Hand Sanitizer Market Size, Share & Trends Analysis Report By Product (Gel, Foam), By Distribution Channel (Hypermarket & Supermarket, Drugstore), By Region (Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-249-5

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Report Overview

The globalhand sanitizer market sizewas estimated atUSD 6.5 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Rising global awareness regarding sanitation and personal hygiene is expected to drive the product demand as it is an antiseptic solution, which is used as an alternative to soap and water. Moreover, it helps in preventing some of the most infectious diseases, including COVID-19, norovirus, influenza, meningitis, hand, foot, and mouth disease, pertussis (whooping cough), and methicillin-resistant staphylococcus aureus (MRSA). The COVID-19 pandemic has called for the increased use of hand sanitizers worldwide in public facilities, transportation, hospitals, nursing homes, and even common households to mitigate the virus burden.

Active ingredients, such as ethyl alcohol, used to manufacture sanitizers are recommended for use against COVID-19 viruses, which is claimed to be effective against SARS CoV-2 virus, by The United States Food and Drug Administration (FDA). Such factors are likely to boost the market growth. Health and hygiene concerns are increasing worldwide. The market has been witnessing significant developments in the industry worldwide in the wake of the pandemic. However, with supply chain disruptions and wide supply-demand gaps worldwide, the industry faced significant challenges in ramping up manufacturing capacities to help mitigate the supply shortage.

To address this supply shortage, several companies have begun leveraging their mass production capabilities to manufacture these products for their domestic markets. For instance, in April 2020 Honeywell announced the expansion of its manufacturing operations at two chemical manufacturing facilities to produce and donate hand sanitizer to government agencies in response to shortages caused by the COVID-19 pandemic. The company’s sites in Muskegon, Michigan, Seelze, and Germany, produced these products for two months, May and June 2020, for government agencies, and institutions in need. However, third-party manufacturers, or contract manufacturers, were critical to major brands in increasing their output in 2020-2021.

For instance, in April 2020, SC Johnson, a global manufacturer of household and professional cleaning and disinfecting products, converted a line reserved for testing new products to produce up to 75,000 bottles of hand sanitizer per month for health workers, first responders, and the company’s own production employees. There have been many investments done by several companies to expand their business in other markets. For instance, in April 2020, Unilever plc adapted one of its deodorant manufacturing lines in the UK to produce supplies of hand sanitizer for the Leeds Teaching Hospital NHS Trust, and the first batch of more than 700-liter sanitizer was supplied to St. James’s University Hospital.

解决潜在的干燥eff的担忧ects of alcohol-based hand sanitizers, manufacturers are incorporating natural ingredients like aloe vera into their products. This addition helps mitigate the risk of rough skin and provides a gentler and more moisturizing experience. Prominent market players are actively promoting the use of hand sanitizers through advertising, promotional campaigns, and media coverage. These efforts contribute to increased consumer awareness and adoption of hand sanitizers, allowing companies to expand their share in the global market. Hand sanitizers with pleasant fragrances gained popularity. Manufacturers frequently introduce new scent options like Black Cherry Merlot, Champagne Toast, Gingham Fresh, Japanese Cherry Blossom, and more, based on consumer preferences and market trends to provide a diverse range of choices for individuals.

Innovators and entrepreneurs across the globe are reinventing their business models in light of the coronavirus pandemic. In the craft cocktail arena, breweries and distilleries are transitioning their focus from spirits to hand sanitizers. For instance, in May 2020, Doctor Shultz’s partnered with Ilthy, a clothing brand for manufacturing and supplying hand sanitizers & face masks. Consumers are increasingly recognizing the significance of hand hygiene for their overall health and well-being, leading to a growing demand for hand sanitizers. Hand sanitizers are considered essential in preventing the transmission of contagious diseases, which is expected to drive market growth. The convenience and portability offered by hand sanitizers, along with their effectiveness in preventing various diseases, are attracting a wide consumer base and boosting sales.

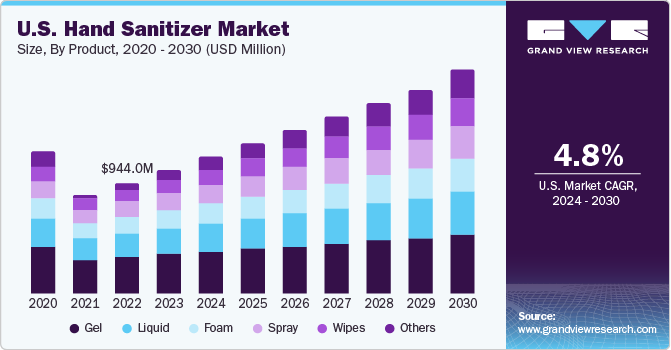

Product Insights

The gel-based hand sanitizer segment held the largest share of 46.4% in 2022 and is expected to maintain dominance over the forecast period. Gel sanitizers are usually light and watery in the formulation and therefore have high spreadability, which allows sanitizers to easily penetrate the skin to kill most bacteria. The easy product availability and wider access to these types of antiseptic products will fuel the demand for these products in the coming years. Gel sanitizers have witnessed unprecedented demand across the globe during the coronavirus outbreak, especially in North America, Europe, and Asia Pacific.

Television news channel CNBC reported that online stocks of numerous gel hand sanitizers were sold out on Amazon, Walmart, and Walgreens in March 2020. However, the foam-based product segment is projected to register the fastest CAGR of 7.0% from 2023 to 2030. Foam-based products easily penetrate the skin and stay for longer periods. Foam-based sanitizers are easy to apply and thus provide the convenience of saving time. These products are expected to witness a rise in demand owing to their higher effectiveness against microbial germs. For instance, in March 2021, Cleancult, a non-toxic, zero waste cleaning brand launched foam-based hand sanitizer, made from fragrance-free formula and is FDA approved disinfectant and claims to kill 99.9% of germs.

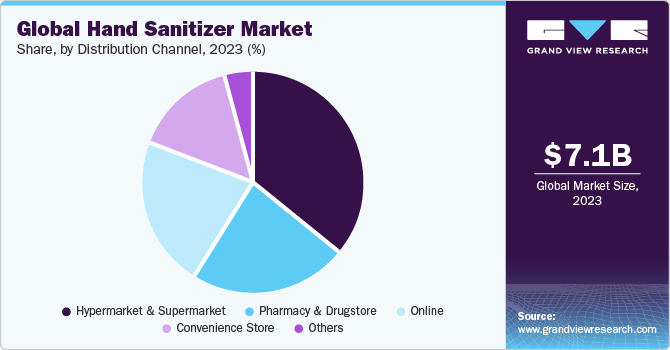

Distribution Channel Insights

的超market & supermarket segment accounted for the largest share of around 37.7% of the global revenue in 2022 due to the increased number of these stores across various regions and the rise in the distribution of cleansers in the market. According to an article published by Consumer News and Business Channel (CNBC), in March 2020, hand sanitizer sales in the U.S. went up by 300% as compared to the same week in the year 2019. Several stores were running out of stock for hand sanitizers in the first couple of weeks of the outbreak. Supermarkets in Singapore were also out of these and other household cleaning products in March 2020, primarily owing to panic shopping or stocking up on hand sanitizers.

阻止囤积和过度的上限buying prices were increased. For instance, in March 2020 Rotunden, a supermarket in Denmark, sold one bottle of these sanitizers at USD 4.09 and two bottles for USD 95. The online distribution channel segment is anticipated to register the fastest CAGR of 6.9% from 2023 to 2030. The segment is poised to emerge as a steady source of revenue over the forecast period. Promising growth exhibited by e-commerce platforms in emerging countries, including India and China, is compelling manufacturers to reorient their retail strategies in these countries.

Consumers were stocking up on hand sanitizers and other antibacterial products due to the coronavirus outbreak. In the U.S., the online purchase of ‘virus protection’ products, such as sanitizers, masks, gloves, and antibacterial sprays, reported an astounding 817% increase during January-February 2020, as compared to the same period the previous year. Alcohol-based hand sanitizer gels, recommended by the World Health Organization (WHO), sold out on prominent online platforms, such as Amazon, Walmart, and Walgreens, in the first couple of months of the outbreak.

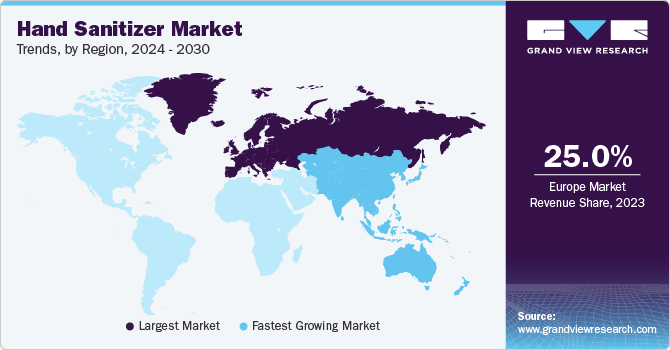

Regional Insights

Europe accounted for the second-largest revenue share of 24.8% in 2022. This region comprises a number of market players, which witness high penetration of different forms of hand antiseptic, such as gel-based, foam-based, sprays, and wipes. Countries including the UK and Germany dominate the market since consumers in the country are more willing to spend on personal care and hygiene products. Also, increasing consciousness about environmental issues prompted some consumers to look for hand sanitizers with eco-friendly packaging, refillable options, or formulations that use natural and sustainable components.

此外,由于COVID-19大流行,酒精-based sanitizers have been witnessing tremendous demand in the region. The trend of panic shopping and hoarding of sanitizers during the pandemic resulted in a shortage of the product; thus, several local drugstores and chemical manufacturers increased their production to meet the excess demand. For instance, in April 2020, Vegamour launched its own hand sanitizer that exceeds the Centers for Disease Control and Prevention (CDC) standards for hand hygiene. Asia Pacific is expected to be the fastest-growing regional market at a CAGR of 6.9% from 2023 to 2030.

The region’s growth can be attributed to the growing awareness about hygiene in the region due to the viral infection caused by COVID-19. Moreover, companies are launching innovative and different types of personal care & hygiene products in the market stressing safety factors for consumers. For instance, in April 2020, DetectaChem, launched its own low-cost antiseptic hand-rub, which is available to purchase on the DetectaChem website. The launch was made in response to increasing community safety during the COVID-19 pandemic.

Key Companies & Market Share Insights

The global market is highly fragmented with the presence of a large number of regional and local players. The market players face intense competition, especially from the top manufacturers as they have a large consumer base, strong brand recognition, and vast distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead of the competition. For instance:

In May 2020, Reckitt Benckiser Group plc. announced its partnership with the Hilton chain of hotels to launch the Hilton CleanStay initiative. Reckitt Benckiser Group plc.’s brands Lysol and Dettol will collaborate with Mayo Clinic’s Infection Prevention and Control team to enhance Hilton’s cleaning and disinfection protocols

In April 2020, Procter & Gamble began the production of hand sanitizers and masks for commercial customers to combat the shortage of these products during the pandemic. They are marketed under the Safeguard brand, owned by Procter & Gamble, and meet the standards and regulations set by the World Health Organization

In March 2020, Henkel AG & Co. launched a global solidarity program to support employees, customers, and communities affected by the pandemic. This program included the production of disinfectants at Henkel production sites and donations worth 2 million euros to the World Health Organization and United Nations Foundation COVID-19 fund and other select organizations

Some of the key players operating in the global hand sanitizer market include:

Reckitt Benckiser Group plc

Procter and Gamble

The Himalaya Drug Company

GOJO Industries, Inc.

Henkel AG and Company

Unilever

Vi-Jon

Chattem, Inc.

Best Sanitizers, Inc.

Kutol

Recent Developments

In May 2022, GOJO Industries Inc. made expansion in its surface hygiene portfolio by launching PURELL® Healthcare Surface Disinfecting Wipes. These wipes are type of hand sanitizers that eliminate 99.9% bacteria and viruses.

In May 2022,Best Sanitizers Inc. collaborated with Saraya Co. Ltd., and the World Health Organization (WHO) to support World Hand Hygiene Day. The purpose is to spread awareness about the benefit of a good hand hygiene, and educating people regarding the usefulness of hand sanitizer for reducing transmission in healthcare environments.

In February 2022, Reckitt Benckiser Group partnered with USC School of Medicine to promote public health, and educate the LA community regarding COVID-19 vaccine. In addition, Reckitt donated 4 million packs of Lysol Disinfecting Wipes which are a form of hand sanitizer to support local hygiene and disinfection.

Hand Sanitizer MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 7.04 billion |

Revenue forecast in 2030 |

USD 10.84 billion |

Growth rate |

CAGR of 6.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Report updated |

July 2023 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; Italy; India; China; Japan; Brazil; South Africa |

Key companies profiled |

Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; Kutol |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Hand Sanitizer Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the hand sanitizer market report based on product, distribution channel, and region:

Product Outlook(Revenue, USD Million, 2017 - 2030)

Gel

Foam

Liquid

Others

Distribution Channel Outlook(Revenue, USD Million, 2017 - 2030)

Hypermarket & Supermarket

Drugstore

Online

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

U.S.

Canada

Europe

UK

Germany

Italy

Asia Pacific

India

China

Japan

Central & South America

Brazil

Middle East & Africa

South Africa

- North America

Frequently Asked Questions About This Report

b.Asia Pacific dominated the hand sanitizer market with a share of 41.8% in 2022. The growth of the regional market is mainly driven by the increased and frequent use of hand sanitizers, there was a rise in demand for products that were gentle on the skin and included moisturizing properties to prevent dryness and irritation.

b.Some of the key players operating in the hand sanitizer market include Reckitt Benckiser Group plc; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Henkel AG and Company; Unilever; Vi-Jon; Chattem, Inc.; Best Sanitizers, Inc.; and Kutol

b.Key factors that are driving the hand sanitizer market growth include panic buying of the product on account of the COVID virus outbreak wherein the industry had witnessed an increase in consumption and manufacturing of the product is expected to contribute to the market growth.

b.The global hand sanitizer market was estimated at USD 6.5 billion in 2022 and is expected to reach USD 7.04 billion in 2023.

b.The global hand sanitizer market is expected to grow at a compound annual growth rate of 6.6% from 2022 to 2030 to reach USD 10.84 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."