无油空气压缩机市场规模、分享和趋势s Analysis Report By Product (Stationary, Portable), By Technology, By Power Rating, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-343-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:0b足球

Report Overview

The global oil free air compressor market size was valued at USD 11,882.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Increasing demand for oil-free air compressors where air quality becomes crucial is anticipated to drive the market. These compressors provide increased operational effectiveness and extremely dependable operation. Furthermore, compliance adherence to meet global industry benchmarks and limit the degree of oil concentration in compressed air continues to propel application.

To limit the spread of the COVID-19 illness, governments around the world imposed stringent nationwide lockdowns in 2020. As a result, the progress of various sectors and industries has been impeded. Furthermore, the second wave of COVID-19 cases in numerous countries resulted in partial lockdowns around the world. This hampered investments in the oil & gas industry, as well as the market growth.

According to the International Organization of Motor Vehicle Manufacturers, in 2020, 14.5 million light vehicles were sold in the U.S. The U.S. is second in the world for both car manufacturing and sales. In 2020, the U.S. exported 1.4 million new light automobiles, 1,08,754 medium and heavy trucks, and 66.7 billion dollar worth of automotive parts to more than 200 markets worldwide. These exports totaled over USD 52 billion. Additionally, oil-free compressed air offers better painting for automotive, which will promote market expansion in the automotive sector in this region.

According to the Centre for Sustainable Systems, University of Michigan, U.S., around 83% of the U.S. population lives in urban cities, which is expected to reach 89% by 2050. Evolving trends in the food & beverage industry such as partnerships with distribution channels, mass-market brand building, product innovation, digital ubiquity, organic growth strategies, and mergers & acquisitions are widely observed in the U.S. food & beverage industry. The valves and actuators on automated filling, packing, and bottling lines are controlled by compressed air. Airborne oil can accumulate and jam these parts, resulting in price line stoppages, which further propels the market growth.

Leading players are developing low-maintenance and eco-friendly systems to persuade consumers to choose next-generation technologies. To distinguish their products in an extremely competitive environment, companies like Ingersoll Rand Plc; Bauer Group; Cook Compression; and Atlas Copco Inc. have developed advanced technologies with high-performance capabilities.

These technologically advanced oil-free air compressors' major advantages include improved efficiency and decreased noise levels. For instance, Atlas Copco's GA 7-110 VSD+ is a cutting-edge oil-injected compressor that increased the standard for energy efficiency by cutting its energy use by about 50%. As a result, during the projection period, the manufacturers will have an opportunity owing to the adoption of energy-efficient technologies.

Furthermore, the aging population in the U.S. is boosting the pharmaceutical industry's expansion. In addition to the aging and growing population, the U.S. pharmaceutical sector is expanding due to increased purchasing power and access to high-quality healthcare and medications for families in the global lower and middle classes. Moreover, oil-free compressors provide less wastage, greater product purity, efficient processes, and increased safety in the pharmaceutical industry, which will further augment the market growth.

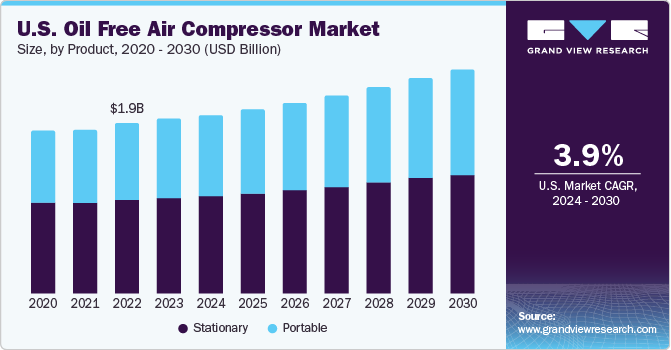

Product Insights

The portable product segment led the market and accounted for 35.7% of the global revenue share in 2022. Growing demand for energy-efficient, low-maintenance devices is expected to be driven by growing industrialization. For instance, the International Energy Agency (IEA) reports that USD 66 billion in funding was provided through government stimulus packages for initiatives related to energy efficiency. These aforementioned factors will drive the demand for portable oil-free air compressors in the coming years.

Portable compressors are widely used in construction & mining activities. Oil-free portable air compressors and generators are dependable power sources utilized mainly for tools and machinery in the construction sector. They are also extensively used across various industrial applications, owing to their convenience in shipping the equipment. These aforementioned factors will drive the demand for portable compressors in construction & mining activities.

The stationary oil air compressors are fixed in one place unlike portables and are preferred for long-term projects. In addition, the stationary air compressor is in high demand for automotive, machinery, and other industrial heavy-duty applications. However, stationary compressors are expected to witness slow growth compared to portable owing to special installation considerations required to mount them.

The stationary product segment is expected to grow at a CAGR of 11.0% over the forecast period. Due to the importance of high-quality products, these products provide a greater tank size, resulting in a higher air-compression capacity, and are widely utilized in the oil & gas and construction industries. These aforementioned factors will drive demand for stationery products in the coming years.

Technology Insights

The reciprocating segment led the market and accounted for 35.7% of the global revenue share in 2022. Reciprocating compressors are known as positive displacement compressors. Low maintenance cost, higher-pressure generation, flexibility of use, and high efficiencies are expected to drive the demand for the reciprocating segment during the forecast period.

The most common types of air compressors are reciprocating and rotary, while centrifugal air compressors are employed in severe or extreme applications. They are employed in the reduction of wellhead casing gas, vapor recovery (VRU), gas boosting, gas blanketing, flare removal, gas gathering, gas evacuation, and increased oil recovery. These aforementioned factors will augment the demand for oil-free air compressors in the coming years.

Rotary air compressors are known as positive displacement gas compressing machines. These compressors dependably provide industrial processes in commercial, trade, and workshop settings with high-quality compressed air or gas. Longer product life cycles and consumer expectations for greater energy savings are all factors that contribute to a significant portion of the total life cycle expenses of compressor maintenance and operation. Due to this, rotary compressors now have a higher revenue share than reciprocating compressors.

The centrifugal product segment is expected to grow at a CAGR of 11.0% over the forecast period. The refining, automotive, and oil & gas industries majorly use centrifugal products. These industries' quick development is a major driver of the segment's growth. Due to advantages like a quicker payback period, which is a major factor for consumers, centrifugal technology is typically favored in industrial settings, driving market expansion.

Power Rating Insights

The 15-55kW power-rating segment led the market and accounted for 35.7% of the global revenue share in 2022. There has been an upsurge in the awareness of air quality and related negative consequences on the environment. The stringent government regulations about environmental air protection and CO2emissions impelled oil-free air compressor manufacturers to develop energy-efficient products.

With the deep retrofit accelerator, the Canadian government has expanded funding for energy efficiency, with USD 200 million in 2022, specifically provided to assist low-income people to make their homes more energy-efficient and cost-effective to maintain. Furthermore, the compressors used in workplaces are required to comply with the Occupational Health & Safety (OHS) regulations. Thus, the rising end-user demand for enhanced air quality and reliability is projected to stimulate the growth of the market.

Oil is used in the compression stage of oil-lubricated air compressors for lubrication, sealing, and cooling. The lubricating oil can be carried over into the compressed air system during operation. A detailed understanding of compressed air quality and testing standards is thus required to meet the purity levels required by various applications, thereby driving market expansion over the forecast period.

The below 15kW power rating segment is expected to grow at a CAGR of 11.0% over the forecast period. Error detection and service warnings are included in the modern monitoring for this 15 kW compressor. This can be attributed to the market for rotary and centrifugal compressors' low-power products. It is projected that the widespread use of these goods across a range of end-use sectors will accelerate segment growth. Additionally, it is anticipated that government initiatives to promote energy conservation and growing consumer awareness will fuel demand during the projected period.

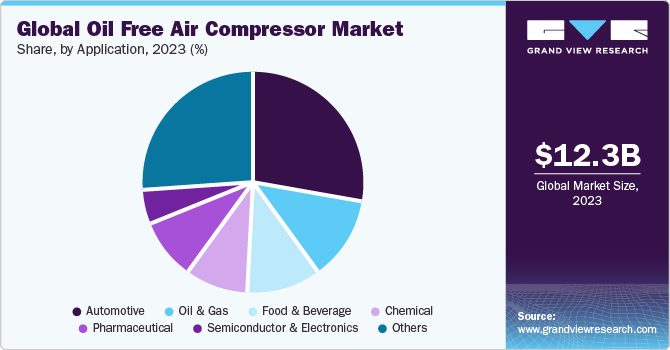

Application Insights

The manufacturing application led the market and accounted for 24.0% of the global revenue share in 2022. The manufacturing sector makes substantial use of portable oil-free air compressors. For instance, oil-free air can be used as a direct power source in a variety of facilities to create machinery and equipment. These aforementioned factors will drive market demand over the forecast period.

Where entrained oil carry-over is not acceptable, such as in the production of semiconductors and home appliances, oil-free air compressors are used. These compressors are lighter in weight, and more reasonably priced than their oil-lubricated counterparts, thus increasing demand from the aforementioned industries.

The oil & gas application segment is expected to grow at a CAGR of 11.0% over the forecast period. In oil & gas industries, air compressors are used for different operations such as petroleum refining, petrochemical synthesis, pipeline transportation, gas injection, and so on. Oil-free air compressors are becoming popular since they have a lower need for maintenance, use relatively less energy, have a lower environmental impact, and are less likely to cause product contamination. These aforementioned factors are anticipated to drive market growth over the forecast period.

Clean air is essentially used in the healthcare industry for pill manufacturing, as well as in culture vessels, aeration tanks, and packaging. Furthermore, medical air compressors are used as the main components in medical air systems for transforming power into potential energy in pressurized air.

Moreover, the use of compressed air is extended for artificial respiration, surgical instrument, and other medical systems. These aforementioned factors will propel the demand for oil-free air compressors in the coming years. For instance, ELGi provides oil-free air compressors to transport medical gas for anesthetic conditions.

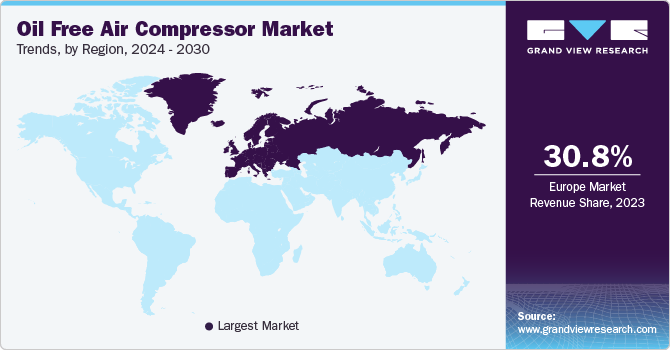

Regional Insights

North America region led the market and accounted for over 35.6% of the global revenue share in 2022. The growing demand for oil-free air compressors from major industries in the region such as manufacturing, healthcare, energy, and oil & gas. Due to benefits including effective operation at lower costs, optimal performance at changing speeds, and a reduced need for repair and maintenance, these compressors are highly favored. Furthermore, the oil-free air compressor industry in the U.S. and Canada has stayed near saturation and will continue to exhibit the same trend without any prominent decline.

Europe is one of the most reliable markets for oil-free air compressors conventionally. However, there have been mixed sales across the region owing to the uncertain economic conditions, and it still, remains one of the most prominent markets for oil-free air compressors. Germany and U.K. remain the most promising countries for upcoming sales and demand of oil-free air compressors owing to the presence of manufacturing hubs.

The demand for oil-free air compressors is estimated to witness growth at a CAGR of 11.2% in Asia Pacific over the forecast period owing to growing urbanization coupled with growing expenditure on manufacturing facilities and infrastructural development. In 2022, The Advanced Manufacturing Business Development Mission will help American manufacturers of advanced manufacturing systems find export opportunities in Indonesia, Singapore, and Japan, according to the International Trade Administration.

Due to their strength and planned growth in sophisticated manufacturing, as well as their advantageous position in the Asia Pacific region, these markets provide great prospects for U.S. businesses. Furthermore, Make in India initiatives have also drawn manufacturing hubs to the country, flourishing the demand for oil-free air compressors.

Due to the hectic lifestyle of many consumers, there is a significant demand for convenience foods & other ready-to-eat food and beverage products, which is further driving up consumption in the Central and South American region. To meet the region's growing demand for freeze-dried foods, producers supply them because they help preserve the majority of the nutrients that would otherwise be lost using heat-based preservation processes.

Compressors are used in various manufacturing processes in this industry, such as agitation and pressurized transport, using clean air for cooling food, packaging, and boxing products. These aforementioned factors will drive the demand for oil-free air compressors in Central and South America.

Key Companies &Market Share Insights

The key players in the market are focusing on collaborating with other players. Moreover, they are making high investments in R&D for developing innovative solutions and gaining a competitive advantage.

For instance, in March 2021, Atlas Copco AB acquired the British compressed air distributor and service provider named Cooper Freer Ltd., a privately owned company. The acquisition allows the former to strengthen its market presence in key regions in the U.K.

此外,制造商也采用均匀pment as a service (EaaS) business model to diversify their revenue channel. A business model known as Equipment as a service, or EaaS, involves renting out equipment to end-users and receiving recurring payments from them for the usage of the equipment.

Some of the advantages of the EaaS business model are improved equipment design, lower Capex, and larger revenue growth. For instance, BASF coatings have adopted the equipment as a service business model termed sigma air utility from KAESER KOMPRESSOREN, in which the company will provide compressed air for paint and coating production as per the usage. Some prominent players in the global oil free air compressor market include:

Atlas Copco

FS Elliott Co.LLC

Hanwha Techwin

Ingersoll Rand Plc

Sullair LLC

Sundyne

Kaeser Kompressoren SE

Doosan Portable Power

Sullivan-Palatek; Inc.

Oil Free Air CompressorMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 12,358.6 million |

Revenue forecast in 2030 |

USD 17,278.2 million |

Growth Rate |

CAGR of 4.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion, CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends |

Segments covered |

Product, technology, power rating, application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country Scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa |

Key companies profiled |

阿特拉斯•科普柯;FS艾略特有限公司,有限责任公司;韩华Techwin;Ingersoll Rand Plc; Sullair LLC; Sundyne; Kaeser Kompressoren SE; Doosan Portable Power; Sullivan-Palatek, Inc.; Elgi Compressors USA Inc.; Zen Air Tech Pvt. Ltd.; Cook Compression; Oasis Manufacturing; Frank Technologies; Bauer Group |

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Oil Free Air CompressorMarket Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil-free air compressor market report based on product, technology, power rating, application, and region:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Stationary

Portable

Technology Outlook (Revenue, USD Million, 2018 - 2030)

Reciprocating

Rotary/Screw

Centrifugal

Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

Below 15kW

15-55kW

55-160kW

Above 160 kW

Application Outlook (Revenue, USD Million, 2018 - 2030)

Food & Beverage

Pharmaceutical

Semiconductor & electronics

Chemical

Oil & Gas

Automotive

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Spain

Italy

Asia Pacific

China

Japan

India

South Korea

Australia

Central & South America

Brazil

Argentina

Middle East & Africa

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global oil free air compressor market size was estimated at USD 11,882.1 million in 2022 and is expected to reach USD 12,358.6 million in 2023.

b.The oil free air compressor market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 17,278.2 million by 2030.

b.Europe region dominated the oil free air compressor market with a share of 31.1 % in 2022. Europe is one of the most reliable market for oil free air compressors. There have been mixed sales across the region owing to the uncertain economic conditions and has remained one of the prominent market for oil free air compressors. Germany and U.K. have the most promising countries for sales and huge demand of oil free air compressors owing to the presence of manufacturing hubs.

b.Some of the key players operating in the oil free air compressor market include Atlas Copco, FS Elliot Co., LLC, Hanwha Techwin, Ingersoll Rand Plc, Sullair LLC, Sundyne, Kaeser Kompressoren SE, Doosan Portable Power, Sullivan-Palatek, Inc., Elgi Compressors USA, Inc., Zen Air Tech Pvt. Ltd., Cook Compression, Oasis Manufacturing, Frank Technologies, Bauer Group.

b.的关键因素驱动无油空气compressor market includes significance of air quality. These compressors provide increased operational effectiveness and extremely dependable operation. As a result, their implementation in various end-use industries is being pushed forward to guarantee compliance with several industry standards that define the degree of oil concentration in compressed air

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."