LED Lighting Market Size, Share & Trends Analysis Report By Product (Lamps, Luminaires), By Application (Indoor, Outdoor), By End-use (Commercial, Residential, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-123-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Semiconductors & Electronics

Report Overview

The global LED lighting market size was worth USD 70.94 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. Rising construction in both developing and developed countries, together with government laws limiting the use of inefficient lighting systems, are the primary factors anticipated to drive the market. LED lighting has a long lifespan, no flicker, and great illumination strength while consuming less energy. Additionally, LED manufacturers are focusing on including features like Wi-Fi, occupancy sensors, and daylighting because these attract customers and increase product sales, thus fostering market growth.

LED lights are often a better option when compared to alternative lighting options like incandescent, CFL, incandescent, and halogen lights, as they can operate with little energy input while delivering strong illumination. LEDs are extensively utilized in both indoor and outdoor situations. LEDs allow designers versatility in their designs and the durability to withstand frequent switching. The market is expected to expand as consumers become more aware of their benefits.

The American National Standards Institute, China Compulsory Certification, and International Electrotechnical Commission are a few significant regulatory bodies that manage product certification. Manufacturing after obtaining the required licenses permits to do business, offer services, and import and export products. Governments in both developed and developing economies are attempting to lower high energy usage.

他们这样做维护合格ty laws that assist them in preserving consumer safety, managing energy use, and monitoring environmental issues. LED lighting is an energy-saving solution with a 50,000-hour lifespan and lower electricity use. As a result, it is anticipated that stringent government rules limiting the use of lighting that uses a lot of energy will promote the expansion of the market.

When used as overhead surgical illumination earlier, halogen lights bothered medical workers during procedures or examinations. Additionally, the examination room's 50 to 100 W halogen bulbs with the tiny surgical illumination produced a lot of heat and consumed too much electricity.

As a result, one factor anticipated to fuel the expansion of the target LED lighting market is manufacturers' strategy for combining LEDs in surgical illumination, exam lights, phototherapy, and endoscopy to enhance patient treatment experiences. The development of the LED lighting industry is also anticipated to be impacted by technological advancements in the medical device sector that will replace older or less efficient equipment.

The COVID-19 pandemic negatively impacted the global economy. The demand for LED lighting was reduced as a result of rigorous suspensions and lockdowns imposed on construction sites. However, the second half of 2021 saw an increase in construction due to the introduction of new as well as upgrading projects, which contributed to the steady recovery of the industry for LED lighting.

Product Insights

Based on product type, the LED luminaires segment accounted for the highest market share of over 54% in 2022 and is poised to continue its dominance in the global market. All luminaires used in track lighting, high bays, troffers, and street lighting, are identified as LED lights. The primary driver of the segment's growth is the installation of new track lights and light poles as a result of the expanding commercial building space and developing smart city initiatives.

The LED lamp category is anticipated to develop at the highest CAGR during the forecast period due to the expanding use of LED lighting systems in the residential sector. LED lamps provide advantages, including increased energy efficiency and greater stability over substitutes like incandescent bulbs and CFLs. They come in a wide range of forms as well. Another factor that is projected to support the growth of the market is the government's policy for raising public awareness of LEDs and their potential to help reduce and manage energy usage.

Application Insights

The indoor segment in application type had the highest revenue share of over 67% in 2022. This is the result of an increase in the demand for high-intensity discharge and fluorescent bulb substitutes from supermarkets, shopping malls, and retail establishments. LED lighting generates less heat, and costs less than conventional lighting options. The segment's growth is also predicted to be aided by rising demand in public institutions like hospitals and schools.

The outdoor market is expected to expand moderately during the projected period. This is because infrastructure-related projects including highways, airports, and public areas are being expanded. The market for LED lights for outdoor applications is also expected to increase due to growing government initiatives to attain net-zero emissions by reducing energy use.

End-use Insights

商业最终用途段发布最高market share of over 51% in 2022. The need for sophisticated lighting among exhibition, museum, and gallery owners for improved lighting applications is one of the driving forces behind the rapid growth of the commercial building industry around the world and is anticipated to promote market expansion. The demand for high-luminance LED lights is expanding predominantly owing to the requirements for office lighting to conform to government regulations and norms, which is boosting the expansion of the market.

The residential market is growing worldwide, which has increased demand for floor lamps, lamps, cabinet lights, etc. The LEDs used in domestic places have an efficiency of above 90-100 lumens per watt. Additionally, industrialized countries employ a lot of LEDs with an intensity of 110 lm/W -130 lm/W. It is therefore projected that quick advancements in LED efficiency will aid in the growth of the target market.

Regional Insights

Asia Pacific accounted for the largest revenue share of 43.61% in 2022. Over the forecast period, the market is expected to witness consistent growth. This is owing to rapidly developing infrastructure projects in emerging markets, which are anticipated to increase demand for LED lighting, coupled with the expanding energy-saving initiatives of regional governments. The rise of the regional market is predicted to be aided by the developing construction industries in China, Japan, and India, as well as the large number of manufacturers operating in these countries with a focus on launching new products.

The market's second-largest revenue share was accounted for by Europe. This market's expansion can be linked to the IT industry's booming construction sector, which is benefiting from increased investments and fresh infrastructure development initiatives. Over the course of the projection period, the architectural service market is anticipated to be stimulated by the gradual restart of the building of numerous data center facilities that had been temporarily suspended due to the COVID-19 pandemic.

Key Companies & Market Share Insights

The rise of new market entrants with cutting-edge solutions is attributed to the favorable business policies of emerging country governments and new venture capital firms. The same is true for major businesses, which are leaning toward strategically buying up other companies to gain a significant market share. For instance, in June 2022, Signify announced the acquisition of Fluence from OSRAM. Signify's position in the affluent North American horticulture lighting industry will grow, and the deal will bolster its worldwide agriculture lighting growth platform. Some prominent players in the global LED lighting market include:

Acuity Brands Lighting Inc.

Cree Lighting

Dialight

Digital Lumens Inc.

Hubbell

LSI Industries Inc.

LumiGrow

Panasonic Corporation

Siteco GmbH

Signify Holding

Semiconductor Co. Ltd.

Zumtobel Group Ag

Recent Development

In July 2023,Zumtobelintroduced two intelligent lighting technology systems and three new luminaires in its product portfolio. These cutting-edge solutions include the TRAMAO pendant luminaire for hotels and offices, which effectually absorbs sound and delivers the highest light quality, and the SLOTLIGHT infinity II light line family.

In May 2023, Dialight announced the launch of its industry-leading 7-year warranty for Aviation Obstruction Lighting Solutions. This initiative highlighted the company’s commitment to both customer satisfaction and product quality in the LED lighting market.

In May 2023, Zumtobel launched the all-new high-accuracy positioning luminaires. These new luminaires are integrated with IoT for smart analyses in logistic, retail, and industrial applications.

In May 2023,Dialightlaunched the ProSite High Mast, an extension of the company’s ProSite Floodlight series. This advanced solution is a precision-engineered LED lighting fixture purposed to support mounting heights of up to 130 feet for diverse outdoor industrial applications, including airports, rail yards, container yards, transport, parking lots, product stockpiles, and perimeter lighting.

In April 2023, Cree Lighting unveiled the launch of its OSQ Series C mid-power LED Area and Flood luminaires. These solutions feature the groundbreaking NanoComfort Technology, delivering matchless efficiency, astonishing visual comfort, precise control, reduced wind load requirements, and ease of installation.

In February 2022, Digital Lumens introduced its Lightintelligence Port integrated with the CLE and RLE luminaire families. This intelligent LED luminaire is equipped with modular IoT capabilities and a smart port for achieving top-notch performance.

In June 2021,LSI Industrieslaunched the Opulence Series of architectural luminaires for outdoor applications. The Opulence luminaires deliver world-class efficiency and can achieve outputs of up to 14,000 lumens at color temperatures that range from 2700-5000K.

2021年3月,意味着宣布启动的first-in-India tailor-made 3D printed luminaires empowering a circular economy. The company also set up a design lab in Noida and a 3D printing facility in Vadodara.

LED Lighting Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 81.48 billion |

Revenue forecast in 2030 |

USD 168.87 billion |

Growth rate |

CAGR of 11.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Rest of Europe; China; India; Japan; Rest of APAC, Brazil; Mexico; Rest of Latin America |

Key companies profiled |

Acuity Brands Lighting Inc.; Cree Lighting; Dialight, Digital Lumens Inc.; Hubbell; LSI Industries Inc.; LumiGrow; Panasonic Corporation; Siteco GmbH; Signify Holding; Semiconductor Co. Ltd.; Zumtobel Group Ag |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

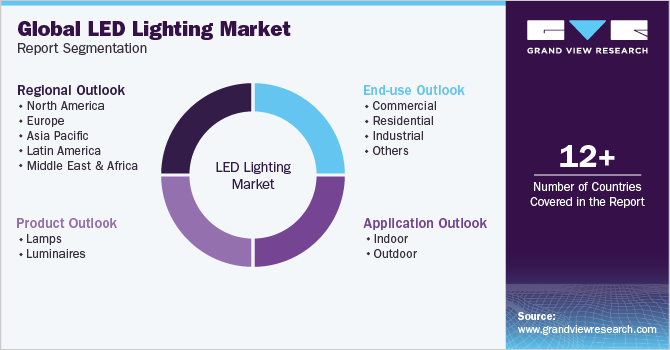

Global LED Lighting Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LED lighting market report based on product, end-use, application, and region:

Product Outlook (Revenue, USD Billion, 2018 - 2030)

Lamps

A-lamps

T-lamps

Others

Luminaires

Streetlights

Downlights

Troffers

Other

Application Outlook (Revenue, USD Billion, 2018 - 2030)

Indoor

Outdoor

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Commercial

Residential

Industrial

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Rest of Europe

Asia Pacific

China

India

Japan

Rest of Asia Pacific

拉丁美洲

Brazil

Mexico

Rest of Latin America

Middle East & Africa

Frequently Asked Questions About This Report

b.The global LED lighting market size was valued at USD 70.94 billion in 2022 and is expected to reach USD 81.48 billion in 2023

b.The global LED lighting market is expected to witness a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 168.87 billion by 2030.

b.The commercial segment dominated the LED lighting market with a share of 51.92% in 2022. This is attributable to the rising demand for LED troffers, downlights across office space, and malls among others.

b.The LED luminaires segment dominated the global LED lighting market in 2022 and accounted for over 54.75% of the global revenue share.

b.The indoor segment led the global LED lighting market and accounted for over 67.62% share of the global market in 2022.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."