Non Invasive Prenatal Testing Market Size, Share & Trends Analysis Report By Gestation Period, By Pregnancy Risk, By Method, By Technology, By Product, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-310-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The global non invasive prenatal testing market size was valued at USD 3.80 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.61% from 2023 to 2030. High demand for early Non Invasive Prenatal Testing (NIPT) and improvements in the reimbursement scenario are among the factors anticipated to boost market growth over the forecast period. The reimbursement for noninvasive prenatal tests varies in insurance plans owing to the difference in contracts. The listed prices of NIPT range from over USD 2,000 to under USD 1,000. However, studies suggest that first-line NIPT screens have become highly cost-effective and are available at low prices ranging from USD 619 to USD 744. Various countries such as the Netherlands are implementing policies to fully reimburse NIPT in the second trimester, thereby resulting in the higher adoption of these tests. In addition, other countries such as Germany plan to reimburse noninvasive prenatal tests for chromosomal disorders such as down syndrome.

The market was slightly impacted by the COVID-19 pandemic. Several manufacturing companies maintained regular communication with the U.S. FDA to keep themselves informed of any supply chain disruptions. In addition, several research studies were conducted to estimate the commercial impact of COVID-19. According to a SeraCare report, IVD developers and clinical testing facilities collaborated with research organizations to determine the effects of COVID-19 infection on pregnancy and congenital debilities in infants and the requirement for NIPT during the COVID-19 pandemic.

The demand for NIPT is increasing in various countries owing to various factors such as an increasing number of doctors choosing advanced genetic testing for high-risk pregnancies, a desire to delay pregnancy, and more pregnancy-related problems in the third- or second trimester. The use of invasive techniques of prenatal testing, such as chorionic villus sampling and amniocentesis, can lead to issues such as miscarriage. This has led to a decline in the use of these procedures and high demand for tests that are more efficient, noninvasive, and safe. NIPT, through the use of cell-free fetal DNA (cffDNA) that circulates in the mother’s blood, can be used for the detection of commonly occurring trisomies in the fetus such as turner syndrome, down syndrome, fetal rhesus D status, and sex chromosome disorders and for determination of fetal sex.

The market is highly saturated with existing key players operating in the NIPT market. Companies are forming partnerships and collaborations to maintain a stable position in the market. For instance, in June 2021, Illumina entered into a strategic collaboration with Next Generation Genomic to introduce a CE-IVD, NGS-based NIPT test, VeriSeq NIPT Solution v2 in Thailand. With this initiative, Illumina would have greater patient access to NIPT's next-generation sequencing.

Improvements and advancements in existing products are currently driving the market. For instance, in April 2020, Natera announced the expansion of coverage for its product Panorama. This product will now cater to all pregnant women irrespective of their age and conditions. Introduction of innovative products is likely to have a positive impact on the market. Increase in reimbursement coverage for all newly introduced products is expected to boost product adoption.

Gestation Period Insights

The 13-24 weeks segment held the largest share of over 51.4% in 2022 owing to the maximum number of tests being carried out during this phase of pregnancy. Complementary application of ultrasound with alpha-fetoprotein screening and non-invasive prenatal testing after 12 weeks of pregnancy is expected to fuel the growth of this segment. Moreover, tests carried out in quad screening, such as Unconjugated Estriol (EU), Alpha-Fetoprotein (AFP), inhibin A, and Human Chorionic Gonadotropin (hCG) is contributing to the revenue generation for this segment.

The 0 to 12 weeks gestation period segment accounted for a considerable revenue share in 2022 owing to the availability of a large number of products in the market. The first-trimester aneuploidy screening and maternal-fetal DNA screening carried out during this period result in significant revenue generation in this segment. In addition, first-trimester risk screening is advantageous over other trimesters as the combined data from biochemistry and sonography can be used to detect genetic alterations with an accuracy level of 91% to 96%.

Pregnancy Risk Insights

The high and average risk segment accounted for the largest revenue share of over 76.7% in 2022. This can be attributed to the growing adoption of these tests in high-risk cases and pregnancies in women 35 years and above. Moreover, with an increase in the number of pregnancies over the age of 35 years, the risk of abnormalities also significantly rises, which is anticipated to impel the demand for prenatal tests in the forecast period.

低风险段预计注册fastest CAGR of 11.38% from 2023 to 2030. Support from the government, such as budget assignment for average-risk pregnancies, is expected to be a favorable factor for growth. For instance, according to the NCBI in 2019, testing in average-risk pregnancies allowed detection of a higher number of affected cases, resulting in an additional budget of USD 35 million for this group in Ontario.

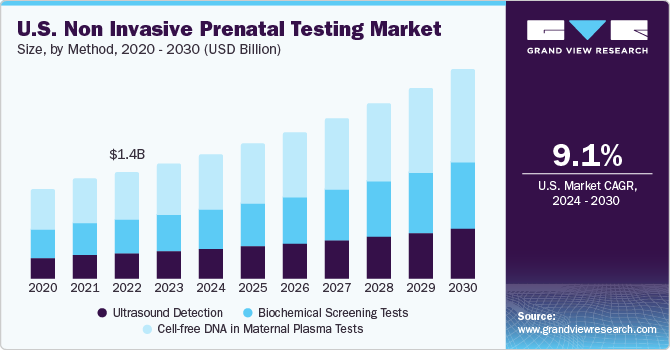

Method Insights

在母亲的血浆DNA测试段游离accounted for the largest revenue share of over 42.8% in 2022. It is increasingly being utilized in predicting the risk of genetic disorders in prenatal care via various genetic analyses. Technological advancements now have expanded the range of testing to whole-genome sequencing, and they can detect many additional chromosomal anomalies, such as microdeletions and sex chromosomal abnormalities.

Ultrasound detection is deployed as complementary to the Cell-free DNA-based NIPT test, resulting in a lower share of this segment. However, recent advancements in technology and 3D-4D imaging have improved real-time monitoring, safety, and efficiency of the test, which is further expected to propel the segment growth. For instance, in May 2022, General Electric Company (GE Healthcare) invested around USD 50 million in Pulsenmore, an Israeli startup. This allows expectant parents to chart their pregnancies at home and perform self-scans.

Application Insights

Trisomy led the market with a share of over 53.4% in 2022 owing to the rising incidence of chromosomal abnormalities. India has a heavy burden of genetic diseases. Various studies suggested that chromosomal abnormalities are found with a frequency of 1 in 166 newborns in the country, while trisomy 21 (down syndrome) has a high incidence rate of 1 in 800 births, resulting in the birth of 32,000 newborns with down syndrome every year.

Currently, technological advancements have expanded the range of testing to whole genome sequencing, and they can detect many additional chromosomal anomalies, such as microdeletions and sex chromosomal abnormalities. For instance, Panorama prenatal test by Natera Inc. helps detect sex chromosomal abnormalities, microdeletions, and triploidy. In addition, a 2021 NCBI article on a study based on 13,607 cases concluded that NGS NTP offers high sensitivities and specificities of more than 98.89%, and the failure rate is less than 0.72% in aneuploidy conditions such as trisomy 21, trisomy 18, trisomy 21 + 13, trisomy 13, and monosomy X.

Product Insights

The consumables and reagents segment dominated the market with a share of over 72.02% in 2022 owing to the presence of major players offering a wide range of consumables and reagents for NIPT. For instance, the CE-marked Harmony IVD Kit offered by Roche is an extensively studied and validated NIPT test and has been employed to screen more than 1.8 million pregnancies. The Harmony test is highly efficient and offers less than a 0.1% false-positive rate for trisomies 13, 18, and 21.

The instruments segment is expected to grow at a lucrative rate of 8.8% over the forecast period owing to continuous efforts undertaken by instrument manufacturers to develop advanced platforms. PerkinElmer, Inc. offers Vanadis NIPT System-an automated instrument to overcome the limitations associated with cost, complexity, and capacity of other NIPT technologies for screening of aneuploidy. The system is the only NIPT screening platform that enables analysis of the targeted cfDNA without PCR or next-generation sequencing.

End-use Insights

Diagnostic laboratories held the largest revenue share of over 61.3% in 2022 owing to the presence of a large number of diagnostic laboratories that offer NIPT across the globe. Labs such as MedGenome Labs Ltd. offer MedGenome Claria NIPT tests for the diagnosis of Trisomies 21, 18, and 13; Monosomy X; and other sex chromosomal abnormalities. Similarly, Claria NIPT Plus offered by MedGenome is used to detect Down Syndrome; Edwards’ Syndrome; Patau Syndrome; Triploidy; Monosomy X (Turner Syndrome); Klinefelter Syndrome, Triple X; Jacob’s Syndrome; 22q11.2 Deletion Syndrome; 1p36 Deletion Syndrome; Prader-Willi Syndrome; Angelman Syndrome; and Cri-du-chat Syndrome.

公立和私立医院的存在offer NIPT across the globe is fueling the growth of the hospitals and clinics segment. In addition, the rise in research studies in hospitals is expected to increase testing rates in hospital settings. For instance, in May 2019, a nationwide study was conducted across 10 Indian hospitals to analyze the effectiveness of NIPT.

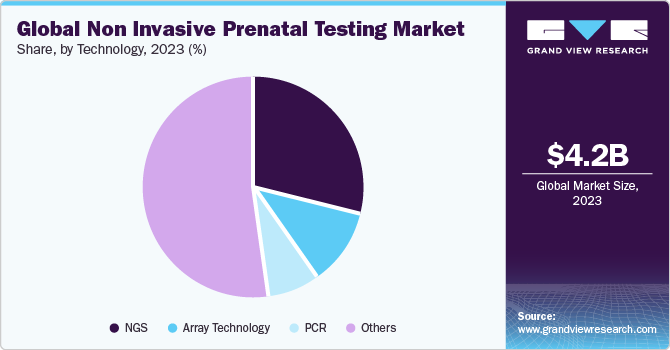

Technology Insights

Next-generation Sequencing (NGS) accounted for the largest revenue share of over 29.61% in 2022. It has gained immense popularity in NIPT. It is commonly used for the identification of trisomy conditions, micro-deletions, and aneuploidies in chromosomes. NGS-based noninvasive prenatal tests are different from other techniques as they can be performed as early as 10 weeks of pregnancy. In addition, other noninvasive prenatal tests offer about 96% accuracy, whereas NGS-based tests are more than 99% accurate.

The adoption of Polymerase Chain Reaction (PCR) for NIPT has increased with the commercial launch of Eurofins LifeCodexx-one of the world's first quantitative real-time PCR NIPT assays to detect fetal trisomy 21 (qNIPT). This novel PCR-based quantitative NIPT assay offers enhanced speed and lower costs as compared to classical NIPT methods. Owing to its benefits, Eurofins LifeCodexx is considered an affordable and reliable prenatal testing method.

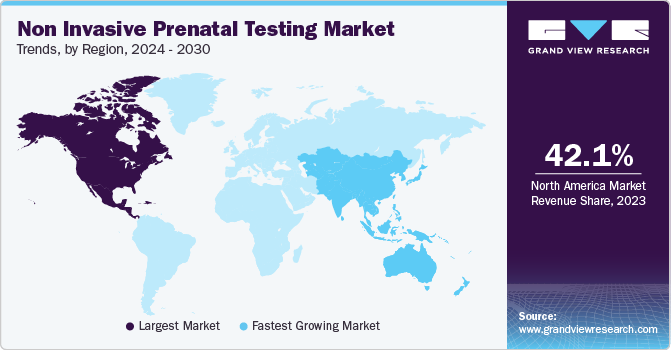

Regional Insights

North America dominated the market with over 42.3% share in 2022, followed by Europe. High R&D investments, high preterm birth rate, a well-established research framework, and the development of whole-genome sequencing in the region are among the factors anticipated to boost the growth of the North American market.

The recent addition of non-invasive prenatal testing (NIPT) in coverage plans of major insurance companies is anticipated to boost the adoption of NIPT in the U.S. Moreover, 46% of average risk and 96% of high-risk pregnancies qualify to receive reimbursement coverage in the nation. These factors are anticipated to positively impact the North American market growth.

Asia Pacific is expected to exhibit the fastest growth of 11.6% over the forecast period owing to the rising maternal age, which contributes to the growing incidence of chromosomal aneuploidies in babies, leading to a rise in the potential customer base. Significant developments in China and Japan, technological integration of NGS procedures, and improving healthcare infrastructure are expected to boost market growth.

Key Companies & Market Share Insights

This market is consolidated due to the broad range of product offerings and strong distribution network of key entities in emerging and developed countries. In addition, companies are undertaking several strategic initiatives, including partnerships, mergers, acquisitions, and product expansions, to strengthen their market position. For instance, in June 2021, Next-Generation Genomic Co., Ltd. and Illumina, Inc. launched VeriSeq NIPT Solution v2 in Thailand. VeriSeq NIPT Solution offers accurate, reliable, scalable, and fast end-to-end genome-wide noninvasive prenatal testing. Some prominent players in the global non invasive prenatal testing market include:

Genesis Genetics (CooperSurgical, Inc.)

Natera, Inc.

Centogene N.V.

Illumina, Inc. (Verinata Health, Inc.)

Eurofins LifeCodexx GmbH

MedGenome Labs Ltd.

F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

Myriad Women’s Health, Inc. (Counsyl, Inc.)

Progenity, Inc.

Qiagen

Laboratory Corp. of America Holdings

Quest Diagnostics, Inc.

Non Invasive Prenatal Testing Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 4.12 billion |

Revenue forecast in 2030 |

USD 7.99 billion |

Growth rate |

CAGR of 9.61% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Gestation period, pregnancy risk, method, technology, product, application, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Singapore; Australia; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

Genesis Genetics (CooperSurgical; Inc.); Natera, Inc.; Centogene N.V.; Illumina, Inc. (Verinata Health, Inc.); Eurofins LifeCodexx GmbH; MedGenome Labs Ltd.; F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics); Myriad Women’s Health, Inc. (Counsyl; Inc.); QIAGEN; Laboratory Corp. of America Holdings; Progenity, Inc.; Quest Diagnostics, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Non Invasive Prenatal Testing Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global non invasive prenatal testing market report on the basis of gestation period, pregnancy risk, method, technology, product, application, end-use, and region:

Gestation Period Outlook (Revenue, USD Million, 2018 - 2030)

0-12 Weeks

13-24 Weeks

25-36 Weeks

Pregnancy Risk Outlook (Revenue, USD Million, 2018 - 2030)

High & Average Risk

Low Risk

Method Outlook (Revenue, USD Million, 2018 - 2030)

Ultrasound Detection

Biochemical Screening Tests

Cell-free DNA in Maternal Plasma Tests

Technology Outlook (Revenue, USD Million, 2018 - 2030)

NGS

Array Technology

PCR

Others

Product Outlook (Revenue, USD Million, 2018 - 2030)

Consumables & Reagents

Instruments

Application Outlook (Revenue, USD Million, 2018 - 2030)

Trisomy

Microdeletion Syndrome

Other Applications

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals & Clinics

Diagnostic Laboratories

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

Japan

China

India

Singapore

Australia

Latin America

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global non invasive prenatal testing market size was estimated at USD 3.80 billion in 2022 and is expected to reach USD 4.12 billion in 2023.

b.The global non invasive prenatal testing market is expected to grow at a compound annual growth rate of 9.61% from 2023 to 2030 to reach USD 7.99 billion by 2030.

b.NIPT for high & average risk type dominated the non-invasive prenatal testing market with a share of 76.73% in 2022. This is attributable to the presence of the favorable payor reimbursement coupled with increasing awareness on the prevention of chromosomal anomalies such as Downs Syndrome.

b.Some key players operating in the non invasive prenatal testing market include Sequenom, Roche (Ariosa Diagnostics); Natera, LabCorp, BGI Genomics; Quest Diagnostics, Illumina, and Berry Genomics among others.

b.Key factors that are driving the non invasive prenatal testing market growth include increasing demand for early and non-invasive prenatal testing procedures to prevent the occurrence of chronic illness in the offspring and improving reimbursement scenarios in the space.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."