectiveness are expected to promote the sales of these dietary supplements.

The prescribed segment is projected to grow at the fastest CAGR of 9.4% from 2023 to 2030. Strict regulations by governing bodies regarding OTC dietary supplements and lower awareness among many individuals about self-medication are expected to augment the demand for prescribed dietary supplements. In addition, increasing R&D expenditure and funding from the public and private sectors are expected to boost segment growth.

Distribution Channel Insights

In terms of distribution channel, the offline segment held a revenue share of 81.3% in 2022. An increase in the number of prescribed dietary supplements by medical practitioners for the treatment of gastrointestinal disorders, immunity-related issues, bone health, folic acid deficiencies, heart health, and age-related macular degeneration is a key factor driving the demand for dietary supplements through offline distribution channels.

The online segment is projected to grow at the fastest CAGR of 9.7% from 2023 to 2030. The sales of dietary supplements through the online distribution channel are expected to witness the highest growth in the coming years. Increased number of internet users, ease of access to numerous brands, fast-paced lifestyles of the masses, 24/7 availability of products, convenience of shopping, and a wide range of products offered are factors driving the sales of dietary supplements through online distribution channels.

Form Insights

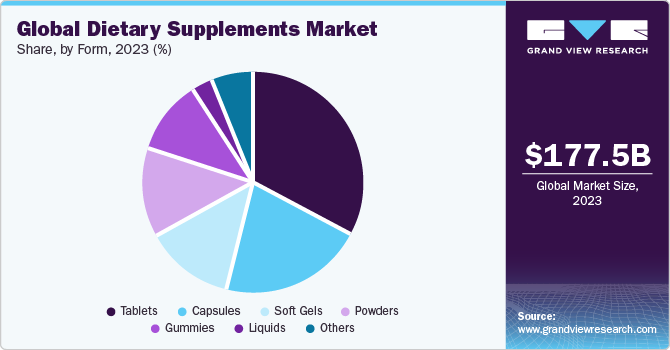

Based on form, the tablets segment held a revenue share of 33.3% in 2022. High-quality supplements use excipients that aid in tablet absorption and disintegration. Although the natural coating provides better dissolution. All these factors are expected to drive the demand for natural health supplements in the form of tablets over the forecast period.

Liquid form segment is projected to grow at the fastest CAGR of 12.2% from 2023 to 2030. A liquid dietary supplement is a liposomal product that is evenly dispersed in water for smooth consumption. This allows the blending of liquid dietary supplements in yogurt, water, smoothies, and energy drinks. Liquid dietary supplements are easily digestible and are preferred by adults and Gen X, owing to which its demand is expected to remain high over the forecast period.

Regional Insights

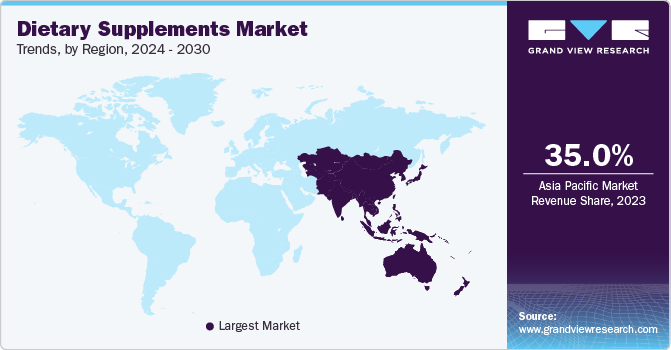

Asia Pacific region dominated the market with a revenue share of 34.9% in 2022. The Asia Pacific market is anticipated to witness increasing demand for dietary supplements as key participants are introducing their brands in the untapped markets of Southeast Asia. China, Japan, and India are among the largest markets for dietary supplements in Asia Pacific owing to the presence of a large consumer base in these countries. Japan and Australia have experienced heightened awareness regarding the health benefits of dietary supplements over the years, which is expected to strengthen the regional market growth over the forecast period.

However, the Middle East and Africa are expected to grow at a significant CAGR of 10.1% from 2023 to 2030. The Middle East & Africa market is anticipated to witness a growing demand for dietary supplements, which can be attributed to the expanding health industry in the region. The market is mainly driven by rising disposable incomes and increasing awareness among consumers regarding the health benefits of dietary supplements. Transitioning demographics in the region, including the rise of the young & working population, have increased the spending on products related to health and well-being.

In addition, the market in South Africa is driven by the increasing product consumption among millennials and rising government focus on creating awareness about the health benefits of dietary supplements.

Europe is anticipated to witness a CAGR of 7.0% over the forecast period. The prevalence of lactose intolerance and obesity in Europe has increased the demand for probiotic health supplements. Furthermore, the German market is fueled by rising clinical evidence to support the benefits or effectiveness of these supplements in disease treatment and the maintenance of general health. Dietary supplements are being increasingly consumed in the country for the treatment of inflammatory bowel disease (IBD), infectious diarrhea, and lactose intolerance.

Key Companies & Market Share Insights

市场既包括国际和domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

In February 2023, the Amway company introduced a new range of nutrition supplements under its Nutrilite brand. The products, including gummies and jelly strips, are designed to meet the nutritional needs of busy millennials. The range includes supplements for overall health and immunity, bone health, and eye health.

In November 2022, the company partnered with TerraCycle, a recycling company, to divert its flexible packaging from landfills under its NOW Recycling Program. Consumers can collect 1 USD for every 1 pound of waste shipped to TerraCycle, which they can donate to a charitable, non-profit organization or school. The NOW Recycling Program enables consumers to recycle flexible food and supplement packaging and toothpaste tubes that are not accepted by most municipal recycling programs.

Some prominent players operating in the global dietary supplements market include:

Amway Corp.

Abbott

Bayer AG

Glanbia plc

Pfizer Inc.

Archer Daniels Midland

NU SKIN

GlaxoSmithKline plc.

Herbalife Nutrition Ltd.

Nature's Sunshine Products, Inc.

XanGo, LLC

RBK Nutraceuticals Pty Ltd

American Health

DuPont de Nemours, Inc.

Good Health New Zealand

Nature's Bounty

NOW Foods

Dietary Supplements MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 177.5 billion |

Revenue forecast in 2030 |

USD 327.4 billion |

Growth rate |

CAGR of 9.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Report updated |

October 2023 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Ingredient, form, application, end-user, type, distribution channel, region |

Regional scope |

North America; Europe; Middle East and Africa; Asia Pacific; Central and South America |

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Peru; Chile; Saudi Arabia, South Africa |

Key companies profiled |

Amway Corp.; Abbott; Bayer AG; Glanbia plc; Pfizer Inc.; Archer Daniels Midland; NU SKIN; GlaxoSmithKline plc.; Herbalife Nutrition Ltd.; Nature's Sunshine Products, Inc.; XanGo, LLC; RBK Nutraceuticals Pty Ltd; American Health; DuPont de Nemours Inc.; Good Health New Zealand; Nature's Bounty; NOW Foods |

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

价格和购买该俱乐部ns |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalDietary Supplements MarketReport Segmentation

这份报告预测收入增长在全球、再保险gional & and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global dietary supplements market report on the ingredient, form, application, end-user, type, distribution channel, and region:

Ingredient Outlook (Revenue, USD Billion, 2017 - 2030)

Vitamins

Botanicals

Minerals

Protein & Amino Acids

Fibers & Specialty Carbohydrates

Omega Fatty Acids

Others

Form Outlook (Revenue, USD Billion, 2017 - 2030)

Tablets

Capsules

Soft gels

Powders

Gummies

Liquids

Others

Application Outlook (Revenue, USD Billion, 2017 - 2030)

Energy & Weight Management

General Health

Bone & Joint Health

Gastrointestinal Health

Immunity, Cardiac Health

Diabetes, Anti-cancer

Lungs Detox/Cleanse

Skin/ Hair/ Nails

Sexual Health

Brain/Mental Health

Insomnia, Menopause

Anti-aging

Prenatal Health

Others

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

Infants

Children

Adults

Pregnant women

Geriatric

Type Outlook (Revenue, USD Billion, 2017 - 2030)

OTC

Prescribed

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

Online

Offline

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

India

Japan

Australia

South Korea

Central and South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

- UAE

Frequently Asked Questions About This Report

b.The main ingredients used in the preparation of dietary supplements include minerals, vitamins, proteins, and amino acids, botanicals, omega fatty acids, and fibers, and specialty carbohydrates.

b.The global dietary supplements is expected to grow at a compounded growth rate of 9.0% from 2023 to 2030 to reach USD 327.4 billion by 2030.

b.The major end-users in the dietary supplements market include adults, pregnant women, children, the geriatric population, and infants, with the infants segment expected to witness the highest growth of nearly 14% during the forecast period.

b.The offline distribution segment dominated the market with over 81% revenue share in 2022 and is expected to grow at a CAGR of 8.9% during the forecast period.

b.The global dietary supplements size was estimated at USD 164.0 billion in 2022 and is expected to reach USD 177.5 billion in 2023.

b.The top application areas in the dietary supplements market include energy & weight management, general health, and bone & joint health, together accounting for a revenue share of over 50% in 2022.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."