Insulation Market Size, Share & Trends Analysis Report By Product (Glass Wool, Mineral Wool, EPS, XPS, CMS Fibers), By End-use (Construction, Industrial, HVAC & OEM), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-196-2

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry:0b足球

Report Overview

The global insulation market size was estimated at USD 61.36 billion in 2022, expanding at a CAGR of 6.6% over the forecast period. Increasing consumer awareness regarding energy conservation is estimated to have a positive influence on the demand for insulation over the forecast period. The global insulation industry has experienced limited growth due to the economic recession caused by the Covid-19 crisis, which has resulted in low investor confidence and a decline in construction activities; as a result, the insulation materials market has also experienced a catastrophic setback.

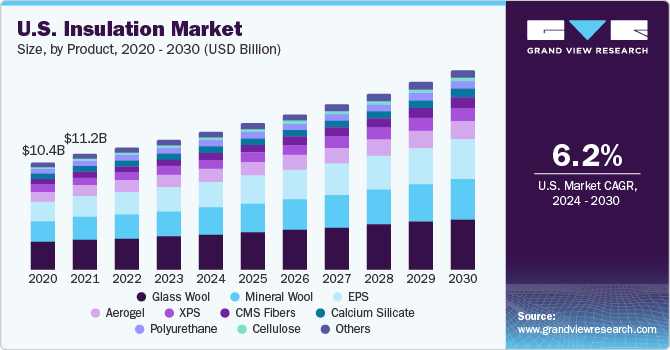

The spread of COVID-19 in the U.S. affected the growth of the engineering and construction industries. The stay-at-home instructions and social distancing mandates have slowed new and retrofit project sites in residential and commercial fields. In the U.S., the glass wool sector accounted for the largest market share of 25.9% in 2022 and is estimated to expand at a CAGR of 6.0% over the forecast period. Glass wool is a thermal insulator consisting of flexible and knotted glass fibers which trap air inside resulting in low density. The segment was followed by mineral wool and EPS, respectively.

The high rate of industrialization, along with rapid urbanization in the emerging markets of China and India, as well as the Philippines, Malaysia, Thailand, and Indonesia, have driven the need for better infrastructure. Moreover, increasing regulatory support and rising demand for residential and industrial insulation are the factors estimated to fuel market demand over the projected period.

However, fluctuating raw material prices and strict environmental regulations are estimated to hamper the overall market growth in the coming years. The rising presence of manufacturing industries in China, India, Brazil, and Mexico is estimated to boost the demand for fiberglass insulation in industrial buildings. This trend is anticipated to boost the market growth further.

Rising demand for sustainable residential buildings due to growing population and urbanization is a recent end-use trend estimated to drive industrial growth. Furthermore, technological enhancements in thermal insulation, like vacuum insulation panels and R&D activities to advance transparent thermal insulation, are the factors estimated to create new opportunities for industrial development.

Companies in the global insulation market continuously offer extensive product portfolios to meet the current and future demands from varied customer demands in different application industries such as petrochemical, oil & gas, construction, and transportation, having significant prominence of product innovation. Moreover, strategic product development, mergers, acquisitions, a vast distribution network, and geographic expansion are expected to drive the market competition.

Product Insights

The EPS insulation product segment led the market and accounted for more than 27.4% share of the global revenue in 2022.Expanded polystyrene is a lightweight and high-tensile plastic foam insulation made out of rigid polystyrene pellets. The product is estimated to continue its dominance over the forecast period.

The glass wool product segment is expected to expand at a CAGR of 6.4% over the forecast period. Glass wool is made of sand and has thermal and acoustic insulation properties such as low weight and high tensile strength. Removable blankets are a byproduct of glass wool and make an excellent cover for turbines, pumps, heat exchangers, tanks, expansion joints, valves, flanges, and other irregular surfaces generating heat in industrial environments.

In 2022, extruded polystyrene foam insulation (XPS) segment held a share of 9.5% of the total market revenue. The product is potentially an environmentally responsible alternative to other building insulation materials. Moreover, stone wool occurs naturally as a byproduct of volcanic eruptions. It is highly resistant to heat transfer since it combines the capabilities of thermal insulation characteristics inherent to wool and the strength of stone.

The Aerogel segment is projected to register a CAGR of 6.5% in value over the forecast period. The product is a solid, open-celled, mesoporous foam of nanostructures interconnected in a network.Aerogelis claimed as the lightest solid material in comparison with other insulation materials. Aerogel bears many advantages, such as optimized thermal conductivity in high-temperature service, faster application on large-bore piping and vessels, quick application on large-bore piping and vessels, etc.

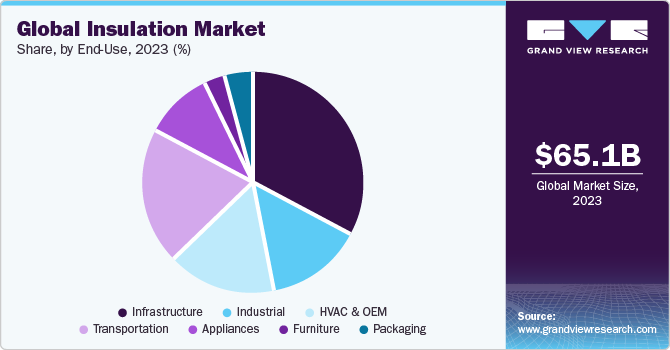

End-use Insights

The construction sector led the market and accounted for the largest market share of 33.3% in 2022 overall revenue. The sector is expected to grow due to the increasing number of insulation-intensive buildings in urban areas compared to rural ones. The construction sector was followed by the transportation and residential construction sector, which are estimated to expand at a CAGR of 6.9% and 6.8%, respectively. Petrochemical industries and refineries are insulated for energy conservation, heat gain/loss reduction, maintaining a uniform temperature, effective operation of equipment or chemical reaction, condensation prevention, etc.

Heating, ventilation, and cooling systems are usually insulated by employing a solution that caters to superior thermal insulation characteristics other than noise reduction and fire protection. Appliances such as refrigerators, microwaves, ovens, and water heaters require insulation to resist heat transfer and absorb sound.除湿机,air purifiers, refrigerators,washing machines, anddishwashersare some other significant appliances that require insulation.

The transportation sector, which comprises automotive, marine, and aerospace, emerged as a significant end-use segment in the global insulation market in 2022. Automakers are constantly looking to enhance the safety and comfort of vehicles, which is a significant factor driving the demand for insulation in this sector.

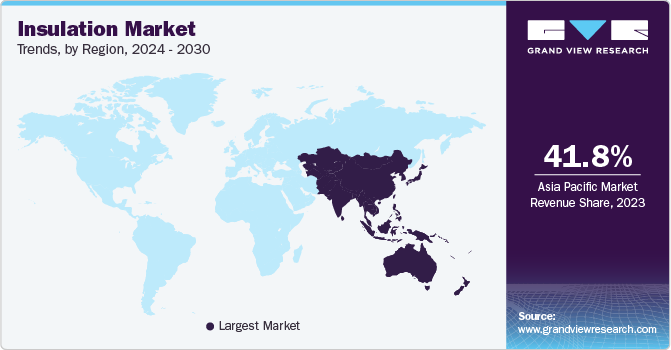

Regional Insights

亚太地区领导市场,占据for the largest market share of 41.5% in 2022. The reason is, rising oil production in the economies of China and India and rising concerns regarding significant energy wastage coupled with the demand for materials in refurbishing and renovation. The market for insulation in North America is highly influenced by demand from oil and gas, manufacturing, metal and mining, power, and other industries, where operating temperature is high. In addition, companies in this region are focusing on reducing losses to improve their performance by practicing regular maintenance inspections.

Europe accounted for 26.6% of the total market share in 2022. The market is projected to be an early adopter of emerging insulation materials owing to the rapid industrialization and the presence of significant insulation product manufacturers in the region. The GDP of Central & South America has exhibited a slow growth rate on account of political and economic disturbances in Brazil, which is one of the leading users of industrial insulation products. The demand for insulation materials in the Middle East & Africa region is expected to be driven by the growth of the downstream petrochemical industry and rising product demand for the maintenance & repair of existing infrastructure.

Key Companies & Market Share Insights

The industry is characterized by the presence of various small- and large-scale vendors, resulting in a moderate level of concentration in the market. The surging requirement for insulation solutions is fueling the growth of the market. The market players are concentrating on new joint ventures, collaborations, agreements, and strategies to advance their production facilities and gain a larger market share.

Biesanz Stone Co. and Michigan Limestone & Chemical Company are the major limestone suppliers, while Alfa Aesar and American Borate Company supply borates. Raw material supply for foamed plastic insulation products is dominated by companies such as BASF, Bayer, and Dow Chemical Company. Some of the prominent players in the global insulation market include:

GAF Materials Corporation

Huntsman International LLC

Johns Manville

Cellofoam North America, Inc.

Rockwool International A/S

DuPont

Owens Corning

Atlas Roofing Corporation

Saint-Gobain S.A.

Kingspan Group

BASF

Knauf Insulation

Recent Developments

In July 2023,Kingspan Groupannounced its plan to acquire majority of Steico SE’s shares, a key wood fibre insulation manufacturer. The acquisition is based on regulatory clearance and is scheduled for early 2024.

In February 2023, GAF launched its Timberline® Ultra HDZ™ shingles for efficient insulation, waterproofing, and faster installation.

In February 2023, Saint-Gobain acquired U.P. Twiga Fiberglass Ltd. (UP Twiga), the glass wool insulation market leader in India. This acquisition is expected to consolidate Saint-Gobain’s positioning in energy-efficient and façade solutions in India.

In September 2022, GAF announced its insulation and roofing operations expansion in Savannah, Cumming, and Statesboro in Georgia. This expansion was aimed to expand the GAF’s thermoplastic polyolefin (TPO) roofing manufacturing capabilities.

Insulation Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

651.1亿美元 |

Revenue forecast in 2030 |

USD 102.47 billion |

Growth Rate |

CAGR of 6.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2022 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2022 to 2030 |

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

Segments covered |

Product; end-use; region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

美国; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea |

Key companies profiled |

GAF Materials Corp.; Huntsman International LLC; Johns Manville; Cellofoam North America, Inc.; Rockwool International A/S; DuPont; Owens Corning; Atlas Roofing Corporation; Saint-Gobain S.A.; Kingspan Group; BASF; Knauf Insulation; Armacell International Holding GmbH; URSA; Covestro AG; Recticel NV/SA; Carlisle Companies, Inc.; Bridgestone Corporation; Fletcher Building, 3M |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Insulation Market Report Segmentation

This report forecasts revenue growth at global, regional, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global insulation market report on the basis of product, end-use, and region:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Glass Wool

Mineral Wool

EPS

XPS

CMS纤维

Calcium Silicate

Aerogel

Cellulose

PIR

Phenolic Foam

Polyurethane

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Construction

Industrial

HVAC & OEM

Transportation

Appliances

Furniture

Packaging

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

美国

Canada

Mexico

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

Japan

India

South Korea

Central & South America

Middle East & Africa

Frequently Asked Questions About This Report

b.The global insulation market size was estimated at USD 61.36 billion in 2022 and is expected to reach USD 65.11 billion in 2023.

b.The global insulation market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 102.47 billion by 2030.

b.EPS led the market and accounted for about 27.4% share of the revenue in 2022. Expanded polystyrene is a lightweight and high-tensile plastic foam insulation made out of rigid pellets of polystyrene.

b.Some of the key players operating in the global insulation market include GAF Materials Corp., Huntsman International LLC, Johns Manville, Cellofoam North America, Inc., Rockwool International A/S, DuPont, Owens Corning, Atlas Roofing Corporation, Saint-Gobain S.A., Kingspan Group, BASF, Knauf Insulation, Armacell International Holding GmbH, URSA, Covestro AG, Recticel NV/SA, Carlisle Companies, Inc., Bridgestone Corporation, Fletcher Building, 3M.

b.The key factors that are driving the global insulation market include, increasing regulatory support and rising demand for residential and industrial insulation are the factors estimated to fuel market demand over the projected period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."