Vibration Control System Market Size, Share & Trends Analysis Report By System Type (Motion Control, Vibration Control), By Application (Automotive, Manufacturing, Oil & Gas), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-196-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Semiconductors & Electronics

Report Overview

The globalvibration control system marketsizewas estimated atUSD 4.91 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. The market is witnessing increased global demand due to the rising focus on mechanical balancing and stability in automobiles and industrial machinery. Vibration Control Systems (VCS) are isolation systems that effectively address incoming vibrations. These systems control vibrations in stationary and moving machines, reducing friction and other disruptive factors. Also, these systems safeguard machine parts' operation, heat generation, wear & tear, loss of energy, and cracks & breakage, among others. They are used in various industries such as automotive, aero & defense, electrical & electronics, oil & gas, and healthcare.

The rapidly growing automotive and aviation industries are expected to drive market growth over the forecast period. The rapid development of next-generation vibration control systems for aircraft to reduce vibration is a primary factor driving the market growth. Also, anti-vibration systems, such as mounting & bushing, reduce quivers in the automotive industry. These systems help in increasing vehicle efficiency as well as the life span of the components. VCSs were initially designed for use in automotive and electrical equipment. These systems are now used in aerospace & defense, oil & gas, and mining & quarrying, among others.

Furthermore, vibration monitoring systems are gaining ground in the healthcare sector as well pharmaceutical companies are using them to mitigate the impacts of trembles and quivers on sensitive equipment, such as DNA sequencing microarrays andMagnetic Resonance Imaging(MRIs), in healthcare and scientific institutions. On the other hand, factors, such as strict industry regulations, high costs of systems, and component reliability issues, are anticipated to hinder market growth over the coming years.

The strict regulations and policies set by the U.S. defense and airline authorities are compelling manufacturers of VCS to upgrade their design. Also, in recent years, anti-vibration control systems are being used in the aerospace & defense industry to maintain the reliability of various components, such as sensors, actuators, and controllers that needed to be improved, thus inhibiting the market's growth. However, the rising demand for smart, self-controlling, and adaptive VCS, along with technological development, such as Active Noise and Vibration Control systems (ANVC) and web-based continuous machine condition monitoring in aircraft, is an opportunity for market growth over the coming years.

COVID-19 Impact Analysis

Vibration control systems are designed to effectively respond to incoming vibrations, serving as isolation systems that modify or reduce vibration levels in mechanical structures. These systems play a crucial role in ensuring the balance and mechanical stability of industrial automobiles and machinery, which is a key driver for the growth of the vibration control system industry. By controlling the vibrations in moving and static machines, these systems help minimize friction and other disturbances while safeguarding machine components and preventing energy loss and heat generation. The pandemic had a varied impact on different markets. Some industries experienced positive effects while others were affected negatively.

During the pandemic, the world grappled with a life-threatening health crisis and a global economic recession resulting from government-imposed lockdowns. The COVID-19 pandemic particularly hit the aviation and automotive industries hard. Both domestically and internationally, travel restrictions imposed during the lockdowns severely impacted the aviation industry. In addition, the temporary closure of manufacturing facilities led to delays in the production of auto parts,commercial vehicles, and passenger vehicles, resulting in a sharp decline in vehicle sales, and adversely affecting the growth of the automotive industry. As a result, vibration control system usage decreased, impacting the overall market growth.

System Type Insights

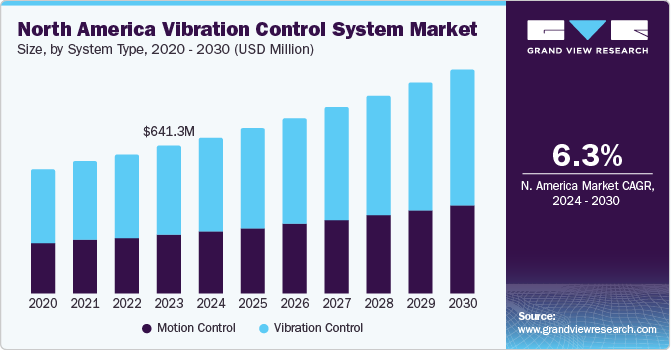

The vibration control systems segment is expected to register the fastest CAGR of over 6.5% during the forecast period. The growth is attributed to the rising demand for tremble and quiver controls in various oil & gas and power plant industries. These mechanisms use multiple anti-vibration devices such as washers, absorbers, bushes, mounts, springs, hangers, and dampers to isolate the effects of tremble and shock in power plants. The vibration control segment is bifurcated into various sub-segments, including isolating pads and isolators.

VCS with motion control type is anticipated to account for a considerable industry share by 2030. This growth is ascribed to the growing automotive and aerospace sectors. Motion control systems are used in fixed-wing aircraft that help to the reduction of quiver and tremble in the helicopter fuselage generated by the main rotor. Besides, the increasing need for passenger comfort and convenience in aircraft is also expected to spur segment growth over the years.

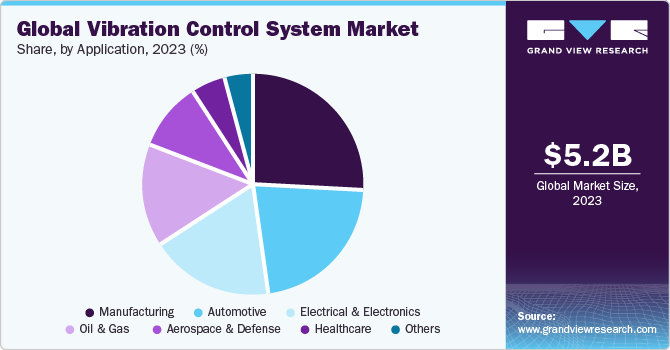

Application Insights

In 2022, the manufacturing segment accounted for approximately 23% of the global revenue share. The electrical & electronics vertical is expected to open significant growth opportunities for all players involved in the value chain on the back of increasing industrial machinery manufacturing globally. The vibration control mechanisms in the electronics industry consist of control electronics,vibration sensors, and actuators, which create a feedback loop in the mechanism and protect structures and equipment from impact forces.

The anti-vibration components for industrial applications include cylindrical buffers, bushes, cylindrical mounts, level mounts, and sandwich mounts. These components provide measuring equipment, passive quiver isolation on electronic instruments, and test cells. Other than electronic & electrical applications, these mechanisms are used in multiple verticals, such as mining & quarrying and food manufacturing. Vibration control systems used in the automotive industry are anticipated to grow considerably over the forecast period.

振动控制系统有助于提高efficiency of vehicles. By minimizing vibrations and reducing friction, these systems contribute to the optimal functioning of vehicle parts, resulting in improved fuel efficiency and reduced wear and tear. The adoption of vibration control systems in the automotive industry continues to grow as manufacturers strive to enhance vehicle performance, comfort, and compliance with regulations. These systems are vital in reducing vibrations, improving efficiency, extending component longevity, reducing noise, and advancing technological capabilities in the automotive sector.

Regional Insights

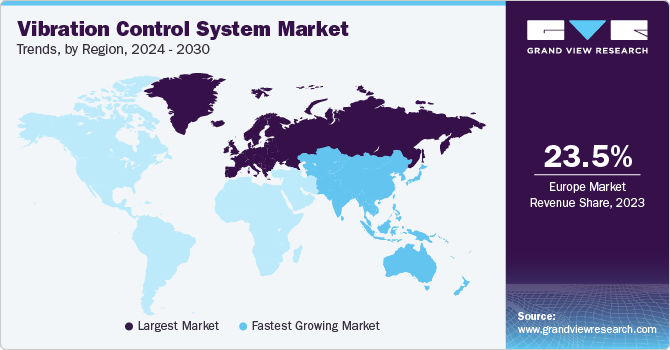

Europe accounted for the largest market share of over 23.0% in 2022. Asia Pacific is expected to emerge as the fastest-growing region with a CAGR of 8.1% over the forecast period. The growth can be attributed to rapid industrialization in Japan, China, and India. Moreover, key manufacturers are from China because of the low capital cost required in the country and developments in technology in the market. Moreover, Latin America is expected to grow considerably over the forecast period owing to continuous technological upgrades in the VCS. Brazil is considerably contributing to the market growth owing to the rapid development in the oil & gas, textile, automotive, and machinery & equipment sectors.

North America held a market share of more than 20% in 2022 of the global revenue. The growth is attributed to the growing demand for healthcare, aviation, and defense anti-vibration systems in the U.S. and Canada. In the current market scenario, the U.S. dominates the regional market. Large-scale adoption of these mechanisms can be seen in the U.S. electronics & electrical, automotive, and food manufacturing sectors. Being early adopters of vibration control technology, North America is home to many vibration-controlling manufacturers and solution providers.

Key Companies & Market Share Insights

Vibration control systems providers focus on new product launches and research & development, which help expand their market presence. For instance, in March 2022, ITT Inc. showcased its comprehensive portfolio of highly engineered shock isolation, vibration control & energy absorption solutions for military & defense applications at the Sea Air Space Exposition, the largest maritime expo in the United States. Some of the prominent players in the global vibration control system market include:

ContiTech AG

Lord Corp.

Resistoflex

Hutchinson

Fabreeka

Sentek Dynamics Inc.

VICODA GmbH

Isolation Technology Inc.

Trelleborg AB

Kinetics Noise Control, Inc.

Vibration Control System Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 5.18 billion |

Revenue forecast in 2030 |

USD 7.93 billion |

Growth rate |

CAGR of 6.3% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Report updated |

August 2023 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

System type, application, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Russia; China; India; Japan; Brazil; Mexico |

Key companies profiled |

Resistoflex; ContiTech AG; Lord Corp.; Fabreeka; Hutchinson; Sentek Dynamics Inc.; Isolation Technology Inc.; VICODA GmbH; Trelleborg AB; Kinetics Noise Control, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Vibration Control System Market Report Segmentation

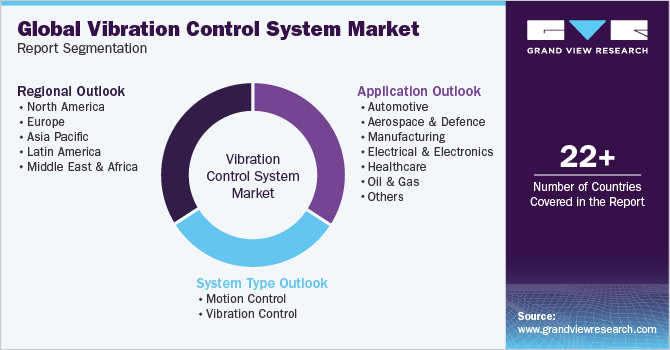

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the vibration control system market report based on system type, application, and region.

System Type Outlook (Revenue, USD Million, 2017 - 2030)

Motion Control

Springs

Hangers

Washers & Bushes

Mounts

Vibration Control

Isolating Pads

Isolators

Others

- Application Outlook (Revenue, USD Million, 2017 - 2030)

Automotive

Aerospace & Defense

Manufacturing

Electrical & Electronics

Healthcare

Oil & Gas

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Russia

Asia Pacific

China

India

Japan

Latin America

Brazil

Mexico

Middle East & Africa

Frequently Asked Questions About This Report

b.The global vibration control system market size was estimated at USD 4.91 billion in 2022 and is expected to reach USD 5.18 billion in 2023.

b.The global vibration control system market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 7.93 billion by 2030.

b.Europe dominated the vibration control system market with a share of 23.34% in 2022. This is attributable to the growing demand for healthcare, aviation, and defense anti-vibration systems in U.K and Germany.

b.一些关键球员在振动控制器操作l system market include ContiTech AG; Lord Corporation; Resistoflex (P) Ltd.; HUTCHINSON; Fabreeka; Sentek Dynamics Inc.; VICODA GmbH; Isolation Technology Inc.; Trelleborg AB; and Kinetics Noise Control, Inc.

b.Key factors that are driving the vibration control system market growth include growing emphasis on the mechanical stability and balancing of industrial machinery and automobiles, growing automotive as well as the aviation industry, rising demand for self-controlling smart & adaptive VCS, along with technological developments, such as web-based continuous machine condition monitoring and Active Noise and Vibration Control (ANVC) systems in aircraft.

We are committed towards customer satisfaction, and quality service.