Masterbatch Market Size, Share & Trends Analysis Report By Type (Black, Filler), By Carrier Polymer (Polypropylene, Polyethylene), By End-use, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-205-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Report Overview

The globalmasterbatch market sizewas valued atUSD 4.85 billion in 2022and is anticipated to exhibit a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The replacement of metal withplasticsin the end-use industries, including automotive and transportation, building and construction, consumer goods, and packaging, is expected to be a key factor driving the global market in the forecast period.

The product is available in solid and liquid forms and is used for imparting color and enhancing valuable properties of polymers such as antistatic, antifog, antilocking, UV stabilizing, and flame retardation. Various carrier polymers, such as polypropylene, polyethylene,polyvinyl chloride, andpolyethylene terephthalate, are preferred along with the product for use in injection molding and extrusion processes.

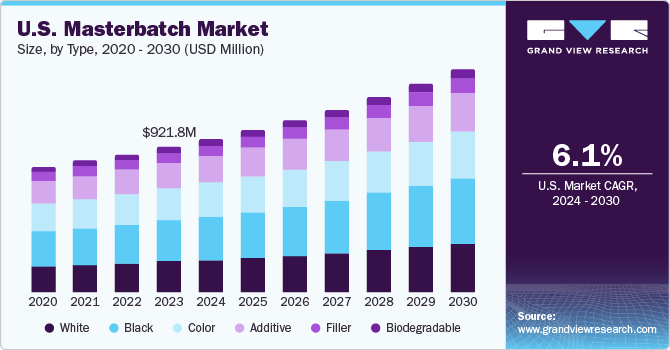

The rising demand from the packaging industry in the U.S. is expected to boost market growth. There has been considerable growth in the packaging market in the U.S. on account of growth in thee-commercebusiness. In the U.S., there are approximately 16,806 plastic manufacturing facilities spread across 50 states. The increasing use of plastic in consumer goods, building & construction, automotive, and other sectors is anticipated to boost the growth of masterbatch in the country in the forecast period. Consumer goods manufacturers are providing attractive product packaging to attract a large number of customers to boost sales of their products. Different types of masterbatch are used in combination with polymers to make attractive packaging, which is projected to increase product demand in the forecast period.

Type Insights

The black type segment dominated the market with a revenue share of 28.3% in 2022. This high share is attributed to the growth in demand for black masterbatch and the high demand for tires, PVC containers, and other products for application in the automotive and transportation, building and construction, agriculture, and packaging industries. The growing need for agricultural products such as drip irrigation tubing and tape, greenhouse films, shade cloth, andgeomembranesis also projected to boost market growth over the forecast period.

The color on products is used to differentiate the products in the market, an essential factor driving the demand for color masterbatches in the forecast period. In addition, color masterbatches provide customization alternatives to manufacture products with an attractive visual appearance.

Carrier Polymer Insights

聚丙烯(PP)载体聚合物段dominated the market with a revenue share of 26.7% in 2022. It is attributed to the demand for polypropylene as a carrier polymer is projected to increase owing to its excellent mechanical strength and flexibility offered by it. Polypropylene also enhances the quality of surfaces. It is lightweight and, therefore, is used to replace metal components in the automotive industry. All these factors are expected to fuel the growth of the polypropylene segment in the forecast period.

Germany, as a major manufacturing hub, is expanding its production facilities, which is expected to increase the demand for polyethylene. The presence of many plastic component manufacturing companies within the European region, which implies the easy and cost-effective availability of plastics, is a crucial factor driving the market in the region.

Polypropylene is being extensively used in consumer goods, contributing to the growth of product demand. It has antimicrobial and antibacterial properties, making it helpful in manufacturing various products related to building and construction. Polypropylene manufacturers are shifting the focus from synthetic to biobased due to environmental concerns, which is projected to drive the market over the forecast period.

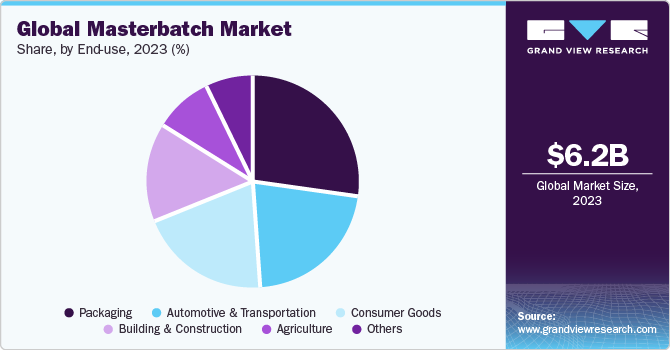

End-Use Insights

包装色母粒最终用途市场占主导地位d the market with a revenue share of 26.9% in 2022. Its high share is attributable to the packaging industry, which includes retail, industrial, and consumer packaging, which further includes flexible and rigid options. A rise in the number of city inhabitants who require packaged goods is resulting in an increased demand for packaging. Consumers need packaging that is convenient, sustainable, flexible, offers protection, and is easily traceable. As plastic packing fulfills all these needs, its demand is expected to grow, which is, in turn, projected to result in the growing demand for the product. There is immense growth potential for the packaging industry in emerging economies such as India and China.

The rise in infrastructural activities in these countries has resulted in the growing demand from the building and construction sector, which may boost product demand. The development of various government schemes such as Make in India and Smart City plans is also projected to ascend the demand for the product in the forecast period.

Regional Insights

Asia Pacific dominated the market with a revenue share of 41.6% in 2022, owing to the presence of several end-use industries, including automotive and transportation, packaging, building and construction, and consumer goods. The growth of these industries is expected to fuel the demand for the product over the next eight years.

In terms of revenue, Europe was the second-largest regional market in 2022, and the trend is projected to continue in the forecast period. The rapid growth of the packaging, consumer goods, and automotive and transportation industries, coupled with the growing building and construction and agriculture sectors in Asia Pacific, which are among the major end-use sectors using the product, is projected to be a significant market driver.

Key Companies & Market Share Insights

The market is fragmented, with several global and regional players. Key players in the market comply with the regulatory policies and are engaged in research & development activities to develop innovative products. For instance, Hubron International became a corporate member of The Graphene Council, the world’s largest community for graphene researchers, developers, producers, academics, and scientists. Since Hubron International is involved in masterbatch/compounding of graphene materials and has technologies available for the processing of 2D materials, the growing usage of 2D materials in the thermoplastic arena for providing lightweight products is expected to strengthen Hublon International’s position in the masterbatch market. Most key industry players are integrated across the value chain, posing entry barriers for new market players. Some prominent players in the global masterbatch market include:

一个。Schulman, Inc.

Ampacet Corporati

Cabot Corporation

Clariant AG

Hubron International Ltd.

Penn Color, Inc.

Plastiblends India Ltd.

Global Colors Group

PolyOne Corporation

Tosaf Group

Recent Developments

In June 2023,Ampacetannounced the launch of PET UVA, a masterbatch that offers protection to the packaging contents from harmful UV light, thereby keeping the food fresher, extending product shelf life, and limiting waste. The company also offers UVA in PP and PE.

In June 2023, Ampacet unveiled the introduction of a new additive - AA Scavenger 0846, designed particularly for restricting the acetaldehyde levels in both PET and rPET bottles. This product launch was aimed at supporting the sustainability efforts of the company in the packaging industry by encouraging the use of recycled materials and reducing waste.

In April 2023, Penn, Color, Inc. announced the commencement of its world-class facility in Rayong Province, Thailand in order to expand its manufacturing capabilities. The objective of this new plant was to enable the company to deliver high-quality colorant & additive masterbatches across the Asia-Pacific market.

In May 2023,Cabot Corporationlaunched its new aerogel particles portfolio - ENTERA, which acts as a thermal insulation additive for enabling the development of ultra-thin thermal barriers for Li-ion EV batteries. The portfolio comprises three products that can be integrated into different thermal barrier forms, including, sheets, blankets, pads, foams, films, and coatings.

In March 2023, Cabot Corporation announced the launch of its sustainable solutions platform - EVOLVE. This platform was aimed at developing sustainable reinforcing carbons for varied industries and curating materials that enable a more sustainable future by leveraging circular value chains & materials recovered from worn tires, bio-based and renewable materials, and processes that limit greenhouse gas emissions.

In October 2022,Clariantlaunched new additive solutions at K 2022 to reinforce more sustainable plastics and decrease resource use. These new developments include Licowax AS 100 TP - an anti-scratch additive for polypropylene and thermoplastic olefins formulations, AddWorks AGC 970 - a light stabilizer for polyethylene agricultural films, and Licocare RBW 560 TP Vita a bio-based wax for injection molded polyester compounds.

Masterbatch Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 5.12 billion |

Revenue forecast in 2030 |

USD 8.07 billion |

Growth Rate |

CAGR of 6.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, carrier polymer, end use, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Germany; U.K.; France; China; India; Japan; Brazil |

Key companies Listed |

一个。Schulman, Inc.; Ampacet Corporation; Cabot Corporation; Clariant AG; Hubron International Ltd.; Penn Color, Inc.; Plastiblends India Ltd.; Global Colors Group; PolyOne Corporation; Tosaf Group. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

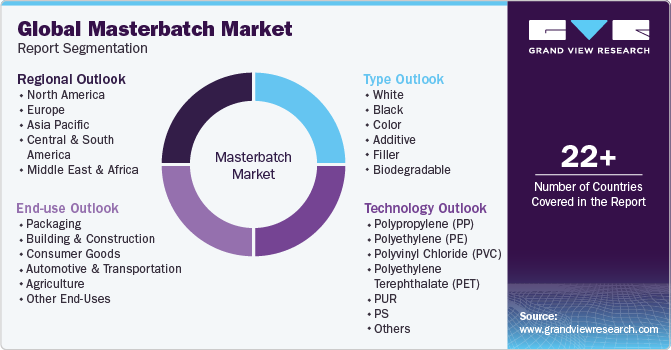

Global Masterbatch Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global masterbatch market report based on type, carrier polymer, end-use and region:

Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

White

Black

Color

Additive

Filler

Biodegradable

Carrier Polymer Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Polypropylene (PP)

Polyethylene (PE)

Polyvinyl Chloride (PVC)

Polyethylene Terephthalate (PET)

Biodegradable Plastics

Others

End-Use Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

Packaging

Building & Construction

Consumer Goods

Automotive & Transportation

Agriculture

Others

Regional Outlook (Revenue, USD Million; Volume, KiloKilotons; 2018 - 2030)

North America

U.S.

Europe

Germany

U.K.

France

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

Frequently Asked Questions About This Report

b.The global masterbatch market size was estimated at USD 4,855.35 million in 2022 and is expected to reach USD 5.12 billion in 2023.

b.The global masterbatch market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 8,067.45 million by 2030.

b.The polypropylene segment dominated the masterbatch market with a share of 26.7% in 2022. Rising demand for Polypropylene a carrier polymer in packaging, building & construction, automotive, and various other end-use industries.

b.Some of the key players operating in the masterbatch market include A. Schulman, Inc., Ampacet Corporation, Cabot Corporation, Clariant AG, Plastiblends India Ltd., and Global Colors Group.

b.Key factors driving the masterbatch market growth include the increasing use of plastics in automotive applications as a replacement for metals and the growing demand for plastics in the packaging industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."