Microcontroller Market Size, Share & Trends Analysis Report By Product (8-bit, 16-bit, 32-bit), By Application (Consumer Electronics & Telecom, Automotive, Industrial, Medical Devices, Aerospace & Defense), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-141-2

- Number of Pages: 119

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Semiconductors & Electronics

Report Overview

The globalmicrocontroller market sizewas valued atUSD 20.61 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. The growth is expected to be driven by the increasing adoption of MCUs across the smart grid systems for smart meter applications and the rising demand for microcontrollers from the automotive and medical sectors. The expenditure on global healthcare services is on the rise due to the increasing prevalence of immunodeficiency disorders, the growing percentage of elderly individuals, and the occurrence of diseases like diabetes and high blood pressure. Consequently, there is a growing need for electronic medical devices to measure blood pressure and sugar levels. Medical device manufacturers are introducing affordable and dependable medical equipment into the market.

Microcontrollers play a crucial role in various medical care devices, ensuring higher affordability and reliability. Devices including blood glucose meters incorporate a significant number of microcontrollers (MCUs). Therefore, there is a high demand for microcontrollers from the medical and healthcare industry. In addition, prominent companies in sectors such as telecommunications, consumer electronics, and automotive are focusing intensely on integrating artificial intelligence into their products. For example, Qualcomm Technologies, Inc. has made significant investments in on-device AI research and development.

Microcontroller manufacturers are actively developing innovative products and consistently delivering groundbreaking solutions, thereby creating significant opportunities for market growth. The emergence of a network of interconnected devices including smart meters, home appliances, security systems, tablets, gaming consoles,televisions, and smartphones has led to numerous advancements in microcontroller technology. This, in turn, is expected to drive the demand forIoT microcontrollers.

Many of these connected devices, designed to operate on batteries for extended periods without requiring replacement or maintenance, rely on the Internet of Things (IoT) end-node applications. The declining costs of essential components such as processors and sensors, coupled with the increasing utilization of wireless connectivity, has facilitated the development of intelligent products capable of seamless communication with one another without human intervention.

Advancements in computing power and enhanced AI algorithms are enabling the integration ofmachine learningin various domains such as automobiles, smartphones, robots, and drones. This progress has facilitated the rise of on-device AI, which offers improved security and privacy protection by processing data offline directly on the device. Embedded artificial intelligence is becoming increasingly prevalent in the AI industry. These cutting-edge developments in AI and machine learning are opening up new avenues for the utilization of microcontrollers in fields including medical, smart cities, smart factories,IoT, and more. As a result, the market for microcontrollers is expected to witness growth opportunities.

COVID-19 Impact

The COVID-19 pandemic has significantly impacted the microcontroller industry, affecting both the production and demand for these devices. One of the significant impacts of the pandemic has been disruptions to global supply chains. The shutdown of factories and other manufacturing facilities has led to shortages of key components and materials, causing delays and bottlenecks in production. This has resulted in longer lead times for microcontrollers and other electronic components and increased prices for some devices.

In 2020, the rapidly rising number of COVID-19 cases across key countries such as China, Germany, the U.S., Japan, and South Korea compelled their respective federal governments to levy stringent regulations. These regulations mainly included lockdowns in highly spreading cities, sealing of international borders for trade, and allowing companies to provide employees with work-from-home facilities.

However, the overall trade of microcontrollers in Q2 of 2020 witnessed a decline owing to the temporary shutdown of production facilities and international borders across several countries globally. Countries such as China, Japan, South Korea, and Singapore are the key suppliers of microcontrollers globally and were substantially impacted by COVID-19. The decline in production and exports of microcontrollers in these countries, coupled with a labor shortage, resulted in a significant decline in the overall market growth in Q1 and Q2 of 2020.

Product Insights

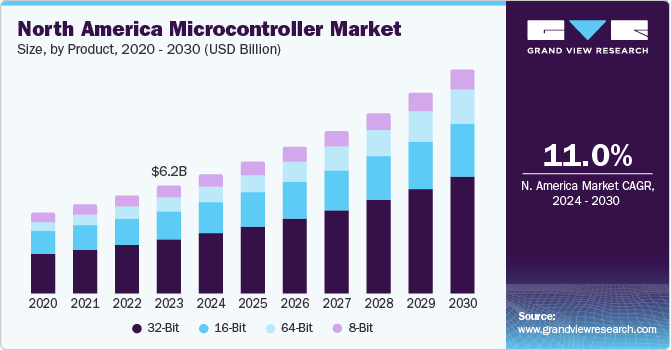

In terms of product, the microcontroller market is classified into 8-Bit, 16-Bit, and 32-Bit. Among these, the 32-Bit segment dominated in 2022, gaining a revenue share of 49.6%. It is expected to grow at the fastest CAGR of 11.8% throughout the forecast period. A 32-bit microcontroller is a type of embedded SoC with a CPU capable of handling 32 bits of data at a time. It often features a high memory capacity (up to several megabytes) and a comprehensive set of cutting-edge peripherals, including fast ADCs, Digital Signal Processors (DSPs), and cutting-edge communication interfaces such as Gigabit Ethernet, USB 3.0, and CAN bus.

One of the primary advantages of 32-bit microcontrollers is their increased processing power. With a more comprehensive data bus, they can perform more calculations and process larger amounts of data than 16-bit microcontrollers. This makes them well-suited for high-performance computing applications, such as industrial control, automotive applications, and complex embedded systems.

The 16-Bit segment is anticipated to grow at a considerable CAGR of 10.5% throughout the forecast period. A 16-bit microcontroller is a type of embedded SoC that has a CPU capable of processing 16 bits of data at a time. It features more peripherals, including Analog-to-Digital Converters (ADCs), Digital-to-Analog Converters (DACs), and communication interfaces such as USB, Ethernet, and Wi-Fi.

Compared to 8-bit microcontrollers, 16-bit microcontrollers offer greater processing capability and memory (up to a few hundred kilobytes), which makes them ideal for applications that require more advanced algorithms and higher performance. They are often used in automobile systems, consumer electronics, industrial automation, and medical equipment. 16-bit microcontrollers typically include a range of on-chip peripherals, such as memory, timers, interrupts, and communication interfaces such as UART, SPI, and I2C, to support various applications. These peripherals make it easier to interface with other electronic components and perform more complex tasks.

Application Insights

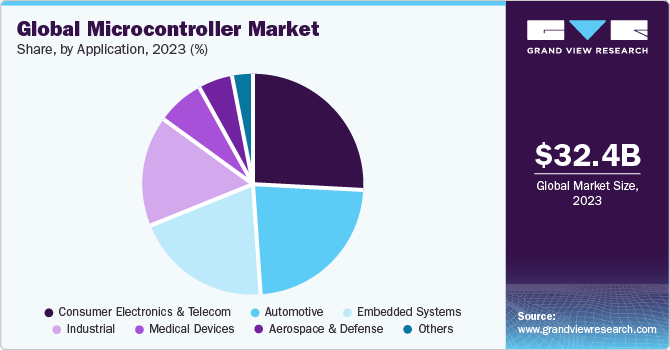

In terms of application, the market is classified into consumer electronics & telecom, automotive, medical devices, industrial, aerospace & defense, and others. The consumer electronics & telecom segment dominated the overall market with a revenue share of 32.6% in 2022. The segment is expected to witness a CAGR of 11.5% during the forecast period. Microcontrollers are employed in consumer electronics and telecom applications owing to their capability to process data, regulate functions, and interact with other devices.

They are used to handle user inputs, interact with other devices, and control a variety of operations in smart home appliances such assmart locks,smart thermostats、和智能照明systems. One of the primary uses of microcontrollers in consumer electronics is to control various functions of these devices. For example, a microcontroller can be used to regulate the temperature in a refrigerator or to control the display and user interface of asmartphone. They can also be used to manage power consumption, extend battery life, and optimize performance.

The automotive segment is anticipated to witness the fastest CAGR of 12.6% throughout the forecast period. Microcontrollers are electronic components that are often used in the automotive sector to manage and control several systems in automobiles. They are compact, low-power integrated circuits made for real-time data processing and control in embedded systems. Automotive applications that use microcontrollers include Advanced Driver Assistance Systems (ADAS), Anti-lock Braking Systems (ABS), airbag control, entertainment systems, and gearbox control. Microcontrollers can process sensor data, interface with other electronic systems inside the car, and control a variety of actuators, thereby enhancing the performance, safety, and comfort of the vehicle.

Regional Insights

The Asia Pacific microcontroller market dominated in 2022, gaining a revenue share of 58.1%. It is expected to grow at the fastest CAGR of 11.6% throughout the forecast period. The region includes countries with a sizable and diverse electronics industry, including China, Japan, South Korea, India, and Taiwan. One of the biggest applications for microcontrollers in the region, particularly in countries such as Japan, South Korea, and China, is the automotive industry. The demand for microcontrollers in this industry is driven by the rising demand for safety features, ADAS, and electric automobiles. In Asia Pacific, the industrial segment is also a prominent end user of microcontrollers, particularly in countries such as China and India, which have substantial and expanding manufacturing industries.

北美是考虑增长预期able CAGR of 10.6% throughout the forecast period. The rising need for smart and connected devices is one of the key factors influencing the market growth. The region is at the forefront of the development of Internet of Things (IoT) technologies, which connect commonplace gadgets to the Internet and allow them to communicate and exchange data. The demand for microcontrollers with cutting-edge features such as connectivity, sensing, and low power consumption is driving the regional market growth. Some of the key players operating in the region include Texas Instruments, Inc.; Microchip Technology Inc.; NXP Semiconductors N.V.; Renesas Electronics Corporation; and STMicroelectronics.

Key Companies & Market Share Insights

The market is characterized by consolidation and is expected to experience heightened competition due to the presence of multiple players. Leading companies are making substantial investments in research and development to incorporate advanced technologies into microcontrollers, thereby intensifying the competition. Notable players in the market include STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Microchip Technology Inc., and Infineon Technologies AG. These players are actively pursuing partnerships and collaborations to gain a competitive advantage and capture significant market share.

2022年11月,英飞凌科技AG)和稀土元素Automotive Ltd., an automotive technology company, joined forces in a partnership to work on the development of the REE modular Electric Vehicle (EV) platform. This platform is designed with versatility and adaptability in mind, serving as a foundational base for a wide range of electric vehicles, including commercial vans, robotaxis, and electric passenger shuttles. Their collaboration aims to create an innovative solution that can be flexibly utilized across different types of electric vehicles, offering enhanced efficiency and functionality. Some prominent players in the global microcontroller market include:

Infineon Technologies AG

富士通半导体李mited

Microchip Technology Inc.

NXP Semiconductors

Renesas Electronics Corporation

STMicroelectronics

TE Connectivity Ltd.

Texas Instruments Incorporated

Toshiba Electronic Devices & Storage Corporation

Yamaichi Electronics Co., Ltd.

Zilog, Inc.

Broadcom

Recent Developments

In January 2023,STMicroelectronicsunveiled the STM32C0 series, a cost-effective lineup of 32-bit microcontrollers targeted at applications in home appliances, industrial pumps, fans, and smoke detectors, traditionally served by simpler 8-bit and 16-bit MCUs. The modern design of the STM32C0 enabled enhanced performance, faster response, additional functionalities, and network connectivity at comparable cost and power consumption

In March 2023, NXP® Semiconductors released the MCUXpresso toolset, empowering developers with enhanced scalability, usability, and portability for faster development of complex embedded applications. The toolset included a custom-built MCUXpresso extension for Microsoft's Visual Studio Code (VS Code), open-source hardware abstraction for code reuse, streamlined partner code delivery via Open-CMSIS-Packs, and an intuitive Application Launch Pad for easy access to application software and NXP documentation

In April 2023,Renesas Electronics Corporationrevealed the successful manufacturing of its inaugural microcontroller (MCU) using cutting-edge 22-nm process technology. This advanced process facilitated improved performance, lower power consumption through reduced core voltages, and seamless integration of a diverse feature set, including RF capabilities, providing customers with a superior product offering

In May 2023, STMicroelectronics launched the second generation of its STM32 MPUs (microprocessors), featuring an enhanced architecture within the existing ecosystem to deliver elevated performance and security for industrial and IoT edge applications. The STM32MP2 Series devices showcased 64-bit Arm Cortex-A35 cores operating at 1.5GHz, complemented by a 400MHz Cortex-M33 embedded core for real-time processing, providing a powerful and efficient solution

In January 2022, Infineon Technologies AG introduced the latest iteration of its AURIX™ microcontroller family, the AURIX TC4x series, specifically engineered to cater to evolving trends in the automotive industry, including eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and cost-effective artificial intelligence (AI) applications

In June 2022,NXP Semiconductorsunveiled the innovative MCX portfolio of microcontrollers, aimed at driving progress in smart homes, factories, cities, and various emerging industrial and IoT edge applications. The portfolio leveraged the widely adopted MCUXpresso suite of development tools and software, enabling developers to expedite development by maximizing software reuse across the range of products

In November 2022, NXP® Semiconductors unveiled the MCX N94x and MCX N54x, the pioneering families in the N series of the innovative MCX microcontroller portfolio. The multi-core design of the MCX N series enhanced system performance and minimized power consumption by intelligently distributing workloads to analog and digital peripherals. These MCX N devices were supported by the widely adopted MCUXpresso suite of software and tools, streamlining and expediting embedded system development for developers

Microcontroller Market Report Scope

ReportAttribute |

Details |

Market size value in 2023 |

USD 22.73 billion |

Revenue forecast in 2030 |

USD 47.16 billion |

Growth Rate |

CAGR of 11.0% from 2023 to 2030 |

Historic year |

2017 - 2021 |

Base year for estimation |

2022 |

Forecast period |

2023 - 2030 |

Report updated |

June 2023 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, region |

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; China; India; Japan; Brazil |

Key companies profiled |

英飞凌科技公司;富士通半导体李mited; Microchip Technology Inc.; NXP Semiconductors: Renesas Electronics Corporation; STMicroelectronics; TE Connectivity Ltd.; Texas Instruments Incorporated; Toshiba Electronic Devices & Storage Corporation; Yamaichi Electronics Co., Ltd.; Zilog, Inc.; Broadcom |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Microcontroller Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global microcontroller market report based on product, application, and region.

Product Outlook (Revenue, USD Billion, 2017 - 2030)

8-Bit

16-Bit

32-Bit

Application Outlook (Revenue, USD Billion, 2017 - 2030)

Automotive

Consumer Electronics & Telecom

Industrial

Medical Devices

Aerospace & Defense

Others

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

Asia Pacific

China

India

Japan

南美

Brazil

Middle East & Africa

Frequently Asked Questions About This Report

b.Some prominent players in the market include NXP Semiconductors, Microchip Technology Inc., Renesas Electronics Corporation, STMicroelectronics, and Infineon Technologies AG, among others.

b.Key factors such as increasing adoption of smart meters in smart grid systems and the growing demand from medical and automotive sectors drive the adoption of microcontroller market

b.The global microcontroller market size was estimated at USD 20.61 billion in 2022 and is expected to reach USD 22.73 billion in 2023.

b.The global microcontroller market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 47.16 billion by 2030.

b.Asia Pacific microcontroller market is expected to dominate in 2022, gaining a market share of 58.1%. It is expected to grow at the fastest CAGR of 11.6% throughout the forecast period. This is attributed to growing adoption of microcontrollers in industrial segment in countries such as China and India, which have a substantial and expanding manufacturing industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."