Stem Cells Market Size, Share & Trends Analysis Report By Product (Adult Stem Cells, Human Embryonic Stem Cells), By Application, By Technology, By Therapy, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-130-6

- Number of Pages: 195

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry:医疗保健

Report Overview

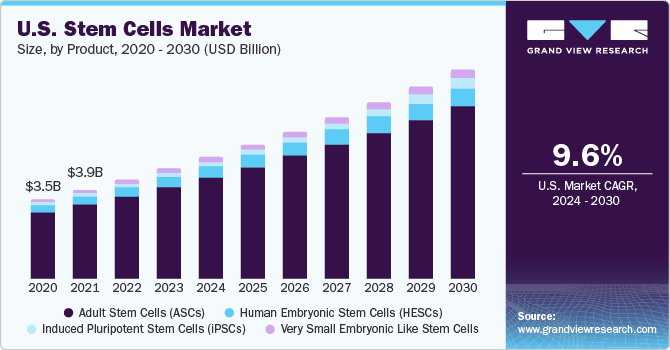

The global stem cells market size was valued at USD 13,266.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.74% from 2023 to 2030. The growing development of precision medicine, increase in the number of cell therapy production facilities and rising number of clinical trials are expected to be major driving factors of the market. Recent advances in the stem cells therapeutics and the tissue engineering hold the potential to draw the attention for treatment of several diseases. Furthermore, increasing demand for stem cells banking and rise in research activities pertaining to stem cells production, storage, and characterization are also expected to fuel the revenue growth for the market. Technological improvements in the parent and ancillary market for stem cells usage are some of the other factors that reinforce the expected growth in demand for stem cells over the forecast period.

The COVID-19 pandemic had a positive impact on the market. The application of the products in the treatment of the novel coronavirus has increased the interest of medical researchers, resulting in an increase in clinical trials. Regenerative medicine based on cellular therapies may be a treatment option for patients, resulting in a reduction in mortality and infection rates. Companies and research institutes are collaborating to develop novel treatment options for the disease. For example, Infectious Disease Research Institute and Celularity, announced in April 2020 that the US FDA had approved a clinical trial application to develop cell-based therapy for COVID-19. Hence, growing applications for clinical trials are expected to boost the demand for stem cells during the forecast period.

Moreover, researchers are increasingly attempting to develop stem cells therapies for targeting COVID-19. For instance, in January 2020, researchers from the University of Miami, administered two stem cells infusions in COVID-19 patients that were suffering from lung damage. The results concluded that there were no significant side effects, and the therapy was reliable. Growing demand for regenerative medicines is expected to fuel market growth. Regenerative medicines have extensive applications in treatment of various diseases including neurology, oncology, hepatology, diabetes, injuries, hematology, and orthopedics. In addition, growing geriatric population and increasing demand for regenerative medicines for early detection and prevention of diseases are some of the factors contributing to market growth.

Regenerative medicines help in restoring normal functioning of cells. Rapid advancements in this field is anticipated to provide effective therapies for chronic conditions. For instance, in March 2022, Wipro Ltd, and Pandorum Technologies, announced a long-term partnership. Together the companies plan to aim on the development of technologies that will reduce the time-to-market and boost the patient outcome during clinical trials and research and development of regenerative medicine. Biotech Pandorum will use Wipro’s AI facilities for the development of regenerative medicine and advanced therapeutics to enhance patient outcomes.

There is wide global anticipation for stem cell-based therapies as they are safe and effective. Stem cells are gaining attention for the development of regenerative medicine. Regenerative cell therapies have the potential for healing and replacing damaged tissues and organs. For these therapies, stem cells represent a great promising cell source and hence are receiving increasing attention from researchers, clinicians, and scientists. Several factors contribute to the market growth such as increasing collaborations, robust funding, government initiatives and extensive R&D. For instance, in May 2020, CiRA Foundation and CGT Catapult launched a new collaborative research project aimed on induced pluripotent stem cell characterization. The companies will combine their competence to investigate the novel methods to characterize pluripotent stem cells for the manufacturing of regenerative medicine products.

Significant R&D expenditures are one of the major contributors of market growth. Furthermore, another factor contributing to the increase is the increased need for effective therapeutics to reduce the disease burden during the forecast period. For instance, Celavie Biosciences' 5-year exploratory study on Parkinson's disease progressed in May 2020. The company is working on regenerative stem cell therapies to treat Parkinson's disease and other central nervous system disorders. Celavie Biosciences announced that their preliminary clinical trials utilizing OK99 stem cells for Parkinson's disease were successful.

Moreover, the increasing recognition of precision medicines is further promoting the market growth. Scientists are finding new procurement methods which can be further utilized for the development of personalized medicines. For instance, induced pluripotent stem cells therapies are developed by utilizing a small amount of sample from a patient’s skin or blood cell which is later on reprogrammed to form new tissue and cells for transplant. Moreover, in September 2022 Century Therapeutics and Bristol Myers Squibb announced a license agreement and research collaboration for the development and commercialization of iPSC-derived allogeneic cell therapies. Hence, with the application of these cells coupled with strategic activities by market players, potential personalized medicines can be developed in the near future

Product Insights

adult stem cells held the largest share of 83.34% of the market in 2022 as these cells do not involve the destruction of embryos, which is the case in embryonic stem cells. Furthermore, there is no risk of graft rejection in the case of adult stem cells. Development of cell banking services and advancements in bio preservation and cryopreservation are expected to further boost the demand for adult stem cells. Lesser ethical concerns surrounding adult cells further propel the growth of this segment. Benefits of adult stem cell banking such as capacity for autologous transformation, low risk of tumor formation, and availability of established treatment options are factors that expected to boost the growth of this segment during the forecast period.

Mesenchymal Stem Cells (MSCs), hematopoietic stem cells, epithelial/skin stem cells and neural stem cells, are all subtypes of ASCs. The MSC segment is expected to witness the fastest CAGR during the forecast period due to its use in autologous transplantation, substantial clinical trials which demonstrated its application for treating various diseases, and extensive ongoing research to investigate its therapeutic applications.

The induced pluripotent stem cells segment is expected to grow at the fastest CAGR of 18.22% during 2023 to 2030, owing to increased investment in developing regenerative medicines using induced pluripotent stem cells, ensured reproducibility and maintenance, ability to differentiate into all cell types, and high proliferative ability. Many leading companies are also expanding services related to iPSCs as their importance in the treatment of various diseases grows. For instance, in January 2021, REPROCELL launched a new personalized induced pluripotent stem cells production service for generating patient-specific iPSC. The service will assist in the preparation and storage of an individual's iPSCs for the development of regenerative medicines to treat future illnesses or injury. They are developed from mature cells using ready-to-use RNA reprogramming technology.

Application Insights

再生医学和药物发现和开发opment are two applications within the application segment. Increased approvals for clinical trials on stem cell therapies targeting various diseases has resulted in regenerative medicine segment capturing the larger market share of 90.17% in 2022. Longeveron LLC, for example, announced in June 2020 that Japan's Pharmaceutical and Medical Devices Agency (PMDA) had approved the start of Phase 2 clinical trial to evaluate the safety and efficacy of their mesenchymal stem cells that can be used to treat aging frailty.

此外,大量探讨了几个国家的政府ting in the development of regenerative medicines. For instance, the Government of Canada invested around USD 6.9 million in regenerative medicine research in March 2020. This fund will be used to support nine translational projects and four clinical trials aimed at developing new therapies in the field of regenerative medicine. The developed regenerative medicines will aid in the treatment of a variety of blood disorders, heart diseases, diabetes, and vision loss.

The drug discovery and development segment is expected to grow at a faster CAGR of 12.96% during 2023-2030. As it is useful in studying human disease etiology, identifying pathological mechanisms, and developing therapeutic strategies for tackling various diseases, market products are seeing increased penetration across drug discovery process. Because they can mimic patients' molecular and cellular phenotypes, iPSC-based models are preferred over phenotypic screening. Pharmaceutical companies can use these to test hypothesized drug mechanisms in vitro in a cost-effective manner prior to conducting clinical trials.

Technology Insights

The cell acquisition segment captured the highest revenue share of 33.67% of the market in 2022. Discovery of embryonic stem cells has paved way for development of novel treatments for several diseases. These cells are pluripotent in nature and can be used to differentiate many cell types in the body. However, obtaining embryonic cells directly from the embryo has raised ethical concerns. Hence, researchers discovered an alternative—iPS cells. For instance, in September 2020, a collaborative team of researchers from Singapore and Australia studied the molecular changes, which occurs when adult skin cells become induced pluripotent stem cells (iPSCs). This led to the creation of new stem cells that could produce placenta tissue which could possibly lead to the development of new treatments for placenta complications arising during pregnancy.

The cell acquisition segment is further segmented into bone marrow harvest, umbilical blood cord and apheresis. The bone marrow harvest segment captured highest revenue share owing to the factors such as rising awareness, increasing prevalence of blood cancer, and easy access to bone marrow transplantation therapy.

Therapy Insights

Allogenic therapy segment captured the largest market share of 59.14% in 2022 with regards to revenue generation. Factors such as high pricing and growth in stem cell banking have contributed to the growth of this segment. Moreover, many cell therapy companies are shifting their business toward development of allogenic cell therapy products. This, in turn, is expected to result in the significant growth of this segment.

In addition, strategic activities by key market players to strengthen their product portfolio will further offer lucrative opportunities in the review period. For instance, In March 2021, Acepodia, announced the closing of its USD 47 million Series B financing to advance the pipeline of allogenic cell therapy candidates. In June 2022, Immatics and Bristol Myers Squibb expanded its strategic alliance for the development of gamma delta allogeneic cell therapy programs.

However, autologous therapy is expected to witness a lucrative rate throughout the forecast period. This is primarily due to low risk of complications associated with autologous treatment. Other factors anticipated to propel the growth of this segment include affordability, improved survival rate of patients, no need for identifying an HLA-matched donor, no risk of graft-versus-host diseases. Furthermore, autologous MSCs are investigated for their potential in the treatment of osteoarthritis as they can differentiate into cartilage and bone tissues.

MSCs have the ability to migrate to the site of injury, promote tissue repair by releasing anabolic cytokines, inhibit pro-inflammatory pathways, and differentiate into specialized connective tissues. Thus, adoption of autologous MSCs in regenerative medicine has increased, which is expected to propel the market growth during the forecast period.

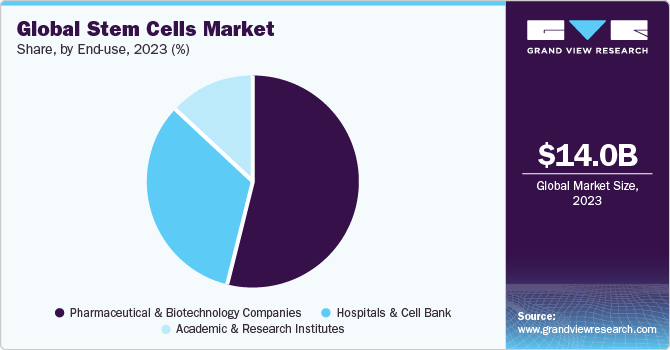

End-user Insights

Pharmaceutical and biotechnology companies segment captured the largest market share of 53.76% in 2022. Some of the factors that can be attributed to the segment's share are rising prevalence of chronic disease, increase in clinical trials, upsurge in strategic activities along with improvements in healthcare services. For instance, in August 2022, StemCyte, Inc. obtained approval from U.S. FDA for their Phase II clinical trial for Post-COVID Syndrome using umbilical cord blood stem cell therapy. Moreover, in April 2022, US FDA granted clearance to BioCardia’s Investigational New Drug (IND) application to initiate a Phase I/II clinical trial of BCDA-04 in adults improving from acute respiratory distress syndrome linked with COVID-19.

Moreover, increasing number of clinical trials coupled with approval of stem cell-based therapies from regulatory bodies will further offer lucrative opportunities. For instance, there are around 5,000 listed clinical trials involved in stem cells research on ClinicalTrials.gov, with new clinical trials being offered every day in this field.

Regional Insights

北美最大的收入占share of 43.56% in 2022. Presence of innovators and key market players has resulted into higher penetration of market products in the region. North America leads the market owing to strong biotechnology industry, presence of key players, extensive R&D and promotion of personalized medicines. The region accounts for the highest revenue share. Moreover, growth in this region can be further attributed to rising government initiative for promoting stem cell therapies. For instance, in March 2020, the government of Canada invested around USD 7 million in regenerative medicine and stem cell research. It will support 9 transnational projects and 4 clinical trials in the country for growing regenerative medicine sector.

Asia Pacific is expected to grow at a rapid rate of 16.09% CAGR during 2023-2030 owing to strong product pipelines of therapies based on stem cells and a huge patient population base. Stem cells market is expected to grow at a rapid rate due to the increasing incidence rate of diseases such as cancer, neurological disorders, and diabetes. Moreover, government funding to accelerate research on stem cell further strengthens the growth of this region. For instance, In February 2022, the government of India has set up the state-of-the-art stem cell research facilities in 40 leading health research and educational institutions. The government has also spent USD 80 million through Indian Council of Medical Research (ICMR) in the last three years under certain research projects.

Key Companies & Market Share Insights

关键球员在这个市场采取不同的或ganic and inorganic strategies such as partnerships, mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence. For instance, in January 2021, Celularity Inc. and GX Acquisition Corp. entered in a merger agreement for accelerating the development & production of new & innovative allogeneic cell therapies such as CAR T cell therapies derived from the postpartum placenta and genetically modified natural killer (NK) cell therapies. Some of the key players in the global stem cells market include:

Advanced Cell Technology Inc.

STEMCELL Technologies Inc.

Cellular Engineering Technologies Inc.

CellGenix GmbH

PromoCell GmbH

Kite Pharma

Lonza

Cellartis AB

Angel Biotechnology

Brainstorm Cell Therapeutics

Celgene Corporation

Osiris Therapeutics

Genea Biocells

Bioheart Inc.

Waisman Biomanufacturing

Tigenix

Caladrius Biosciences

Gamida Cell

Recent Developments

In July 2023,PromoCellannounced the launch of the ‘PromoExQ MSC Growth Medium XF’ for cell therapy manufacturing applications. The xeno- and serum-free medium is compliant with the company’s EXCiPACT GMP certification scheme and has been optimized for in-vitro expansion of human MSCs in GMP regulated environment, offering consistent growth and maintenance of various types of multipotent MSCs

In April 2023, Gamida Cell announced that its allogeneic cell therapy, Omisirge (omidubicel-onlv), had received approval from the U.S. FDA for use in adult & pediatric patients aged 12 years and above facing hematologic malignancies. The therapy has received approval based on a global and randomized Phase 3 clinical study, making it the first allogeneic stem cell transplant therapy to do so

In March 2023,Cellular Engineering Technologies(CET) announced that it had received exclusive approval for using immortalized human stem cells from the John Paul II Medical Research Institute. These stem cells were developed through the gene editing of human stem cells for producing next-generation human cells that have more native PTM than the existing cell lines deployed currently in bio-production applications. The exclusivity gives CET a strong chance to address various financial and scientific challenges related to iPSC-dependent cell replacement therapy

In January 2023, BrainStorm Cell Therapeutics announced that it would be donating biospecimens from NurOwn's placebo-controlled Phase 3 ALS trial to the Northeast Amyotrophic Lateral Sclerosis Consortium biorepository for use in the research community. The specimens submitted include serum and cerebrospinal fluid (CSF) samples that have been collected from participants in the trial treated with placebo

In June 2022,STEMCELL Technologiesannounced a supply partnership with PBS Biotech to make the PBS-MINI Bioreactor available via STEMCELL Technologies for researchers aiming to scale up their human pluripotent stem cell cultures. The PBS-MINI is compatible with STEMCELL’s TeSR family of 3D suspension culture media, offering convenience in the scale-up of hPSC cultures that are established already in TeSR media

In April 2022, STEMCELL Technologies Canada announced a collaboration with Applied Cells for delivering an efficient cell separation solution that combines STEMCELL's EasySep immunomagnetic cell separation kits with the MARS platform of Applied Cells. Through this development, researchers globally would be able to automate and improve the efficiency of isolating high-quality cells from a range of sample types, including bone marrow, whole blood, apheresis products, and dissociated tissue

In March 2022, Cellular Engineering Technologies announced that the United States Patent and Trademark Office had granted it a patent for its virus- and oncogene-free induced pluripotent stem cell (iPSC) technology. This comes on the back of the company receiving an SBIR grant from the National Institutes of Health for commercializing this technology to provide reproducible iPSC and differentiated neural stem cells that maintain genetic stability and pluripotency during large scale production

Stem Cells Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 14,795.1 million |

Revenue forecast in 2030 |

USD 31.6 billion |

Growth rate |

CAGR of 9.74% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2019 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, technology, therapy, end-use, region |

Regional scope |

北美;欧元pe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Advanced Cell Technology Inc., STEMCELL Technologies Inc., Cellular Engineering Technologies Inc., CellGenix GmbH PromoCell GmbH, Kite Pharma, Lonza, Cellartis AB, Angel Biotechnology, Brainstorm Cell Therapeutics, Celgene Corporation, Osiris Therapeutics, Genea Biocells, Bioheart Inc., Waisman Biomanufacturing, Tigenix, Caladrius Biosciences, Gamida Cell |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Stem Cells Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the stem cells market on the basis of product, application, technology, therapy, end user, and region.

Product Outlook (Revenue, USD Million, 2018 - 2030)

Adult Stem Cells (ASCs)

Hematopoietic

Mesenchymal

Neural

Epithelial/Skin

Others

Human Embryonic Stem Cells (HESCs)

Induced Pluripotent Stem Cells (iPSCs)

Very Small Embryonic Like Stem Cells

Application Outlook (Revenue, USD Million, 2018 - 2030)

Regenerative Medicine

Neurology

Orthopedics

Oncology

Hematology

Cardiovascular and Myocardial Infraction

Injuries

糖尿病。

Liver Disorder

Incontinence

Others

药物发现和开发

Technology Outlook (Revenue, USD Million, 2018 - 2030)

Cell Acquisition

Bone Marrow Harvest

Umbilical Blood Cord

Apheresis

Cell Production

Therapeutic Cloning

In-vitro Fertilization

Cell Culture

Isolation

Cryopreservation

Expansion And Sub-Culture

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

Autologous

Allogenic

End-user Outlook (Revenue, USD Million, 2018 - 2030)

Pharmaceutical & Biotechnology Companies

Hospitals & Cell Banks

Academic & Research Institutes

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

欧元pe

UK

Germany

法郎e

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

Japan

India

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East and Africa

South Africa

Saudi Arabia

UAE

Kuwait

常见问题关于这个报告

b.The global stem cells market size was estimated at USD 13.3 billion in 2022 and is expected to reach USD 14.8 billion in 2023.

b.The global stem cells market is expected to grow at a compound annual growth rate of 9.74% from 2023 to 2030 to reach USD 31.56 billion by 2030.

b.Adult stem cells dominated the stem cells market with a share of 83.34% in 2022 owing to their high penetration over other stem cell types and the presence of a substantial number of approved adult stem cell therapies for clinical use.

b.Some key players operating in the stem cells market include Advanced Cell Technology Inc., STEMCELL Technologies Inc., PromoCell GmbH, Cellular Engineering Technologies Inc., and others.

b.Key factors that are driving the stem cells market growth include the rising number of stem cell banks, the growing focus on increasing the therapeutic potential of these products, and extensive research for the development of regenerative medicines.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."