下一个背包ion Sequencing Market Size, Share & Trends Analysis Report By Technology (WGS, Targeted Sequencing & Resequencing), By Product (Platform, Consumables), By Application, By Workflow, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-428-4

- Number of Pages: 300

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry:Healthcare

下一个背包ion Sequencing Market Trends

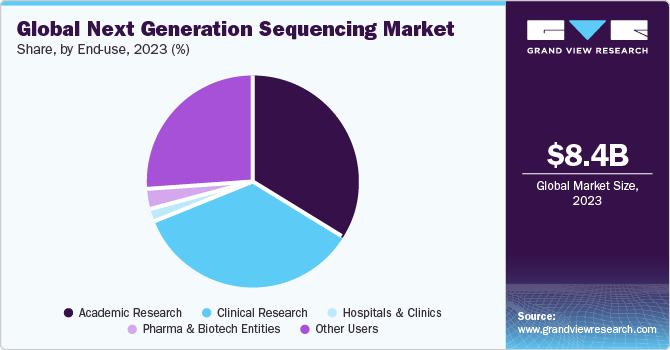

The globalnext generation sequencing market size was estimated at USD 8.29 billion in 2023and is expected to grow at a compound annual growth rate (CAGR) of 21.12% from 2024 to 2030. Next Generation Sequencing (NGS) refers to the hugeDNA sequencingmethods that aid in genomic discovery. Following the World Health Organization's (WHO) declaration of COVID-19 as a pandemic, a diverse group of recognized pharmaceutical and biotechnology companies, have decided to step forward with an aim to boost the global research efforts to develop test kits and vaccines. Furthermore, major companies globally have increased their research and development capacities. The substantial focus on COVID-19 vaccine development offered a lucrative opportunity for the adoption of NGS during the pandemic period.

For instance, a group of researchers in China utilized MinION Mk1C, a product by Oxford Nanopore Technologies (UK) for the sequencing of COVID-19 samples. In addition, factors such as the extensive adoption of NGS technologies in clinical diagnostics due to rapid result time and faster processing are also projected to offer a favorable environment for market growth during the forecast period. For instance, in August 2020, Pediatrix Medical Group, GeneDx Inc., and OPKO Health signed an agreement to provide state-of-the-art, next generation gene-sequencing to enhance clinical diagnosis in uncommon disorders for newborn intensive care units.

Moreover, growing technological developments in NGS instruments and technologies are further likely to offer significant market growth over the coming years. For instance, in January 2020, the Intelligence Advanced Research Projects Activity in the U.S. awarded a grant of USD 23 million to Harvard University, DNA Script, and Broad Institute. The institutes are conducting collaborative research to develop a novel technology that will combine enzymatic DNA synthesis and NGS into a single instrument.

To better understand the link between genetics and disease, several countries have invested in their own national population genome mapping projects. Furthermore, millions of genomes are being sequenced by government groups to progress research and discover better ways to identify and cure cancer, uncommon disorders, and other ailments. Efforts are being undertaken by the EU to improve the region’s large-scale genomic data with projects such as France’s French Plan for Genomic Medicine 2025 and the UK’s 100,000 Genomes Project. Such initiatives have resulted in the growth of NGS informatics services in the region.

Certain advantages offered by NGS such as cost-effectiveness, rapid and accurate sample analysis, and technological advancements are estimated to boost the adoption of NGS technologies during the forecast period. In addition, the development of genomics programs in several countries is projected to benefit the NGS market. The advent of next generation sequencing-based diagnoses, along with proactive government support, are also some of the key market growth factors.

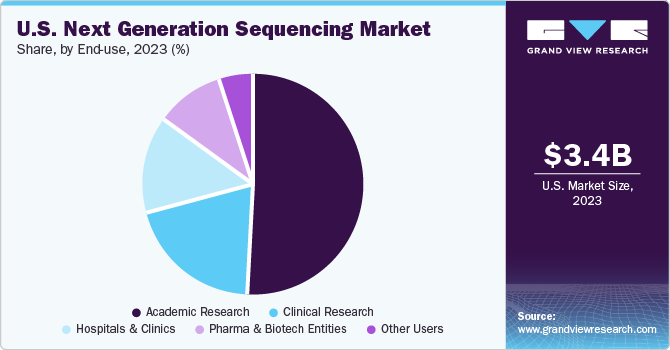

End-use Insights

The academic research segment held the largest market share of 53.25% in 2023. Application of NGS solutions in research projects that are carried out in the universities and research centers can be attributed to the largest share of this segment in the market. Furthermore, scholarships offered for PhD projects in NGS are anticipated to drive demand for NGS products and services, thereby resulting in lucrative growth over the forecast period. Provision of on-site bioinformatics courses that include workshops on practical implementation of NGS sequencing and data analysis are also expected to boost revenue generated through academic research segment in the coming years.

Clinical research segment is anticipated to register the fastest CAGR of 22.36% during the forecast period. Owing to the use of NGS in cancer research and, more specifically, in discovery of new cancer-related genes, studying tumor heterogeneity, and identification of alterations that are contributive in tumorigenesis, the segment is expected to witness significant growth over the forecast period. In addition, availability of clinical research solutions through market entities such as Illumina, Thermo Fisher Scientific Corporation, and Agilent Technologies for the purpose of target enrichment & detection is anticipated to provide this segment with high growth opportunities over the forecast period.

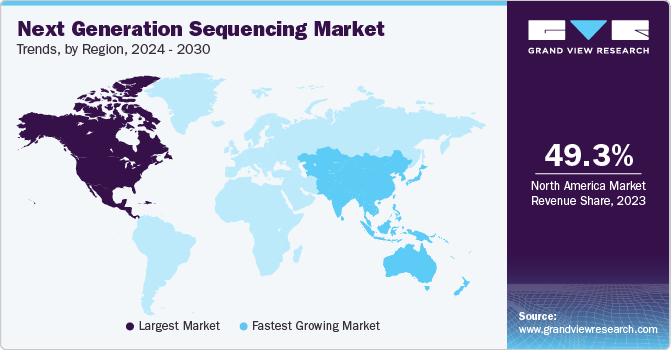

Regional Insights

North America dominated the market with the largest revenue share of 49.35% in 2023.The regional market is driven by the presence of multiple clinical laboratories that employ NGS to provide genetic testing services. Furthermore, due to the presence of high R&D investment, and availability of technologically advanced healthcare research framework, the development of WGS in the region is also expected to serve as a critical factor for the growth of North America market over the forecast period. In addition, the regional presence of several key players and initiatives undertaken by them are expected to boost the market. For instance, in September 2022, Illumina Inc. launched its next-generation NovaSeq X systems for drug development and other research applications.

亚太地区是fas估计test-growing region owing to the presence of significant developments made by China and Japan for technological integration of NGS methodologies, and the development of healthcare, R&D and clinical development frameworks of emerging economies such as India and Australia have poised the Asia Pacific market to witness lucrative opportunities of growth over the forecast period.

Market Dynamics

With decreasing costs, the adoption of NGS in the clinical setting is increasing. Furthermore, a rise in the demand for clinic-based NGS solutions is expected to drive the NGS market over the forecast period. Use of genome sequencing and NGS/MPSS has become essential for diagnosis & analysis of rare diseases and for identifying therapeutic targets, as well as for prenatal testing. Over the years, the use of NGS has increased and is now used in preconception carrier screening in healthy individuals too.

For clinical settings, NGS technologies are being used for incorporating genomic information in health management systems and storage of analyzed genomic data. The technologies are also being used for improvement in preclinical/early-stage margins, given that the demand for preclinical research (and consequently, capacity utilization) remains healthy, with utilization at near-optimal levels, albeit with modest additional capacity for now.

NGS is expected to witness increasing adoption in hereditary conditions and infectious disease treatment, along with transplant medicine, noninvasive prenatal testing (NIPT), and pharmacogenomics. Targeted panels and gene expression profiling via qPCR remain the two most common applications for NGS sequencers in a pathology laboratory. While oncology remains a primary area of NGS use in clinics, pathologists are expected to adopt it in other areas too over the forecast period.

Technology Insights

The targeted sequencing & resequencing segment held the highest market share of 73.67% in 2023. This segment is expected to witness growth in demand subsequent to the growth of whole genome sequencing, as the availability of a large amount of whole genome data will be required to be analyzed at specific gene locations and isolated genetic expressions. There are many companies in the NGS industry offering targeted sequencing services. Thus, this segment is expected to grow in tandem with WGS segment throughout the forecast period.

Illumina offers targeted resequencing with its gene panel and array finder, whereas Pacific Biosciences of California’s Sequel System with its SMRT technique allows targeted sequencing and accurate detection of variants.Targeted sequencing panels are expected to remain the workhorse for cancer molecular diagnostics and are projected to become the routine part of the heme malignancies and solid tumor.

Product Insights

The consumables segment held the largest market share of 75.15% in 2023 and it is anticipated to register the fastest CAGR from 2024 to 2030. The larger share and exponential growth rate of this segment are mainly attributed to the recurrent usage and high demand of consumables in the commercial as well as research applications of NGS. These consumables include sample preparation kits as well as kits for target enrichment. The adoption of NGS consumables has increased as most of the pharmaceutical companies and research institutes are utilizing NGS for several diagnostic applications and cancer research.

的增长的一个重要因素the consumables segment is the involvement of key companies in development of innovative products, more focus on regulatory approvals, along strategic initiatives to ensure the constant supply of consumables to meet the increasing demand. These efforts also strengthen the company’s product portfolio, thus, maintaining the leading position in the market. For instance, in June 2022, PerkinElmer, Inc. launched three sample preparation kits for research purpose only, which include PG-Seq Rapid Kit v2, NEXTFLEX Small RNA-Seq Kit v4, and NEXTFLEX Rapid XP V2 DNA-Seq Kit. All these factors along with increasing R&D activities in the sequencing market will continue to boost the market growth.

Application Insights

The oncology segment held the largest market share of 27.31% in 2023. A gradually growing prevalence of cancer that warrants use of latest technology to enable oncologists better understand the mechanics of cancer and tumor cells and the application of NGS for DNA & RNA sequencing, epigenetics, and analysis of chromosomal abnormalities accounting for over three fourths of the global sequencing data are factors responsible for the large market share.Companies like Myriad, through its myRisk product, offer genetic testing to identify people who may be at higher risk of developing certain cancers in the future. In January 2021, Merus N.V.; a clinical-stage immuno-oncology company; collaborated with National Cancer Center, Japan, and Erasmus University Medical Center, Netherlands to evaluate its HER2/3-targeting bispecific antibody in solid tumors.

Furthermore, theconsumer genomicssegment is anticipated to register the fastest CAGR of 24.25% over the forecast period. Continuous introduction of new products by the key players is driving growth in the consumer genomics segment.The presence of companies such as 23andMe that are involved in the provision of the “Personal Genome Service” can be attributed to growth in the coming years. Moreover, Ancestry.com, Color Genomics, Cloud Health (which purchased a HiSeq X Ten), National Geographic and several Japanese consumer companies, as well as a nascent consumer business, Helix, which was launched by Illumina are expected to impact revenue generation in this segment. Rapid proliferation in genealogy, paternity testing, and personal health awareness is expected to drive the growth in the consumer genomics, as an application of NGS.

Workflow Insights

The sequencing segment held the largest market share of 57.15% in 2023. NGS sequencing is the most important phase of the workflow and consequently accounts for the largest share of the market. These systems are able to provide an accurate amount of liquid, which is important in NGS. Moreover, functions such as changing tubes and microliter plates are also performed by the system, which helps streamline workflow. The advantage of using robotic liquid handling system is that it enables researchers focus on analyzing the data rather than managing the process.

NGS Data Analysis is anticipated to be the fastest growing segment with a CAGR of 22.33%. A key factor contributing to the industry growth is the growing acceptance of sequencing platforms for clinical diagnosis due to a huge cost reduction of installation. Moreover, easy genomic and proteomic information availability is anticipated to create significant growth opportunities in this industry during the forecast period. Furthermore, the cost reduction of these sequencing technologies has resulted in increased adoption of NGS. In addition, strategic activities by key market players will further offer lucrative opportunities in the review period. For instance, Illumina's BaseSpace Suite aids in the analysis of sequencing data and production of findings in a short amount of time. To expand its data analytics capabilities, the company has also purchased DRAGEN Bio-IT Platform (DRAGEN) and Edico Genome. Furthermore, Genomatix and DNAnexus, provide cloud-based solutions for the interpretation and management of enormous volumes of sequencing data.

Key Companies & Market Share Insights

The industry is marked by high competition between the dominant players and these players are rapidly undertaking strategies such as strategic collaborations, geographical expansion, and partnerships through mergers & acquisitions in economically favorable and emerging regions.

For instance, in September 2023, Integrated DNA Technologies (IDT) launched its xGen NGS products, including primers, adapters, and universal blockers for the Ultima Genomics UG 100 platform.

In April 2022, Illumina, Inc. launched a Regional Solution Center in São Paulo, Brazil, to enhance access to NGS training & expertise for customers in Latin America and strengthen its presence in the region.

In May 2022, Oxford Nanopore Technologies plc launched Remora, a methylation analysis tool for MinKNOW, Oxford Nanopore’s operating software. This initiative is expected to provide access to direct, PCR-free nanopore sequencing.

Key Next Generation Sequencing Companies:

- Illumina

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

下一个背包ion Sequencing Market Report Scope

Report Attribute |

Details |

Market size value in 2024 |

USD 9.90 billion |

2030年的收入预测 |

USD 31.26 billion |

Growth rate |

CAGR of 21.12% from 2024 to 2030 |

Base year for estimation |

2023 |

Historical data |

2018 - 2022 |

Forecast period |

2024 - 2030 |

Report updated |

November 2023 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Technology; product; application; workflow; end-use; region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Illumina; QIAGEN; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; Bio-Rad Laboratories, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Next Generation Sequencing Market ReportSegmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global next generation sequencing market report based on technology, product, application, workflow, end-use, and region.

Technology Outlook (Revenue, USD Million, 2018 - 2030)

WGS

Whole Exome Sequencing

Targeted Sequencing & Resequencing

DNA-based

RNA-based

Others

Product Outlook (Revenue, USD Million, 2018 - 2030)

平台

Sequencing

Data Analysis

Consumables

Sample Preparation

Target Enrichment

Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

Oncology

Diagnostics and Screening

Oncology Screening

Sporadic Cancer

Inherited Cancer

Companion Diagnostics

Other Diagnostics

Research Studies

Clinical Investigation

Infectious Diseases

Inherited Diseases

Idiopathic Diseases

Non-Communicable/Other Diseases

Reproductive Health

NIPT

Aneuploidy

Microdeletions

PGT

Newborn Genetic Screening

Single Gene Analysis

HLA Typing/Immune System Monitoring

宏基因组,Epidemiology & Drug Development

Agrigenomics & Forensics

Consumer Genomics

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

Pre-Sequencing

NGS Library Preparation Kits

Semi-automated Library Preparation

Automated Library Preparation

Sequencing

NGS Data Analysis

NGS Primary Data Analysis

NGS Secondary Data Analysis

NGS Tertiary Data Analysis

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Academic Research

Clinical Research

Hospitals & Clinics

Pharma & Biotech Entities

Other Users

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global next generation sequencing market size was estimated at USD 8.29 billion in 2023 and is expected to reach USD 9.90 billion in 2024.

b.The global next generation sequencing market is expected to grow at a compound annual growth rate of 21.12% from 2024 to 2030 to reach USD 31.26 billion by 2030.

b.North America dominated the NGS market with a share of 49.35% in 2023. This is attributable to the presence of major clinical laboratories that are using next-generation sequencing technology to perform genetic tests.

b.Some key players operating in the NGS market include Illumina, QIAGEN; Thermo Fisher Scientific Inc.; F Hoffman-La Roche Ltd.; Oxford Nanopore Technologies; Genomatix GmbH; PierianDx; DNASTAR, Inc.; Eurofins GATC Biotech GmbH; Perkin Elmer, Inc.; BGI; and Bio-Rad Laboratories, Inc.

b.Key factors that are driving the NGS market growth include exponentially decreasing costs for genetic sequencing, development of companion diagnostics and personalized medicine, rise in competition amongst prominent market entities, a rising clinical opportunity for NGS technology, technological advancements in cloud computing and data integration, growing healthcare expenditure, and increasing prevalence of cancer.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."