Probiotics Market Size, Share & Trends Analysis Report By Product (Food & Beverages, Dietary Supplements), By Ingredient (Bacteria, Yeast), By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- 代表ort ID: 978-1-68038-093-4

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

代表ort Overview

The globalprobiotics market sizewas estimated atUSD 77.12 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 14.0% from 2023 to 2030. The growing awareness about the health benefits of probiotics, such as improved gut health and overall digestive function, is anticipated to boost the growth of the market across the globe. As more people become interested in taking a proactive approach to their health, they are looking for natural, non-pharmaceutical solutions that can help support their gut microbiome. The market penetration of dairy products is projected to be high on account of the increased consumption of functional dairy products for digestive wellness.

Consumers across the world are largely focused on improving gut and microbiome health. According to a survey conducted by the International Food Information Council (IFIC), in 2021, 70% of the respondents consumed yogurt for general health and wellness. However, 60% of the respondents believed it was good for enhancing digestive health. It is anticipated that probiotics in dairy products, such as yogurt, will witness high penetration as they are known to control intestinal flora. Fast-paced lifestyles have led to increased health issues and gut problems, compelling consumers to increasingly focus on preventive healthcare.

Consumers are also shifting towards diets that aid in disease prevention, which is one of the primary factors driving the inclusion of probiotics infunctional foodsand nutraceuticals. Other factors contributing to the uptake of probiotics as a preventive healthcare measure include increased disposable income, improved living standards, and the growth of the elderly population. Moreover, consumers have become more aware of the benefits of probiotics for digestive health. Currently, several well-characterized strains of lactobacilli and bifidobacteria can reduce the risk of gastrointestinal infections or treat similar conditions.

By consuming probiotics, the digestive tract can be replenished with beneficial bacteria, thereby improving digestive health. In addition, the field of probiotics has seen significant research advancements, leading to a better understanding of the mechanisms of action and potential health benefits of different strains. This scientific progress has fueled the interest of probiotic companies in leveraging this knowledge to develop strains with specific attributes and functionalities. For instance, in March 2023, England-based pharmaceutical company, FERRYX Ltd., announced the launch of the FX-856 strain that helps reduce the symptoms of diarrhea, constipation, bloating, and ulcerative colitis.

Market Dynamics

Consumers have been seeking alternatives to conventional pharmaceutical interventions, which has driven the demand for natural and holistic health solutions. This trend has compelled probiotic companies to develop probiotic strains that can address specific health concerns and provide natural solutions to consumers.

Manufacturers are increasingly fortifying food and beverage products with enzymes, probiotics, and prebiotics. This is attributed to consumer demand for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. This is expected to fuel market growth over the forecast period.

预计增加创新领域的to result in high product demand. General Mills, Inc. partnered with Goodbelly to launch probiotic cereals and yogurt, which are available in five flavors, namely vanilla bean, peach, coconut, strawberry, and black cheery. General Mills will be responsible for the production, sales, and marketing of the products. Plant-based products are also being introduced in the market. For instance, in February 2022, Optibac Probiotics announced the launch of all-in-one probiotic adult gummies sourced from plant fibers. The supplement contains Vitamin D, calcium, zinc, and bacillus coagulans.

Product Insights

The probiotic food & beverage segment dominated the market with a revenue share of over 60% in 2022. Manufacturers are increasingly fortifying food and beverage products withenzymes和益生菌。这是归因于消费者民主党and for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. The increasing awareness of improving quality of life and the rise in disposable incomes have prompted consumers to adopt probiotics as a solution to their health issues. Manufacturers are expanding their businesses in response to the growing demand for probiotics in foods and beverages. For instance, in August 2022, Korea's Hy Co, formerly known as Korea Yakult, announced its expansion into probiotic business categories to include a wider range of products.

While the company previously focused primarily on functional fermented milk products, it is now diversifying into probiotic food, drinks, and supplements. The probiotic dietary supplements segment is expected to grow at a CAGR of 14.13% during the forecast period. The growing inclination toward wellness programs on account of increasing health-related issues, such as blood pressure, unhealthy lifestyles, obesity, and improper diet, is expected to drive the growth of the probiotics dietary supplement industry. These supplements help build a strong immune system to treat several gastrointestinal diseases, dental caries, and breast cancer. Furthermore, many adults and children in the U.S. take one or moredietary supplementslike probiotics to get adequate amounts of essential nutrients to enhance their health.

Manufacturers are investing in clinical research to develop new strains of probiotics that would help boost immunity, support women’s health concerns, and balancing of nutrition. The key players in the market are focusing on introducing products with new ingredient formulations. Rising awareness regarding weight management is a key factor fueling the market growth owing to increasing obesity rates and chronic diseases.In May 2023, Roquette introduced PEARLITOL ProTec, an innovative excipient specifically designed to enhance the stability of probiotic supplements. This new offering addresses the challenge of maintaining the viability and efficacy of probiotics throughout their shelf life.

Ingredient Insights

The bacteria-based ingredient segment accounted for a revenue share of 83.6% in 2022. These products offer numerous health benefits for both humans and animals. They serve as aflatoxin adsorbents, contribute to the prevention of colon cancer, and aid in the prevention of oral diseases, urinary tract infections, respiratory infections, bowel ailments, and other bacterial infections within the body. The market is experiencing growth due to the increasing popularity of functional foods, the adoption of probiotic ingredients in developing economies, and rising disposable incomes. In April 2023, Lesaffre's Gnosis introduced an enhanced quality specification for its well-established probiotic bacteria, LifeinU L. Rhamnosus GG.

This development is a response to the growing consumer interest in superior probiotics, driven by an increased understanding of the significance of the microbiome in maintaining overall health and well-being. The demand for yeast-based probiotics is expected to grow at a CAGR of 13.4% during the forecast period. These products offer several advantages over bacterial probiotics, particularly in the treatment of intestinal manifestations, gastric acidity, and various types of diarrheas. Yeast-based dietary supplements are popular as they contain significant amounts of proteins,amino acids, vitamin B, and peptides. Furthermore, probiotic yeast is considered safe for consumption across all age groups.In September 2021, Angel Yeast launched a strain of yeast probiotic, Saccharomyces boulardii Bld-3. It is effective in combating diarrhea while simultaneously enhancing the digestive and immune systems in both children and adults.

End-use Insights

The human probiotic segment dominated the market with a revenue share of nearly 85% in 2022. The aging population is increasing globally, and this rapid rise is likely to lead to an increase in the number of chronic diseases, which, in turn, is expected to boost the need for microbes such as probiotics to control the threat of the leading chronic diseases such as colon cancer, inflammatory bowel disease (IBD) and diarrheal diseases. In October 2021, Qingdao Vland Biotech Group Co. and ADM announced that they established a joint venture to meet the increasing demand for human probiotics in China. This 50-50 joint venture specializes in the production and distribution of human probiotics, leveraging the experience and expertise of ADM and Vland. By integrating a comprehensive range of technological, commercial, and production capabilities, the joint venture aimed at catering to the market's diverse needs.

The demand for animal probiotics is projected to grow at a CAGR of 13.7% during the forecast period. There has been a rise in the adoption of probiotics in animal feed for farm animals in the past few years. The use of probiotics in animal feed has shown significant results in terms of improved immune systems, animal performance, and digestion. The increasing focus on animal welfare and the desire to reduce the use of antibiotics in animal husbandry have further fueled the demand for animal probiotics. In August 2021, Chr. Hansen, a leading bioscience company, introduced an innovative range of live probiotics specifically formulated for pet foods and supplements. These probiotics help promote optimal digestion, enhance immunity, and improve the overall well-being of pets.

Distribution Channel Insights

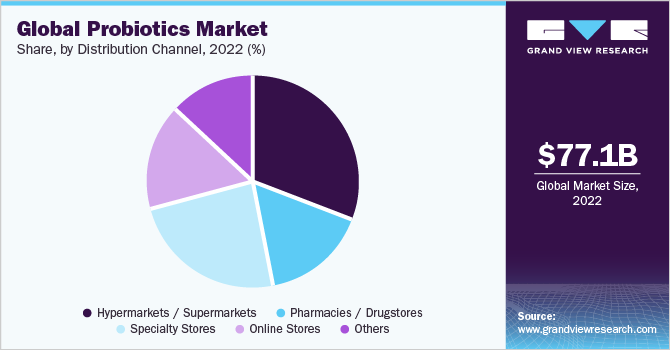

Sales of probiotics through hypermarkets/supermarkets accounted for a revenue share of 31.1% in 2022. The presence of a huge variety of probiotics in one place and the ease of purchasing have contributed to the dominance of supermarkets & hypermarkets as a distribution channel in the market in recent years. The regulatory framework surrounding probiotics plays a major role in their distribution through pharmacies and drugstores. Probiotic supplements are often categorized as over-the-counter (OTC) products, which can be conveniently purchased without a prescription. This classification allows probiotics to be readily available in pharmacies and drugstores, further increasing their accessibility to consumers. Sales through online stores are projected to grow at a CAGR of 16.6% during the forecast period.

Online distribution channels have been experiencing significant growth in the probiotics industry due to several key factors. The convenience and accessibility offered by online shopping have contributed to the rising popularity of online purchases of probiotics. Furthermore, with online shopping, consumers can browse and compare a wide range of probiotic products from the comfort of their own homes without the need to visit physical stores. In January 2021, HempFusion Wellness expanded its distribution on Amazon by establishing a distinctive e-commerce store within the platform. This strategic move enabled HempFusion's renowned probiotic supplement brand, Probulin, to effectively enhance brand awareness while simultaneously boosting sales and providing comprehensive product information for its extensive range of scientifically formulated offerings.

Regional Insights

The Asia Pacific region accounted for a revenue share of 38.2% in 2022. Consumers in this region are increasingly seeking healthy products on account of rising awareness regarding fitness and maintaining good digestive health. Rising disposable incomes, improving the standard of living, and increasing acceptance of functional foods are the major factors driving the growth of the industry. In addition, the growing importance of gut health in overall well-being has increased demand for products that maintain a healthy gut microbiome. Probiotic supplements are seen as a convenient and effective way to introduce beneficial bacteria into the gut and thus have become increasingly popular among health-conscious consumers in the region. The demand in India is projected to grow at a CAGR of 15.8% during the forecast period.

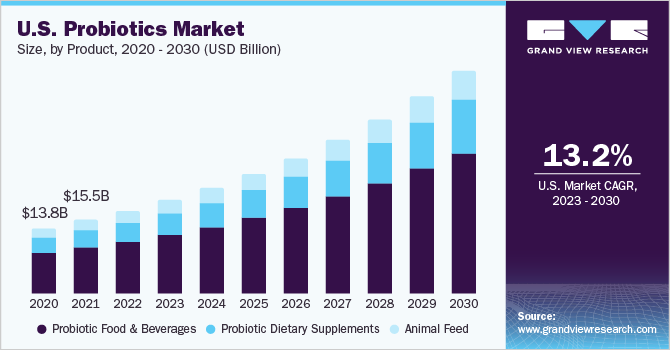

这个市场目前处于新兴阶段,manufacturers continue to focus on digestive and immune health. Liquid probiotics remain dominant in the market with the increasing demand for probiotic-filled beverages, milk, yogurt-based drinks, and juices. The demand in the North America market is expected to grow at a CAGR of 13.2% during the forecast period. North America is one of the prominent regional markets for probiotics owing to higher market penetration in the developed economies of the region. The U.S. market was valued at USD 17.47 billion in 2022. Rising awareness regarding healthy lifestyles and increasing disposable incomes are the major factors contributing to the growth of the market in the region and its member countries.

The Europe market is expected to grow at a CAGR of 13.2% during the forecast period.The initiatives undertaken by the European Probiotic Association (EPA), such as providing guidelines and organizing educational webinars, serve as driving factors for the growth of the probiotics industry in Europe. The guidelines established by the EPA ensure that probiotic products in Europe meet stringent quality and safety standards. This fosters consumer confidence in probiotics and encourages their usage, leading to an increased demand for probiotic products in the market. The availability of clear guidelines helps manufacturers develop high-quality probiotic formulations, which further contributes to market growth. The UK probiotics industry accounted for a revenue share of over 15% in 2022 and is projected to grow at a CAGR of nearly 14% during the forecast period.

Key Companies & Market Share Insights

The global market is characterized by intense competition, mainly attributed to several players operating in the market. Various companies operating in the market are offering innovative products to cater to consumer demand.For instance, in November 2022,Arla Foods Group announced the launch of fermented protein drinks, which contain whey-based hydrolysates Lacprodan HYDRO.365 and Nutrilac FO-8571. The company is looking to develop trendy beverages that are high in probiotics and protein, enabling it to stand out amidst the competition. Some of the prominent players in the global probiotics market include:

Arla Foods

BioGaia

Chr. Hansen Holding A/S

Danone

DuPont De Nemours, Inc.

通用磨坊公司

i-Health, Inc.

Lallemand Inc.

Lifeway Foods Inc.

Mother Dairy Fruit & Vegetable Pvt. Ltd.

Kerry Group plc

Nestle S.A.

Probi AB

Yakult Honsha Co., Ltd.

Recent Development

In June 2023,ADMannounced the opening of a USD 30 million state-of-the-art manufacturing facility in Spain to cater to the unmet demand for probiotics and postbiotics.

In April 2023, the FDA approved Seres Therapeutics’ live oral microbiome capsule Vowst and will be commercialized by Nestle using its gastroenterology sales force.

In November 2022,Nestlémade a breakthrough discovery and product in infant microbiome, launched under the brand name WYETH S-26® ULTIMA®, in collaboration with Pennington Biomedical Research Center and Rhode Island Hospital, USA.

In April 2022, Symrise and Probi collaboratively introduced SymFerment®, a sustainable probiotic skincare ingredient.

In August 2021, Chr. Hansen Holding A/S introduced its new science-based stable live probiotics product portfolio for the pet segment. The line-up included CHR. HANSEN PET-PROSTART™ for kittens and puppies, CHR. HANSEN PET-PROESSENTIALS™ for adult pets, and CHR. HANSEN PET-PROVITAL™ for senior cats and dogs.

In July 2021,Symriselaunched its first processed probiotic dedicated to oral care called SymReboot™ OC which promotes a healthy oral microbiome and strengthens gums.

In May 2021, Chr. Hansen Holding A/S launched Bovacillus™, an innovative product to support beef cattle health and dairy farming.

Probiotics Market代表ort Scope

代表ort Attribute |

Details |

Market size value in 2023 |

USD 87.72 billion |

Revenue forecast in 2030 |

USD 220.14 billion |

Growth rate |

CAGR of 14.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

代表ort updated |

August 2023 |

Quantitative units |

Revenue in USD million/billion, CAGR from 2023 to 2030 |

代表ort coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Product, ingredient, end-use, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa |

Key companies profiled |

Arla Foods; BioGaia; Chr. Hansen Holding A/S; Danone; DuPont De Nemours, Inc.; General Mills, Inc.; i-Health, Inc.; Lallemand Inc.; Lifeway Foods Inc; Mother Dairy Fruit & Vegetable Pvt. Ltd; Kerry Group plc; Nestle S.A.; Probi AB; Yakult Honsha Co., Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Probiotics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030.For this study, Grand View Research has segmented the probiotics market report based on product, ingredient, end-use, distribution channel, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

Probiotic Food & Beverages

Dairy Products

Non-Dairy

Cereals

Baked Food

Fermented Meat

Dry Foods

Probiotic Dietary Supplements

Food Supplements

Nutritional Supplements

Specialty Supplements

Infant Formula

Animal Feed

Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

Bacteria

Yeast

End-use Outlook (Revenue, USD Million, 2017 - 2030)

Human Probiotics

Animal Probiotics

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Hypermarkets / Supermarkets

Pharmacies / Drugstores

Specialty Stores

Online Stores

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

Central & South America

Brazil

Argentina

Middle East & Africa

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global probiotics market size was estimated at USD 77.12 billion in 2022 and is expected to reach USD 87.72 billion in 2023.

b.The probiotics market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 220.14 billion by 2030.

b.Probiotic food & beverage was the dominant product segment in terms of revenue, occupying over 60% in 2022 and is expected to experience significant growth over the forecast period. Growing awareness regarding the health benefits of fermented food products has been driving the demand for probiotic food & beverages.

b.Some of the key players in the probiotics market include Arla Foods, BioGaia, Chr. Hansen Holding A/S, Danone, DuPont De Nemours, Inc., General Mills, Inc., i-Health, Inc., Lallemand Inc., Lifeway Foods Inc, Mother Dairy Fruit & Vegetable Pvt. Ltd, Kerry Group plc, Nestle S.A., Probi AB, and Yakult Honsha Co., Ltd.

b.The growing awareness about the health benefits of probiotics, such as improved gut health and overall digestive function, is anticipated to boost the growth of the probiotics market across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."