北美空调系统市场规模, Share & Trends Analysis Report By Type (Unitary, Rooftop), By Technology (Inverter, Non-Inverter), By End-use, By Region, And Segment Forecasts 2023 - 2030

- Report ID: 978-1-68038-131-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

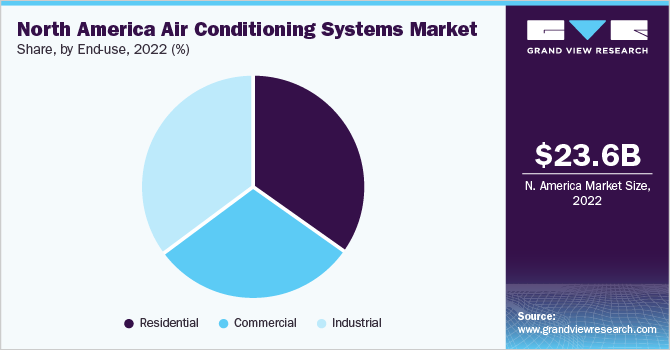

的North America air conditioning systems market size was worth USD 23.58 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Rising demand for energy-efficient and power-saving products are expected to be some of the major factors driving the growth of the industry. With the advent of technology, the market is anticipated to witness a wide array of new product development and innovation. Inverter-based systems and natural refrigerants are projected to influence demand favorably. Moreover, increasing the need for power-saving ratings and strict policies and regulations concerning efficient ways of utilizing energy in the U.S. together with better consumer awareness is projected to fuel demand.

Air conditioning systems use refrigerants that are detrimental and toxic in nature thereby contributing substantially to global warming. Replacement products available in the industry are expected to drive the market’s growth over the forecast period.

美国的温度逐渐增加can cities such as San Antonio, Texas, Phoenix Arizona, and Fort Worth, Texas along with cities stretched across the sun belt of the South Western and Southern America owing to global warming and climate change are also responsible for the increasing uptake of different air conditioner in the country. U.S. Energy Information Administration conducted the Residential Energy ConsumptionSurveywhich states that most American residences (88%) have air conditioning (AC).

的primary AC system used by two-thirds of American residences is a central air conditioner or heat pump. With 92% and 93% of households utilizing AC, respectively, the Midwest Census Region and the South Census Region had the highest rates in 2020. The West Census Zone, which comprises homes in a variety of climate regions, including the marine climate region along the Pacific Coast, where residential AC use was 49%, had the lowest percentage of households using AC at 73%.

的North America air conditioning systems market is expected to witness growth in shipments because of growing construction. However, competition between established organizations and Chinese suppliers who market products at reduced prices may challenge growth in North American countries including the U.S. and Canada. Preventive measures from non-profit organizations (NPOs), public forums, media, and government, to spread awareness among end-users relating to environmental issues, are expected to encourage people to adopt eco-friendly equipment.

Additionally, stiff competition from Chinese producers such as Haier, Gree, and Midea is anticipated to remain a cause of concern for local manufacturers, subsequently resulting in reduced profits. Research and development costs to develop new products are expected to accentuate on account of stringent norms regarding energy efficiency. However, the continued and undeviating focus of companies on customer service is anticipated to serve as a potential prospect to maintain the market share and earn profits.

Type Insights

Based on type, the North American air conditioner market is divided into unitary, rooftop, and PTAC. The unitary air conditioner type accumulated the largest revenue share of 37.12% in 2022 and is estimated to grow at a CAGR of over 7.5% by 2030. The unitary air conditioners offer advantages such as low installation cost which includes labor charges for fitting and assembly. The freedom to control individual room temperatures with unitary ACs with different cooling parameters for each room contributes to the adoption of the product type. Increasing temperatures and rising demand for residential AC systems are expected to boost the demand for unitary air conditioners. The use of unitary AC in schools, offices, and hospitals is expected to support its demand.

Technology Insights

Based on technology, the market is divided into inverter and non-inverter technologies. The inverter segment accumulated the largest market share of over 67% in 2022 and is estimated to grow at a CAGR of more than 6% during the forecast period. Air conditioner system manufacturers prefer inverter technology based on its advantages such as the ability to adjust the power supply frequency of the compressors. The inverter-based ACs consume comparatively lesser energy owing to compressor speed adjustment for controlling the gas flow rate, this provides the inverter ACs to control their operating capacity. Therefore, its advantage of low energy consumption and low bills is favoring the demand.

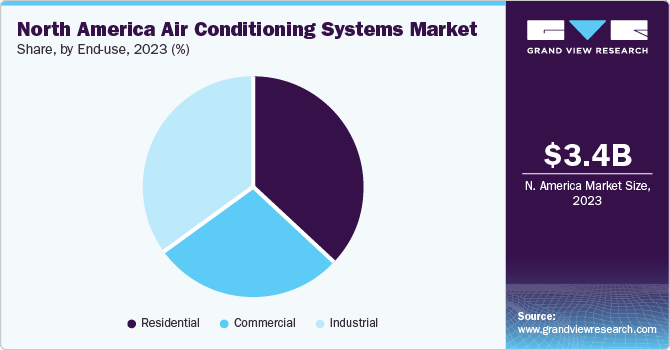

End-use Insights

Based on end-use, the market was dominated by air conditioning systems used in residential sites, accounting for a market share of 35.04% in 2022. The residential segment is anticipated to witness above-average growth owing to new end-use applications including air conditioners in tents facilities growing demand for residential air conditioning systems can be attributed to the increasing need for portable systems for camping trips and outdoor activities.

Over the projection period, the residential segment is anticipated to witness significant growth. A rise in disposable income combined with declining home financing rates in emerging nations is also anticipated to favorably impact market expansion.

Additionally, during the course of the projection period, the demand for architectural services is anticipated to be driven by rising urbanization in tier-II cities in emerging economies. In addition, to better manage their smart city projects, architects are predicted to want more services including urban planning and project management.

Regional Insights

的market is expected to be driven on account of demand from different sectors and diverse weather circumstances. The U.S. held the largest market share of over 97% in 2022. Traditional air conditioning systems that consume significant energy are expected to be replaced by products with compressors that consume less power. The U.S. is expected to witness approximately 5.5% of CAGR in terms of revenue over the forecast period.

Key Companies & Market Share Insights

Key market players include Carrier Corporation, Daikin Industries Ltd., Ingersoll Rand, Mitsubishi, and Hitachi. Industry participants strategize to expand globally by entering new markets through mergers and acquisitions and joint ventures. Furthermore, to establish a strong geographical presence, companies focus on having a firm distribution network to meet customer needs. Some prominent players in the North America air conditioning systems market include:

Arcelik

BSH Group

Carrier Corporation

Daiki Industries Ltd

Haier Group

Electrolux

Hitachi Air Conditioning

Ingersoll Rand

LG Electronics

Mitsubishi Electric

Whirlpool Corporation

North America Air Conditioning Systems Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 24.59 billion |

Revenue forecast in 2030 |

USD 35.66 billion |

Growth rate |

CAGR of 5.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

卷千单位,收入在十亿美元nd CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, technology, end-use, region |

Regional scope |

North America |

Country scope |

U.S.; Canada |

Key companies profiled |

Arcelik; BSH Group; Carrier Corporation; Daiki Industries Ltd; Electrolux; Haier Group; Hitachi Air Conditioning; Ingersoll Rand; LG Electronics; Mitsubishi Electric; Whirlpool Corporation |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Air Conditioning Systems Market Segmentation

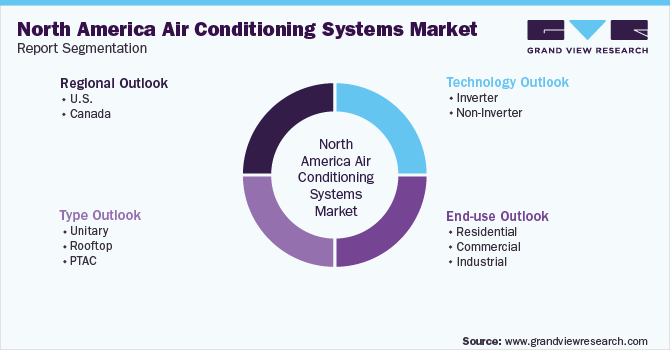

的report forecasts the volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America air conditioning systems market report based on type, technology, end-use, and region:

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

Unitary

Rooftop

PTAC

Technology Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

Inverter

Non-Inverter

End-use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

Residential

Commercial

Industrial

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

U.S.

Canada

Frequently Asked Questions About This Report

b.的North America air conditioning systems market size was estimated at USD 23.58 billion in 2022 and is expected to reach USD 24.59 billion in 2023.

b.的North America air conditioning systems market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 35.66 billion by 2030.

b.Inverter dominated the North America air conditioning systems market with a share of 67% in 2022. This is attributable to superior benefits offered as compared to other variants in terms of installation, purchase costs, and noise levels.

b.Some key players operating in the North America air conditioning systems market include Carrier Corporation, Daikin Industries Ltd., Ingersoll Rand, Mitsubishi, and Hitachi.

b.Key factors that are driving the market growth include rising demand for energy efficient and power saving products coupled with rise in spending in the construction sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."